Digital Marketing for Nepal Insurance: Growth & Strategy

Industry Overview: The Nepalese Insurance Sector at a Crossroads

The insurance industry in Nepal stands at a pivotal juncture, characterized by robust financial growth on one hand and significant untapped market potential on the other. Regulated by the Nepal Insurance Authority (NIA), the sector is a substantial component of the nation’s economy, yet it grapples with fundamental challenges related to public awareness, trust, and accessibility. Understanding this dual reality is the first step toward unlocking its future growth through strategic digital transformation.

Market Landscape: Size, Segmentation, and Key Metrics

The Nepalese insurance sector has achieved considerable scale. As of the 2022-2023 financial year, the market capitalization was estimated at approximately NPR 460 billion (US$3.5 billion). Total gross premium collection for the fiscal year 2080/81 (2023/24) reached NPR 197.97 billion, marking a healthy 8.23% increase from the previous year’s NPR 182.91 billion. The life insurance business, in particular, has demonstrated formidable growth, with annual business now exceeding NPR 200 billion.

The market is structured into distinct segments, each contributing differently to the overall premium pool. The NIA oversees 14 life insurance companies, 14 non-life companies, 2 re-insurance companies, and 7 micro-insurance companies. Life insurance is the dominant force, accounting for NPR 156.5 billion in gross premiums in FY 2080/81, compared to the non-life sector’s NPR 41.47 billion. This clear segmentation indicates that the majority of consumer spending and, consequently, marketing efforts are concentrated within the life insurance domain.

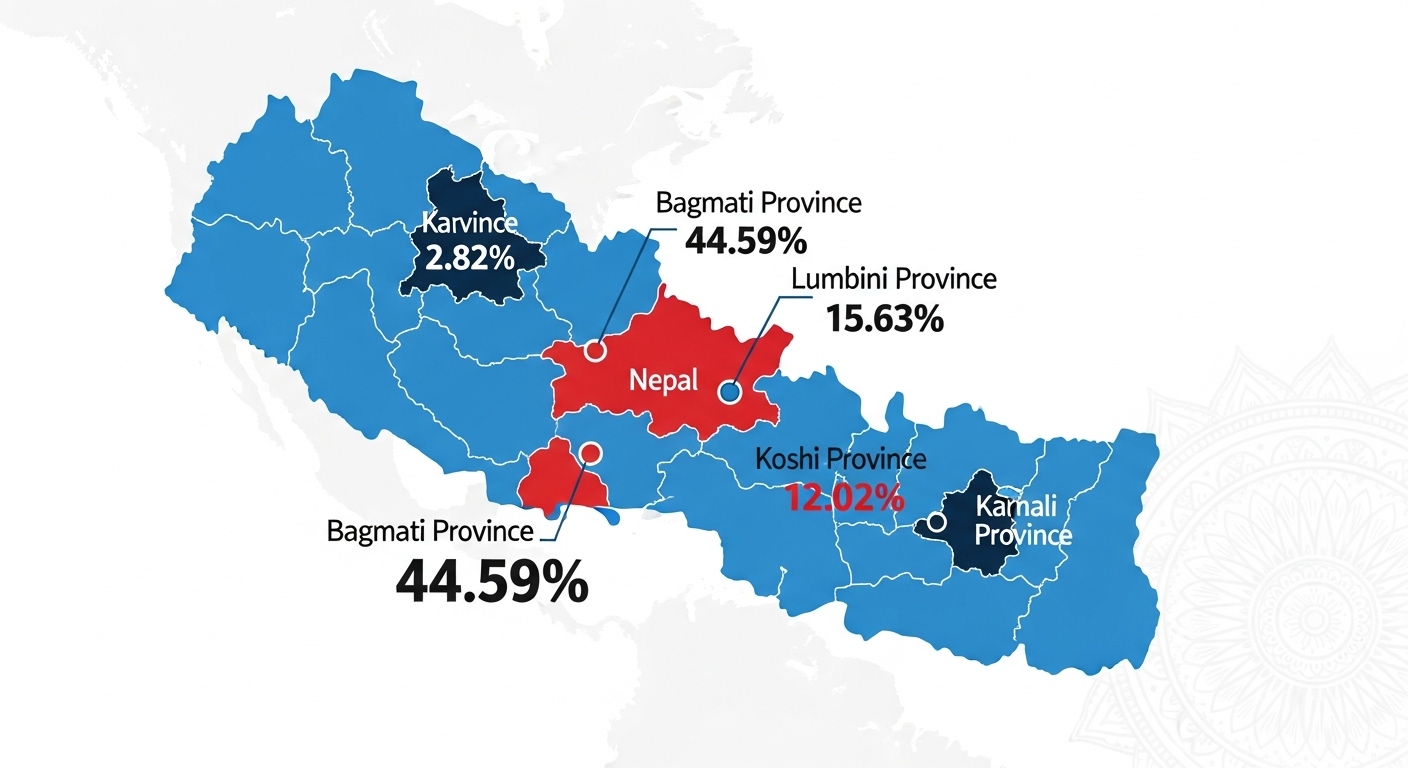

A critical dimension of the market landscape is its geographical concentration. Analysis of premium collection reveals a significant imbalance across Nepal’s provinces. Bagmati Province, which includes the capital Kathmandu, is the undisputed epicenter of the insurance market, contributing a staggering 44.59% (NPR 62.58 billion) of the total life insurance premiums. Following at a considerable distance are Lumbini Province (15.63%) and Koshi Province (12.02%). At the other end of the spectrum, Karnali Province represents the smallest market, with just a 2.82% share. This heavy reliance on the central region highlights the limitations of traditional, branch-based distribution models and presents a clear opportunity for digital channels to penetrate underserved markets.

Growth Trajectory & Emerging Trends

The industry’s growth is not just stable; it is dynamic. The life insurance sector recorded a 16.05% year-on-year increase in business in the last fiscal year. This momentum has continued, with life insurance premiums growing by 15.55% in just the first month of the current fiscal year. This trend suggests strong underlying demand and increasing financial engagement from the existing, aware segment of the population.

Within this growth story, specific players are setting the pace. Nepal Life Insurance stands as the market leader in terms of sheer business volume, collecting NPR 48.03 billion in premiums. It is followed by other established names like National Life Insurance and LIC Nepal. However, an interesting trend is emerging from smaller, more agile competitors. Companies like Reliable Nepal Life, while smaller in total volume, are exhibiting the highest growth rates, with a remarkable 28.80% increase in business. This suggests that aggressive, focused strategies can effectively capture market share, a lesson highly relevant for digital-first approaches.

This narrative of strong premium growth, however, conceals a fundamental paradox: the problem of low penetration. While headline figures from the NIA suggest that insurance coverage has reached 47.39% of the population, this number is inflated by the inclusion of mandatory, short-term policies for migrant workers (Foreign Employment policies) and other temporary schemes. When these are excluded, the data reveals a starkly different picture. The actual percentage of the population covered by standard, long-term life and non-life insurance policies is a mere 16.77%. This discrepancy is the central challenge and opportunity for the industry. The growth seen in premium collection is largely “vertical“—deeper engagement and higher spending from the same, relatively small, urban, and financially literate customer base. The vast potential for “horizontal” growth—expanding into the 83% of the population that remains uncovered—is largely unrealized. The primary barrier to unlocking this potential is not economic but educational and psychological, rooted in a lack of awareness and trust.

The Trust Deficit: Unpacking Key Challenges

Despite its financial expansion, the Nepalese insurance sector is constrained by several deep-seated challenges that hinder its ability to achieve widespread penetration. These issues form a trust deficit that digital marketing is uniquely equipped to address.

- Lack of Awareness and Education: This is the most pervasively cited obstacle. A significant portion of the Nepali populace does not understand the fundamental benefits of insurance, how policies work, or the process of making a claim. This knowledge gap fosters skepticism and a pervasive misconception that insurance companies are primarily looking for ways to avoid paying claims, thereby devaluing the product in the consumer’s mind.

- Low Trust and Credibility: Beyond a simple lack of information, there is an active distrust of financial institutions. This is compounded by a perception of inadequate security in digital transactions and reports of unethical industry practices. A notable example is the misleading advertisement of maximum bonus rates, where companies promote the highest possible returns that are only applicable to a tiny fraction of long-term policies, creating confusion and disappointment among consumers who purchase more common, shorter-term plans. Allegations of regulatory corruption further erode public confidence.

- Product and Service Gaps: The industry is perceived as lagging in innovation, customer service efficiency, and policy retention. Manual processes and slow service delivery create friction for customers, making the experience cumbersome. Digital transformation is frequently identified as a “low-hanging fruit” to streamline these operations, from policy issuance to claims processing, thereby improving the overall customer experience.

- Regulatory Environment: The regulatory framework, managed by the NIA, can also present challenges. Insurers have cited a slow approval process for new products and inadequate enforcement of existing regulations, which can stifle innovation and create a climate of uncertainty.

These challenges are interconnected. A lack of education breeds distrust, which is then reinforced by inefficient service and perceived regulatory weaknesses. Breaking this cycle requires a strategic shift from a sales-centric model to an education-centric one, a task for which digital platforms are ideally suited.

The Digital Landscape in Nepal: A Fertile Ground for Growth

Nepal’s digital ecosystem is undergoing a rapid and profound transformation, creating a fertile environment for businesses that can navigate its unique characteristics. Driven by increasing mobile penetration and strong government initiatives, the country is becoming a mobile-first society. For insurance companies, this digital shift presents both an unprecedented opportunity to connect with the population and a complex set of consumer behaviors that must be understood and addressed.

Connectivity & Usage Statistics

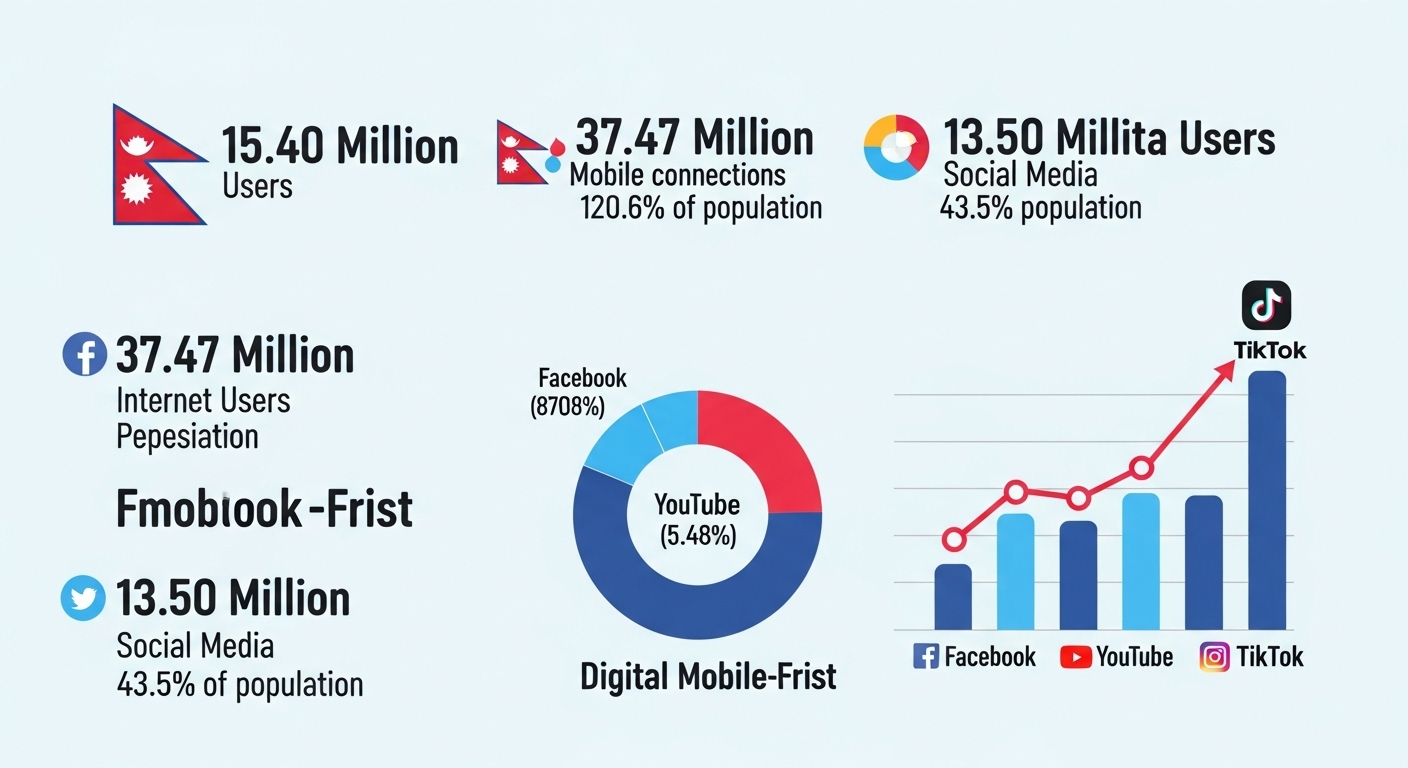

The foundation of any digital strategy is connectivity, and Nepal’s progress in this area is significant. As of January 2024, the country was home to 15.40 million internet users, achieving an internet penetration rate of 49.6%. While this number indicates that half the population is still offline, the growth trajectory is steep. More telling is the figure for cellular mobile connections, which stands at 37.47 million—equivalent to 120.6% of the total population. This statistic unequivocally establishes Nepal as a mobile-first nation, where the primary gateway to the internet for most citizens is a smartphone. This reality dictates that any effective digital strategy must be designed and optimized for mobile consumption.

This digital expansion is supported by a clear government vision. Initiatives like the “Digital Nepal Framework” and the declaration of an “IT Decade” signal a strong national commitment to digitization, with goals to expand broadband access, promote digital literacy, and integrate technology into public services.

Within this connected environment, social media is not just a popular activity; it is the dominant force. Nepal has 13.50 million active social media users, representing 43.5% of the total population. This user base is not static; it grew by a remarkable 1.7 million people, a 13.9% increase, in just one year. Critically, social media platforms account for nearly 80% of all internet traffic in Nepal. This data confirms that for a vast number of Nepalis, the social media feed is the internet—the primary portal for news, entertainment, communication, and discovery.

Platform Dominance & Demographics

Understanding which platforms command the attention of the Nepali audience is crucial for effective channel selection.

The landscape is dominated by a few key players:

- Facebook’s Hegemony: Facebook is the undisputed leader, with a staggering 87.08% market share of social media traffic. Its 13.5 million active users in Nepal mean it reaches 87.7% of the entire internet-using population. The platform’s user base has a slight male skew, with 56.4% male and 43.6% female users. Its ubiquity makes it an essential channel for reaching a broad cross-section of the population.

- The Rise of Visual & Youth-Oriented Platforms: While Facebook dominates, other platforms are carving out significant niches. YouTube holds the second-largest market share at 5.46%, underscoring the population’s preference for video content. Instagram is experiencing explosive growth, with its potential ad reach increasing by 67.4% in a single year. It has become a major hub for Gen Z and young millennials, who are often drawn to its lifestyle-focused content to avoid the “cluttered” feel of Facebook, which is now populated by older generations and family members. TikTok has achieved “insane popularity,” particularly among Gen Z, and has emerged as a primary channel for influencer marketing and short-form video content.

- Professional Networking: For more targeted B2B or high-income professional outreach, LinkedIn offers a valuable, albeit smaller, audience of 1.5 million users.

This platform data points to a clear trend: the Nepali digital audience is mobile-first and increasingly video-centric. Marketing messages delivered via text-heavy websites or lengthy documents are likely to be ineffective. To capture attention, communication must be visually compelling, optimized for a small screen, and delivered in easily digestible, short-form formats. Animated explainers, infographic-style videos, and authentic short testimonials will outperform traditional digital content.

2.3. Online Consumer Behavior in Finance: The Trust-Convenience Equation

While Nepalis have enthusiastically embraced digital platforms for social interaction and entertainment, their attitude towards digital financial services is more cautious, defined by a delicate balance between convenience and trust.

The primary drivers for the adoption of digital banking and payments are perceived usefulness and ease of use. The shift was significantly accelerated by the COVID-19 pandemic, which normalized the use of mobile wallets and e-banking for everyday transactions out of necessity.

However, significant barriers remain, creating a digital trust deficit. The most prominent obstacles for consumers are deep-seated security concerns. Fears of cyber threats, online fraud, identity theft, and data breaches make many hesitant to engage in sensitive financial transactions online. This is compounded by a simple lack of familiarity with digital interfaces and long-standing habits of using conventional, in-person banking methods. Research shows that perceived credibility is a critical factor that consumers evaluate before subscribing to any online financial service.

This creates a fundamental tension: the very platforms where insurance companies must be present to reach their audience (social media) are viewed with a degree of skepticism when it comes to financial matters. Nepalis are comfortable sharing their personal lives on Facebook but are wary of sharing their financial details through a digital form. This means that trust is highly contextual. An insurance company cannot simply appear on social media with a sales pitch and expect to succeed. The initial digital strategy must be entirely dedicated to building credibility and establishing trust. This involves providing tangible value without an immediate expectation of a return—offering free financial literacy content, transparently explaining how insurance works, and busting common myths. Only after a foundation of trust has been laid can a company realistically expect a user to progress to a commercial action like requesting a quote.

Furthermore, the strategic environment is shaped by regulatory volatility. The government’s recent actions, including temporary bans on platforms like TikTok for failing to comply with local registration rules, introduce a tangible platform risk. A marketing strategy that becomes overly reliant on a single platform is therefore vulnerable. A resilient, long-term approach must be omnichannel. It should prioritize the development of “owned” digital assets—such as a high-quality, SEO-optimized website, a comprehensive blog, and a proprietary email list—which are immune to platform-specific regulatory actions. Social media should then be used as the primary channel for distributing content from these owned assets and engaging with the audience, thus diversifying risk and ensuring strategic longevity.

3. Strategic Digital Marketing Opportunities for Nepalese Insurers

The challenges facing the Nepalese insurance industry—low awareness, a trust deficit, and service inefficiencies—are significant, but they are not insurmountable. The burgeoning digital landscape offers a powerful toolkit of strategies that can directly address these core problems. By shifting from a traditional, product-push model to a digital, customer-pull model, insurers can educate the market, build lasting relationships, and drive sustainable growth.

3.1. Addressing Core Challenges with Digital Solutions

Digital marketing provides a direct line of attack against the industry’s most pressing issues. Each strategy can be mapped to a specific challenge, creating a cohesive and purposeful plan.

- Building Trust and Awareness Through Content Marketing: The foundational problem is a lack of understanding and trust. Content marketing is the most potent solution. By creating and distributing valuable, educational, and unbiased content—such as blog posts, simple videos, and clear infographics that demystify insurance concepts—a company can transform its role from a mere seller to a trusted advisor. This approach builds credibility and addresses consumer pain points directly, establishing the brand as a transparent expert in a field often perceived as opaque.

- Expanding Reach with Local SEO: The heavy concentration of business in urban centers is a result of the physical limitations of branch and agent networks. Local Search Engine Optimization (SEO) shatters these geographical barriers. By optimizing a digital presence for location-based searches (e.g., “health insurance in Biratnagar,” “motorcycle insurance near me”), companies can ensure they are visible to potential customers in underserved regions at the exact moment they are seeking a solution. This is a highly efficient way to capture latent demand outside the competitive Kathmandu Valley market.

- Driving Engagement via Social Media: Insurance is often perceived as impersonal and corporate. Social media platforms like Facebook and TikTok provide the ideal stage to humanize the brand. Running awareness campaigns, sharing authentic client testimonials, hosting live Q&A sessions with agents, and engaging in genuine two-way conversations makes the company more accessible and relatable. This direct interaction helps to break down the barriers of distrust and build a loyal community.

- Generating Qualified Leads with PPC Advertising: While building an organic presence is crucial for the long term, Pay-Per-Click (PPC) advertising offers a way to generate immediate results. Targeted Google Ads and social media ad campaigns can reach high-intent users who are actively researching insurance options. By directing this traffic to optimized landing pages with clear calls-to-action (CTAs) like “Get a Free Quote” or “Download Our Guide,” insurers can capture qualified leads and fill the sales pipeline efficiently.

3.2. A Blueprint of Best-Fit Strategies for Nepal

A successful strategy for Nepal must be tailored to the local context, prioritizing simplicity, accessibility, and trust-building. The following mix of strategies forms a robust blueprint:

- Content Marketing: The cornerstone of the strategy should be educational content, primarily in simple, accessible Nepali. The focus should be on answering the most fundamental questions that the average citizen has: “What is term insurance and why do I need it?”, “How do I file a health insurance claim without hassle?”, and “What are the real benefits of insurance for my family’s future?”. This directly addresses the critical education gap.

- Search Engine Optimization (SEO): A two-pronged SEO approach is recommended. First, a comprehensive on-page SEO strategy for the main corporate website to rank for broad, informational, and commercial keywords. Second, a hyper-local SEO strategy focused on creating and optimizing a Google Business Profile for every single branch, encouraging local reviews, and generating location-specific content to capture traffic in regional markets.

- Social Media Marketing: A multi-platform approach is essential. Facebook should be used for broad audience engagement, community building, and running targeted lead generation ad campaigns. TikTok and Instagram should be leveraged to connect with the under-35 demographic through short, engaging, and educational videos (“edutainment”) and collaborations with local influencers.

- Paid Advertising (PPC): Campaigns should be highly targeted to maximize return on investment. Google Search ads should focus on transactional, long-tail keywords (e.g., “buy family health insurance plan Nepal”) that indicate a strong intent to purchase. Facebook lead ads can be used to target specific demographic segments, such as new parents, recent homebuyers, or salaried professionals, with tailored messaging and offers.

- Email Marketing: This is a crucial, often overlooked, channel for nurturing leads.

Once contact information is captured through the website or social media ads, an automated email sequence can deliver further educational content, build the relationship, and guide the prospect toward a consultation or purchase decision without aggressive sales pressure.

3.3. Case Studies in Action: Global Lessons for the Nepali Market

While the Nepali market is unique, valuable lessons can be drawn from successful international insurance marketing campaigns that have tackled similar challenges.

- Lemonade (US) – “Insurance that Works Faster”: This innovative insurtech company built its entire marketing message around its core technological advantage: an AI-powered claims process that settles claims in seconds. The campaign focused on speed, transparency, and fairness. The lesson for Nepal is profound: digital marketing is most powerful when it promotes a genuinely improved customer experience. Insurers should first use technology to simplify processes—like online claim intimation or digital policy issuance—and then market that efficiency as a key differentiator. This directly counters the consumer perception of slow, bureaucratic service.

- State Farm (US) – “Jake from State Farm”: This iconic campaign succeeded by creating a relatable, friendly, and human persona for a massive, seemingly impersonal corporation. “Jake” became a cultural touchstone, making the brand feel approachable and trustworthy. The lesson for Nepal is the immense value of humanizing the brand. In a low-trust environment, putting a friendly face to the company—whether through featuring real agents in videos, creating an animated mascot, or developing a consistent, helpful brand personality on social media—can significantly break down barriers and build familiarity.

- FWD (Philippines) – “Prioritize Insurance Today”: Launched in the wake of the pandemic, this campaign masterfully blended emotional storytelling with practical, educational content. It tapped into the heightened sense of vulnerability and the desire to protect loved ones that the crisis created. The lesson for Nepal is the importance of connecting insurance to culturally resonant life events and emotional triggers. Marketing messages should focus not on policy features, but on the emotional outcomes: securing a child’s education, protecting parents in their old age, or ensuring a family’s stability. This emotional connection is far more persuasive than technical jargon.

Ultimately, the strategic path forward in Nepal’s digital insurance market is clear. A direct, hard-sell approach is destined to fail in a low-trust environment. The sequence must be inverted: attract with value, build trust through education, nurture the relationship with consistent engagement, and only then present a commercial offer. This content-first philosophy is the key to unlocking the vast, untapped market. Furthermore, while national-level digital marketing is important, the most immediate and impactful gains can be made at the local level. Insurers that master hyper-local SEO and community engagement can dominate regional markets where competition is lower and the need for accessible financial services is greater.

4. Competitive Analysis: The Digital Presence of Nepal’s Top Insurers

To formulate a winning strategy, it is essential to first understand the current digital battlefield. An analysis of the online presence of Nepal’s leading insurance companies reveals a market in transition. While most have established a basic digital footprint, there is a wide variance in sophistication, with a few forward-thinking players beginning to pull away from the pack. This landscape presents both best practices to emulate and significant strategic gaps for a savvy competitor to exploit.

4.1. Digital Maturity Assessment of Key Players

A review of the top life and non-life insurance companies in Nepal shows varying levels of digital adoption and marketing prowess.

- Nepal Life Insurance: As the market leader by premium volume, Nepal Life has a correspondingly significant digital presence. Their website is equipped with essential features like a digital login portal, online premium payment options, and detailed product information. Most notably, they have embraced emerging platforms, maintaining an active TikTok account (@officialnepallife) with over 15,000 followers. Their content strategy on this platform is particularly astute; instead of direct sales pitches, they post videos on related topics like mental health awareness and financial planning, effectively building brand affinity with a younger demographic.

- Shikhar Insurance (SICL): A leading non-life insurer, Shikhar demonstrates a high level of digital maturity. Their website is user-friendly, featuring a premium calculator, integration with major local payment gateways like eSewa and Khalti, and valuable customer resources such as an “Insurance Glossary” and a Citizen’s Charter. Their commitment to an omnichannel strategy is evident through their active presence across all major social media platforms—Facebook, Twitter, Instagram, LinkedIn, and YouTube—and the availability of a dedicated mobile app.

- MetLife Nepal: Being a global entity, MetLife brings a sophisticated approach to the Nepali market. Their digital strategy focuses on providing tangible value beyond the core insurance product. This was recognized when they won the “Social Media Initiative of the Year” award for a campaign promoting their “One by MetLife” app. The app’s Health Risk Assessment feature, which allows users to check health metrics via their phone’s camera, drove 10,000 new registrations. They also invest in creative content marketing, such as the “Hello Beema” comic video series, designed to educate the public in an engaging format.

- Himalayan Everest Insurance (HEI): This company effectively uses its website to communicate its value proposition as a “Trusted Insurance Partner.” The site is equipped with standard digital tools, including a premium calculator and a downloads section for forms and documents. They maintain an active presence on key professional and visual platforms like Facebook, Instagram, and LinkedIn.

- Other Key Players (e.g., Rastriya Beema Sansthan, Neco Insurance, SALICO): These companies generally possess functional websites that allow for online policy inquiries and claim intimations. However, their broader digital marketing efforts appear less proactive. For instance, Rastriya Beema Sansthan, the state-owned insurer, has online portals but a minimal and less engaging social media presence. Similarly, Neco Insurance and Sagarmatha Lumbini Insurance (SALICO) offer online tools but show less evidence of dynamic content strategies or large-scale social media campaigns.

4.2. What They Are Doing Well (Strengths to Emulate)

Across the industry, several best practices have emerged that should be considered foundational for any new or enhanced digital strategy.

- Essential Digital Tools: The provision of online premium calculators and digital payment integrations is no longer a differentiator but a baseline customer expectation. The top players have universally adopted these tools.

- Value-Added Mobile Innovation: MetLife’s award-winning app serves as a benchmark for the industry. By offering a genuinely useful feature like a health assessment tool, they have successfully incentivized digital engagement and data sharing, creating a powerful touchpoint with their customers.

- Youth-Centric Social Media Engagement: Nepal Life’s strategy on TikTok is a prime example of effective audience targeting. By discussing topics relevant to young adults in a non-promotional manner, they are building a relationship with the next generation of policyholders, a long-term investment in brand loyalty.

- Commitment to Omnichannel Presence: Shikhar Insurance’s activity across a diverse range of social platforms demonstrates a crucial understanding: different customer segments inhabit different digital spaces. A comprehensive strategy requires being present and active where each target persona spends their time.

4.3. Gaps and Opportunities to Outperform Them

Despite these strengths, the competitive landscape is rife with strategic gaps that present clear opportunities for differentiation and market capture.

- Lack of Definitive Educational Content Hubs: While some companies maintain a blog, no single insurer in Nepal has established itself as the undisputed, go-to authority for financial literacy. A massive opportunity exists to create a comprehensive, high-quality content hub (whether a blog, a YouTube channel, or a podcast series) that consistently and clearly answers the financial questions of the Nepali people. Becoming this trusted resource would confer immense brand authority.

- Underdeveloped and Generic SEO Strategy: A preliminary analysis of competitors’ online presence suggests that their SEO efforts are primarily focused on ranking for their own brand names. There is a significant untapped opportunity to target non-branded, informational keywords that capture users at the beginning of their research journey (e.g., “how to save for retirement in Nepal”). Furthermore, the field of long-tail, hyper-local keywords remains largely uncontested.

- Predominantly Promotional Social Media Content: With a few notable exceptions, the majority of social media content from insurers is generic and promotional. Feeds are often filled with festival greetings, product announcements, and corporate press releases. There is a distinct lack of consistent, value-driven content that sparks conversation, builds community, and provides genuine utility to followers.

- Limited Use of Personalization and Nurturing: The digital customer journey offered by most insurers is a one-size-fits-all experience.

There is little evidence of sophisticated digital marketing techniques such as lead nurturing through automated email marketing, personalized content recommendations based on user behavior, or remarketing campaigns to re-engage website visitors.

The following matrix provides a comparative snapshot of the digital presence of key competitors, highlighting these strengths and weaknesses.

| Competitor | Website & UX | SEO & Content Strategy | Social Media Presence | Key Differentiator / Weakness |

|---|---|---|---|---|

| Nepal Life Insurance | Good (Digital Portal, Calculators) | Moderate (Basic blog, weak non-branded SEO) | Strong (Leading presence on TikTok) | Differentiator: Effectively engaging a younger audience on TikTok. |

| Shikhar Insurance | Excellent (Payment gateways, mobile app, glossary) | Moderate (Blog exists but content is infrequent) | Strong (Active on all major platforms) | Differentiator: Strong omnichannel presence and excellent website UX. |

| MetLife Nepal | Excellent (Modern design, clear navigation) | Strong (Creative content campaigns, blog) | Strong (Award-winning app promotion campaign) | Differentiator: Sophisticated, value-added digital innovation (e.g., health app). |

| Himalayan Everest Ins. | Good (Premium calculator, clear value prop) | Weak (No visible blog or strong SEO focus) | Moderate (Active on professional platforms like LinkedIn) | Weakness: Lack of a clear content marketing strategy to build authority. |

| Rastriya Beema Sansthan | Average (Functional but dated UX, has online portal) | Very Weak (No blog, minimal SEO visibility) | Weak (Basic presence, low engagement) | Weakness: Underdeveloped digital marketing across all fronts. |

Recommended Strategy: A Tailored Digital Blueprint

An effective digital strategy cannot be a generic template; it must be meticulously tailored to the specific market conditions, cultural nuances, and consumer behaviors of Nepal. The following blueprint translates the preceding analysis into a concrete and actionable plan, defining precisely who to target, the channels to use, the messages to convey, and how to execute it all in a practical, budget-conscious manner.

Defining the Target Audience: From Demographics to Psychographics

A one-size-fits-all approach is destined for failure in a country as diverse as Nepal. Socioeconomic factors, including education, income level, age, and occupation, are proven to heavily influence insurance purchasing decisions. The primary untapped market lies in the nation’s underserved regions and among its lower-to-middle-income populations. To reach these disparate groups, it is essential to develop detailed customer personas.

Persona 1: “Urban Professional Prabin”

- Demographics: Age 28-40, residing in a major urban center like Kathmandu or Pokhara. He is a salaried employee in a growing sector such as technology, banking, or an NGO. He is tech-savvy, a frequent user of mobile banking apps, and professionally active on LinkedIn and Instagram.

- Psychographics & Pain Points: Prabin is forward-looking and financially conscious. His primary concerns revolve around securing his future: planning for marriage and a family, ensuring financial security for his aging parents, and finding effective tax-saving investment vehicles. He is skeptical of the traditional, high-pressure sales tactics of insurance agents and prefers to conduct his own thorough research online before making a decision.

- Digital Behavior: He is a methodical researcher who compares quotes, reads online reviews, and values transparency. He is influenced by professional, well-designed websites that present information clearly and logically.

Persona 2: “Family-Focused Sita”

- Demographics: Age 35-50, living in a semi-urban or emerging city like Butwal, Biratnagar, or Hetauda. She is either a homemaker or runs a small family business, and her husband may be a migrant worker, making her the primary financial manager at home. Her digital life revolves around Facebook and Viber, which she uses to maintain strong family connections.

- Psychographics & Pain Points: Sita’s world revolves around her family. Her foremost priority is ensuring a bright future for her children, particularly their education. She worries constantly about unexpected healthcare costs and the family’s financial stability should something happen to the primary earner. While she lacks deep financial literacy, she is highly motivated to learn and make responsible decisions for her family’s welfare.

- Digital Behavior: Trust is her primary currency. She relies heavily on recommendations from her social circle on Facebook. She engages most deeply with emotional, story-based content and videos presented in simple, clear Nepali.

Persona 3: “Next-Gen Nabin”

- Demographics: Age 18-25, a university student or in his first job. He could be living anywhere in Nepal with reliable internet access. His media consumption is dominated by short-form video; he spends several hours a day on TikTok, YouTube Shorts, and Instagram.

- Psychographics & Pain Points: Insurance is not top-of-mind for Nabin. His focus is on achieving financial independence, pursuing his passions, and establishing his identity. He is highly susceptible to trends and the opinions of influencers he follows.

- Digital Behavior: He has a short attention span and consumes content almost exclusively in video format. He is repelled by overtly corporate or sales-oriented messaging, responding instead to content that feels authentic, entertaining, and genuine. He follows a host of Nepali content creators and influencers.

Recommended Channels and Campaign Types

Based on these personas, a multi-channel strategy is required to reach each segment effectively.

- Primary Channels:

- Website/Blog: This is the central hub of credibility. It will host the in-depth educational content needed to earn the trust of Prabin and provide the detailed answers Sita is looking for.

- Google Search (SEO & PPC): This is the primary channel for capturing high-intent individuals like Prabin who are actively searching for insurance solutions.

- Facebook: The most effective channel for broad reach, community building, and running targeted lead generation campaigns aimed at Prabin and, especially, Sita.

- TikTok/YouTube Shorts: The key channels for building long-term brand awareness and delivering “edutainment” (educational entertainment) to Nabin.

- Campaign Types:

- Brand Awareness Campaign: Utilize engaging video ads on TikTok and Facebook to tell simple, emotional stories that connect with core Nepali values. The “Kina Ki Jiwan Amulya Chha” (Because Life is Precious) campaign by Nepal Life serves as an excellent model. The goal is to make the concept of insurance relatable, not to sell a specific product.

- Lead Generation Campaign: Deploy Facebook Lead Ads and Google Search Ads that offer a clear value exchange. Instead of just “Buy Now,” the call-to-action should be to download a free, helpful resource (e.g., “A Simple Guide to Retirement Planning in Nepal”) or to “Get a Free, No-Obligation Quote”.

- Content-Driven Nurturing Campaign: Once a lead is captured, use a combination of email marketing and social media retargeting to share a sequence of relevant blog posts and videos. This multi-touchpoint approach builds trust over time, educating the prospect before a salesperson ever makes contact.

Content Ideas Specific to the Nepali Context

Content must be culturally and linguistically relevant to resonate.

- Blog/Article Series (in both English and Nepali):

- “नेपालमा बच्चाको भविष्यको लागि कसरी बचत गर्ने?” (How to Save for a Child’s Future in Nepal) – Targets Sita’s primary pain point.

- “Term Insurance vs. Endowment Policy: A Simple Comparison for Nepalis” – Provides clarity for Prabin’s research.

- “5 Common Myths About Insurance Claims in Nepal (And the Truth)” – Directly confronts and dismantles trust barriers.

- “Understanding Tax-Saving Benefits of Life Insurance in Nepal” – Offers tangible value to salaried professionals like Prabin.

- Video Content:

- Animated Explainer Videos (Shorts/Reels): Simple, 60-second animated videos in Nepali explaining concepts like “What is Health Insurance?” or “How Third-Party Motor Insurance Works.” – Appeals to all personas.

- Authentic Client Testimonials: Short, professionally shot but emotionally raw videos of real Nepali families sharing how an insurance policy provided a crucial safety net during a difficult time. – Builds immense trust with Sita.

- “Ask an Expert” Series: A weekly or bi-weekly series where a friendly, approachable agent answers questions submitted by users on social media. This humanizes the brand and provides direct value. – Engages Prabin and Sita.

- Community Involvement Showcase: Videos highlighting the company’s participation in or sponsorship of local festivals, clean-up drives, or community health camps. This demonstrates a commitment to the community beyond profits.

- Interactive Content:

- Online Calculators: A simple, mobile-friendly tool on the website titled “How Much Life Insurance Do I Really Need?”

- Social Media Polls (Facebook/Instagram Stories): Engage the audience with simple questions like, “What is your biggest financial worry for the future? A) Children’s Education, B) Retirement, C) Health Emergencies.” This provides valuable market research while boosting engagement.

Budget-Friendly Digital Marketing Approaches

A powerful digital strategy does not require a massive budget. The focus should be on smart, sustainable tactics.

- Prioritize Organic Growth: The most cost-effective long-term strategy is to invest in owned assets.

A heavy focus on Local SEO—optimizing the Google Business Profile for every branch is free and highly effective—and creating high-quality, evergreen blog content will generate qualified traffic for years to come at no recurring media cost.

- Leverage User-Generated Content (UGC): Run social media contests that encourage users to share their own stories or photos related to financial goals (e.g., “Share a photo of what you’re saving for”). Featuring the winners provides authentic, relatable content and fosters a sense of community at minimal cost.

- Build an Email List from Day One: Email marketing consistently delivers the highest ROI of any digital channel. Nurturing existing leads and customers via email is far more cost-effective than constantly paying to acquire new ones. Make email list building a primary goal of the website.

- Execute Hyper-Targeted Ad Campaigns: Instead of broad, expensive brand awareness campaigns, allocate a small budget to highly specific PPC campaigns. Focus on long-tail keywords with clear purchase intent or use Facebook’s detailed targeting to reach a very niche demographic. This approach minimizes wasted ad spend and maximizes ROI by ensuring every dollar is spent reaching the most relevant audience possible.

6. Keywords & SEO Opportunities: Capturing High-Intent Traffic

Search Engine Optimization (SEO) is the art and science of ensuring a business is visible when potential customers search for solutions online. For Nepalese insurance companies, SEO represents one of the most powerful and cost-effective long-term strategies for generating qualified leads. The key to success lies in moving beyond generic terms and targeting the specific phrases and questions that real people use when they are considering insurance.

6.1. Understanding Keyword Intent

A successful SEO strategy is built on understanding user intent—the “why” behind a search query. Targeting the right intent is more important than targeting the highest volume keywords. For the insurance sector, efforts should be focused on four primary categories of search intent:

- Informational Intent: The user is looking for information or an answer to a question. (e.g., “what is life insurance?”). This is the top of the marketing funnel. Capturing this traffic with blog posts and guides establishes the brand as an expert.

- Navigational Intent: The user is trying to find a specific website. (e.g., “Nepal Life Insurance login”). This is important for existing customers.

- Commercial Investigation Intent: The user is comparing products and services, intending to make a purchase soon. (e.g., “best health insurance plan in Nepal”). These are high-value keywords to target with comparison pages and detailed service pages.

- Transactional Intent: The user is ready to buy now. (e.g., “buy car insurance online Nepal”). These are the highest-intent keywords and are ideal targets for both service pages and PPC advertising campaigns.

6.2. High-Intent “Money” Keywords for Ranking

These are the core commercial and transactional keywords that should be the focus of main service pages and paid advertising campaigns. While competition can be high, ranking for these terms is essential for capturing customers at the final stage of their decision-making process.

- Life Insurance: life insurance quotes Nepal, buy term insurance plan online, best life insurance policy in Nepal, LIC Nepal premium calculator.

- Health Insurance: health insurance companies in Nepal, family health insurance quote, medical insurance Nepal price, critical illness cover Nepal.

- Motor Insurance: car insurance online Nepal, third party bike insurance, motor insurance renewal, vehicle insurance quote Kathmandu.

- General/Non-Life: home insurance Nepal, travel insurance for Thailand from Nepal, best non-life insurance company Nepal.

6.3. Long-Tail Keyword Opportunities (Nepal-Specific)

This is where the most significant competitive advantage in SEO can be gained. Long-tail keywords are longer, more specific search phrases (typically 3+ words). They have lower search volume individually, but they are far less competitive and have a much higher conversion rate because they reflect a very specific need.

- Location-Based Long-Tail Keywords: These are crucial for capturing the underserved market outside Kathmandu.

- motorcycle insurance renewal in Pokhara

- best health insurance for family in Butwal

- find insurance agent in Biratnagar

- travel insurance for India from Nepalgunj

- Problem/Solution-Based Long-Tail Keywords: These keywords capture users who are seeking solutions to specific life situations.

- how to get insurance for parents over 60 in Nepal

- best child education saving plan in Nepal

- insurance for foreign employment to Dubai

- what to do after a bike accident in Nepal

- Comparison-Based Long-Tail Keywords: These target users in the final stages of commercial investigation.

- Nepal Life vs MetLife policy comparison

- Shikhar Insurance vs Sagarmatha Lumbini third party insurance

- endowment plan vs ULIP plan in Nepal

The following matrix provides a starter pack of keyword ideas, categorized by insurance type and user intent, including crucial Nepali language variations in Devanagari script. Many users, especially outside of major urban centers, will search in their native language—a segment often overlooked by competitors.

| Insurance Type | High-Intent Keywords (English/Romanized) | Long-Tail Keywords (English/Romanized) | High-Intent Keywords (Devanagari) | Long-Tail Keywords (Devanagari) |

|---|---|---|---|---|

| Life Insurance | buy life insurance Nepal, life insurance quote, term plan online | best term plan for 30 year old, child education insurance plan, retirement pension plan Nepal | जीवन बीमा, जीवन बीमा योजना, टर्म इन्सुरेन्स | नेपालमा छोरीको लागि उत्तम बीमा योजना, सेवानिवृत्ति योजना, बच्चाको पढाईको लागि बीमा |

| Health Insurance | health insurance quote, medical insurance Nepal, family health plan | health insurance with maternity cover, critical illness policy Nepal, best health insurance for parents | स्वास्थ्य बीमा, मेडिकल इन्सुरेन्स, पारिवारिक स्वास्थ्य बीमा | अस्पताल खर्चको लागि बीमा, गम्भीर रोग बीमा, आमाबाबुको लागि स्वास्थ्य बीमा |

| Motor Insurance | car insurance online, bike insurance price, third party insurance | third party bike insurance renewal online, comprehensive car insurance quote, scooter insurance price in Nepal | मोटर बीमा, गाडीको बीमा, तेस्रो पक्ष बीमा | पुरानो बाइकको बीमा कसरी गर्ने, गाडीको बिमा कति पैसा लाग्छ, स्कुटरको तेस्रो पक्ष बीमा |

| Travel Insurance | travel insurance Nepal, international travel insurance, student travel insurance | student travel insurance for Australia from Nepal, travel insurance for Schengen visa, family travel insurance for India | यात्रा बीमा, विदेश यात्रा बीमा, विद्यार्थी यात्रा बीमा | थाइल्याण्ड भिसाको लागि यात्रा बीमा, युरोपको लागि यात्रा बीमा, परिवारको लागि यात्रा बीमा |

7. Implementation Roadmap: From Quick Wins to Long-Term Dominance

A comprehensive digital strategy can seem daunting. To ensure successful execution, it is essential to break down the process into a phased, time-bound roadmap. This approach allows for the achievement of early, momentum-building victories while laying the groundwork for sustained, long-term market leadership. The roadmap is divided into three distinct phases: Foundational Quick Wins, Growth & Engagement, and Scaling & Optimization.

7.1. Phase 1: Foundational Quick Wins (Months 1–3)

Goal: To establish a professional and trustworthy digital footprint while capturing the lowest-hanging fruit for immediate impact.

- Technical SEO Audit & Fixes: The very first step is to ensure the company’s primary digital asset—the website—is technically sound. Conduct a comprehensive audit to identify and fix critical issues such as broken links, slow page load speeds, and poor mobile-friendliness. A fast, functional, and mobile-responsive website is the bedrock of all future digital efforts.

- Google Business Profile (GBP) Optimization: This is arguably the single most impactful and cost-effective action for local lead generation. Claim, verify, and meticulously optimize the GBP listing for the head office and, crucially, for every single branch office. This includes ensuring accurate addresses, phone numbers, and business hours, uploading high-quality photos of the office and staff, and selecting the correct service categories.

- On-Page SEO for Core Service Pages: Optimize the website’s homepage and main service pages (e.g., Life Insurance, Health Insurance, Motor Insurance) with the primary high-intent keywords identified in the previous section. This involves refining page titles, meta descriptions, headings, and body content to clearly signal relevance to search engines.

- Social Media Profile Optimization: Conduct a thorough review of all existing social media profiles (Facebook, LinkedIn, Instagram, etc.). Ensure that branding is consistent, all profile sections are completely filled out with up-to-date information, and links to the website are prominent. This presents a professional and cohesive brand image across all platforms.

- Launch a Foundational Blog: Begin the content marketing journey by publishing the first 3-4 high-value, evergreen blog posts. These articles should address the most fundamental and frequently asked questions from customers, such as “What is the difference between term and endowment insurance?” or “A simple guide to making a motor insurance claim.” This immediately establishes the website as a helpful resource.

Phase 2: Growth & Engagement (Months 4–12)

Goal: To build brand authority, generate a consistent flow of inbound leads, and cultivate an engaged online community.

- Consistent Content Creation: Transition from foundational posts to a regular publishing schedule. Aim to publish one to two high-quality, SEO-optimized blog posts per week. Develop a content calendar based on the persona pain points and keyword opportunities identified earlier. Consistency is key to building an audience and signaling expertise to search engines.

- Launch a Video Content Strategy: Begin producing video content to cater to the preferences of the Nepali audience. Start with short-form (under 60 seconds) explainer videos for social media platforms like TikTok and Facebook Reels. Concurrently, aim to produce one longer-form video per month for YouTube, such as an in-depth “expert interview” or an authentic “customer testimonial”.

- Initiate Targeted PPC Campaigns: With the website and foundational content in place, begin strategic paid advertising. Launch low-budget Google Search ad campaigns targeting a small, curated list of 10-15 high-intent, long-tail keywords. Simultaneously, launch a Facebook lead generation campaign offering a valuable piece of content (like a free guide) in exchange for contact details.

- Systematic Email List Building: Actively promote an email newsletter signup across the website (e.g., in blog post footers, via a pop-up) and on social media. Begin sending a monthly newsletter that provides genuine value—summarizing the month’s best tips, linking to new blog posts, and sharing company news—to start nurturing the captured leads.

- Proactive Community Engagement: Shift from passive posting to active engagement on social media. Assign resources to respond to every comment and message promptly and helpfully. Begin participating in relevant local Facebook groups (e.g., community forums, business groups) to offer expert advice and answer questions, positioning the brand as a helpful community member rather than a direct seller.

Phase 3: Scaling & Optimization (Months 12+)

Goal: To solidify market leadership, optimize all activities for maximum Return on Investment (ROI), and explore advanced digital initiatives.

- Implement Marketing Automation: As the lead volume grows, manual follow-up becomes inefficient. Implement an email marketing automation platform to create sophisticated nurturing sequences. This can include a “welcome series” for new subscribers, a “lead nurturing drip” for prospects who downloaded a guide, and automated reminders for policy renewals.

- Conduct Advanced Analytics Review: With a year’s worth of data, perform a deep-dive analysis using Google Analytics, social media insights, and CRM data. Identify which content topics, traffic channels, and ad campaigns are driving the most qualified leads and actual sales. Reallocate budget and resources to double down on what is proven to work and scale back on underperforming initiatives.

- Pilot an Influencer Marketing Campaign: Having established a strong brand presence, collaborate with two or three mid-tier Nepali influencers in the finance, lifestyle, or family-focused niches. A well-executed campaign on Instagram or TikTok can provide a significant boost in credibility and reach among their dedicated followers.

- Expand Digital Product Offerings and Services: Leverage the trust and digital infrastructure built over the previous year to enhance the customer experience further. Explore the development of a value-added mobile application, similar to MetLife’s, or invest in the technology required to offer a fully seamless, end-to-end online journey for policy purchasing and claims processing.

Conclusion: The Imperative of Digital Transformation

The Nepalese insurance market is at a critical inflection point. The industry’s current trajectory, marked by impressive premium growth from a narrow customer base, is not sustainable for achieving the widespread financial inclusion the nation requires. A profound crisis of trust and a pervasive lack of awareness have left the vast majority of the population uninsured and vulnerable. The traditional, agent-centric distribution models that built the industry have proven insufficient to bridge this gap, particularly in a nation that is rapidly becoming mobile-first and digitally connected.

Digital marketing, therefore, is not merely an alternative channel or a supplementary tactic; it is the most effective, scalable, and necessary solution to the industry’s most fundamental challenges. It provides the platform to educate millions at a scale previously unimaginable, to build trust through transparency and consistent value delivery, and to use data-driven insights to reach and serve customers more efficiently and personally than ever before.

A Call to Action for Future-Ready Insurers

The choice for insurance companies in Nepal is no longer if they should adopt a comprehensive digital marketing strategy, but how quickly and effectively they can execute one. The competitive landscape is still formative, and the opportunity to become the dominant, trusted digital voice in the industry is open. The companies that act decisively now—to build a robust digital presence founded on the principles of education, transparency, and customer value—will be the ones to capture the immense untapped market and emerge as the undisputed leaders of the next decade.

Executing the comprehensive strategy detailed in this report requires a unique blend of local market understanding, technical expertise, and strategic marketing acumen. This is not a journey to be undertaken lightly or with inexperienced partners. Gurkha Technology (www.gurkhatech.com) is a leading digital marketing and technology agency in Nepal, possessing a proven track record of empowering businesses to digitize, optimize, and thrive in the online ecosystem.

With a full suite of in-house services, Gurkha Technology is uniquely positioned to partner with ambitious insurance companies to implement every phase of this strategic roadmap. Our expertise includes:

- Search Engine Optimization (SEO): To ensure you are found when customers are searching.

- Social Media Marketing & Management: To build your brand, engage your community, and generate leads on platforms like Facebook and TikTok.

- Google Ads & Paid Advertising: To drive immediate, high-intent traffic and measure ROI precisely.

- Web Development & Hosting: To build the fast, secure, and user-friendly website that serves as the foundation of your digital presence.

Our team of seasoned professionals is dedicated to developing bespoke strategies that deliver measurable results, helping clients like Nepal Airlines Corporation and Nimbus Nepal achieve their digital objectives.

Empower your digital success and secure your future in the evolving Nepali market. Contact Gurkha Technology today for a free, no-obligation consultation to begin your transformation.

📚 For more insights, check out our digital marketing best practices.