Nepal Pharma Digital Marketing & Transformation Guide

Industry Overview: A Market of Contradictions

The Nepalese pharmaceutical sector presents a dynamic yet challenging landscape. It is an industry characterized by robust growth and significant economic contribution, but simultaneously undermined by deep-seated structural weaknesses. These contradictions create a complex operating environment where traditional business models are increasingly strained, paving the way for strategic digital intervention. Understanding this duality is fundamental to unlocking future growth.

The Pharmaceutical Landscape

Nepal’s domestic pharmaceutical industry is a vibrant mix of established veterans and emerging players. The backbone of local production is formed by key manufacturers such as Deurali-Janta Pharmaceuticals Pvt. Ltd., Magnus Pharma Pvt. Ltd., Quest Pharmaceuticals Pvt. Ltd., Asian Pharmaceuticals Pvt. Ltd., and Nepal Pharmaceuticals Laboratory Pvt. Ltd.. These companies, among others, represent the nation’s capacity for self-reliance in medicine manufacturing.

A critical benchmark for quality and international acceptance within this landscape is the World Health Organization’s Good Manufacturing Practice (WHO-GMP) certification. Over 30 domestic companies have achieved this standard, with several others in the process of certification. This distinction serves as a vital marker of credibility, separating companies that adhere to global quality standards from the rest of the market. This certification is not merely a regulatory hurdle but a significant asset for brand positioning and building trust with healthcare professionals (HCPs) and patients alike.

Market Size, Growth, and Economic Contribution

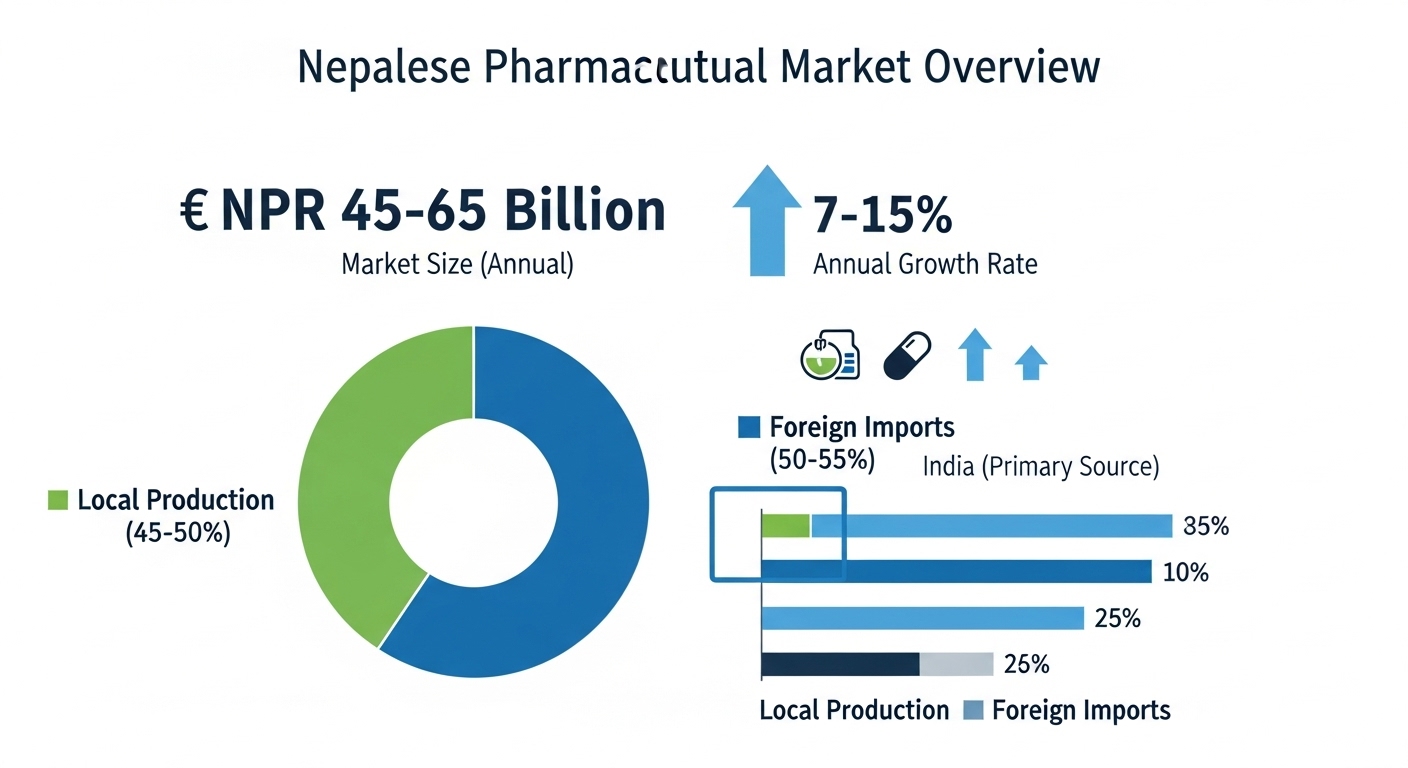

The pharmaceutical market in Nepal holds a significant economic footprint, with valuations estimated to be between NPR 45 billion and NPR 65 billion. The sector is on a strong upward trajectory, demonstrating an impressive annual growth rate estimated between 7% and 15%. This expansion is propelled by demographic and social shifts, including a growing and aging population, increased health consciousness, and rapid urbanization, particularly in areas like Bhairahawa, which is emerging as a pharmaceutical hub.

The market is defined by a delicate balance between local production and foreign imports. Domestic manufacturers cater to approximately 45% to 50% of the market demand in value terms, a testament to their growing capabilities. However, imports continue to play a dominant role, accounting for the remaining 50% to 55% of the market share, with India being the primary source. This dynamic underscores the intense competitive pressure faced by local companies. Trade data further illuminates this dependency; in 2023, Nepal imported $311 million worth of pharmaceutical products while exporting a comparatively minuscule $11.2 million, highlighting a significant trade deficit in the sector.

Key Challenges: The Fault Lines of the Industry

Despite its growth, the Nepalese pharmaceutical industry is fraught with systemic challenges that threaten its stability and erode public trust.

- Supply Chain Vulnerability: The entire domestic manufacturing sector is 100% reliant on imported Active Pharmaceutical Ingredients (APIs) and other essential raw materials. With the majority of these inputs sourced from India and China, the industry is perpetually exposed to geopolitical tensions, price fluctuations, and supply chain disruptions beyond its control.

- The Quality and Trust Deficit: A pervasive and deeply concerning issue is the circulation of substandard, falsified, and unregistered medicines. The Department of Drug Administration (DDA) regularly recalls products, and these recalls are almost evenly split between domestically produced and imported drugs. A significant number of these recalled products were never even registered with the DDA, indicating they were circulating illegally in the market. This persistent quality control failure has created a significant trust vacuum among both prescribers and the public.

- Regulatory Weaknesses and Policy Gaps: The regulatory framework struggles to keep pace with the market’s complexities. The DDA is critically understaffed, with reports indicating as few as 38 drug inspectors are tasked with monitoring thousands of pharmacies and distributors across the country. This resource deficit makes effective oversight nearly impossible. Furthermore, government policies have been criticized for being more import-oriented than supportive of domestic industry. A critical pain point for manufacturers is the government’s failure to adjust the prices of essential medicines since 2073 BS (approximately 2016-2017), which severely squeezes profit margins and stifles investment in quality and innovation.

- “Unhealthy” Market Competition: Because the market is dominated by generic drugs, true product differentiation is difficult. Consequently, competition often devolves into aggressive, incentive-based marketing aimed directly at physicians. This practice, described by industry insiders as “unhealthy competition,” involves offering bonuses, samples, and other financial benefits to influence prescription patterns. This “company bombardment” creates an environment where marketing budgets may be prioritized over product quality, raising significant ethical concerns and further damaging trust in the healthcare ecosystem.

The confluence of these challenges—substandard drug circulation, inadequate regulatory monitoring, and ethically ambiguous marketing tactics—has resulted in a market where trust is a scarce commodity. Patients and healthcare professionals alike are left without a reliable, unbiased source of information to guide their decisions. This environment presents a unique opportunity. A pharmaceutical company that can successfully leverage digital channels to deliver transparent, accurate, and high-quality health information can distinguish itself not just as a manufacturer, but as a “beacon of trust.” This strategic positioning directly addresses the market’s most profound vulnerability and offers a powerful path to sustainable brand leadership.

Digital Landscape in Nepal: Navigating a New Reality

The digital ecosystem in Nepal is undergoing a period of rapid evolution and significant disruption. While user adoption of digital technologies continues to grow, recent regulatory shifts have fundamentally altered the social media landscape. For pharmaceutical companies, crafting a viable digital strategy requires a clear understanding of not only who is online, but where they can be compliantly reached.

Internet and Social Media Penetration (Early 2024 Snapshot)

Nepal’s population is increasingly connected. As of early 2024, the country was home to 15.40 million internet users, achieving an internet penetration rate of 49.6%. Mobile connectivity is even more pervasive, with 37.47 million active cellular connections, equivalent to 120.6% of the total population, indicating widespread multi-SIM ownership and a mobile-first user base.

Social media usage is also robust and growing. There were 13.50 million active social media users at the start of 2024, representing 43.5% of the population. This figure saw a notable increase of 1.7 million users (+13.9%) between 2023 and 2024, signaling a society that is rapidly embracing digital platforms for communication and information consumption.

The Platform Ecosystem and the Great Regulatory Shift

Historically, Nepal’s social media environment has been dominated by a single platform. With a market share of over 87%, Facebook has been the undisputed leader, to the extent that for many Nepalese, “Facebook is the internet”. YouTube and Instagram have followed as other popular choices.

However, this status quo has been upended by a game-changing government directive. Citing the need for accountability and compliance with local laws, the government has mandated that all social media platforms must formally register to operate in Nepal. Major international platforms, including Meta (Facebook, Messenger, Instagram, WhatsApp), Alphabet (YouTube), and X (formerly Twitter), failed to meet the registration deadline, leading to a ban on their services (hypothetically effective late 2025).

This regulatory action fundamentally reshapes the digital marketing playbook. The ban effectively removes the largest and most familiar channels from the marketing mix, forcing a strategic pivot. It elevates the importance of the platforms that have successfully registered and complied with local regulations. Chief among these are TikTok and the messaging application Viber, which now represent the primary social and communication platforms for reaching a mass audience in Nepal.

Consumer Online Behavior in Healthcare

As Nepalese consumers spend more time online, their health-seeking behaviors are also shifting to digital channels.

- Information Seeking and Trust: A growing number of consumers, especially younger demographics, use the internet to research health conditions and medical information. However, this behavior is tempered by challenges related to digital literacy and a general distrust of online sources, making the credibility of the information provider paramount.

- Drivers of Online Engagement: When it comes to online purchasing and engagement, Nepalese users are highly price-sensitive and significantly influenced by the opinions of friends, family, and online ratings. For health-related decisions, such as purchasing insurance or engaging with health services, trust in the brand is the most critical factor.

- Adoption of Digital Health Tools: The willingness to adopt new digital health tools is driven less by necessity and more by user experience.

Factors such as ease of use (“facilitating conditions“) and the enjoyment derived from the interaction (“hedonic motivation“) are the strongest predictors of adoption. This indicates a clear preference for intuitive, well-designed, and engaging digital health platforms.

The government’s sweeping ban on major social media platforms, while disruptive, inadvertently creates a “forced maturity” in the digital marketing landscape. Companies can no longer default to the simple, broad-reach tactics of advertising on Facebook. The easy option of “renting” access to a massive audience is gone. Instead, they are compelled to adopt a more sophisticated and sustainable strategy focused on “owning” their audience. This means investing in foundational digital assets that they control: a high-quality, SEO-optimized website to serve as a central information hub, and direct communication channels like email and Viber to nurture relationships. This regulatory hurdle, therefore, acts as a catalyst, pushing the industry toward building long-term digital equity rather than relying on the volatile, short-term nature of traditional social media marketing. The first pharmaceutical company to master this new reality will not only comply with the law but will also build a formidable and lasting competitive advantage.

Digital Marketing Opportunities: From Challenge to Competitive Edge

The unique intersection of the Nepalese pharmaceutical industry’s challenges and its newly constrained digital landscape creates a fertile ground for strategic innovation. Digital marketing, when applied thoughtfully, ceases to be a mere promotional tool and becomes a powerful mechanism for solving core business problems—from rebuilding trust to navigating a complex competitive environment.

How Digital Marketing Can Solve Key Challenges

A well-executed digital strategy can directly address the primary fault lines identified within the industry:

- Building Trust in a Low-Trust Environment: The most significant opportunity lies in addressing the market’s “trust vacuum.” By investing in high-quality content marketing and robust Search Engine Optimization (SEO), a pharmaceutical company can establish its corporate website as the premier, authoritative source for reliable health information in Nepal. This allows the company to directly combat the rampant misinformation and skepticism stemming from issues with substandard drugs, creating a safe, credible space for patients and HCPs.

- Educating and Empowering Audiences: Digital channels provide a direct-to-audience platform for education. Companies can develop compliant, value-driven content such as blogs, videos, and webinars to inform patients about disease management and empower HCPs with the latest treatment information. This creates a “pull” effect, where audiences are attracted by the value of the information, as opposed to the traditional “push” effect driven by sales incentives.

- Bypassing Unhealthy Competition: By establishing direct lines of communication with both patients and HCPs through channels like a corporate website, Viber, and email, companies can reduce their dependency on the traditional, incentive-driven medical representative model. This allows them to build relationships based on credibility and educational value rather than on financial inducements, thereby occupying a higher ethical ground.

Best Digital Marketing Strategies for Nepalese Pharma

Given the regulatory constraints and market needs, a successful strategy must be multi-faceted, compliant, and focused on long-term value creation.

- Search Engine Optimization (SEO): This is the non-negotiable cornerstone of any digital strategy in Nepal’s new landscape. With major social platforms gone, Google is the primary gateway for Nepalese users seeking health information. A dedicated SEO strategy focused on creating high-quality, bilingual (English and Nepali) content that answers common health questions is the most effective way to attract organic traffic and build a sustainable audience.

- Content Marketing: The fuel for the SEO engine is a robust content marketing program. The objective is to transition the company’s perception from a mere product manufacturer to a trusted health partner. This involves the consistent creation of valuable, accurate, and easily digestible content, including disease awareness articles, myth-busting infographics, patient education videos, and detailed treatment guides.

- Compliant Social Media (TikTok & Viber):

- TikTok: As a registered and popular platform, TikTok should be used strategically for top-of-funnel brand awareness and unbranded disease education campaigns. Content must be engaging and informative, strictly adhering to TikTok’s healthcare advertising policies and targeting users aged 18 and over. Campaigns could focus on public health messages, hygiene tips, or general wellness, subtly building brand association without making direct product claims.

- Viber: With its widespread use in Nepal, Viber for Business is a powerful tool for direct and personalized communication. It can be used for transactional messaging (e.g., delivery updates for partner pharmacies), compliant promotional messaging for Over-The-Counter (OTC) products, and conversational support, creating a direct and trusted channel to end-users and partners.

- Influencer Marketing: To amplify reach and bolster credibility, collaborations with trusted local health influencers are key. Partnering with credible Nepalese doctors and wellness experts on platforms like TikTok (e.g., @nepalesedoctor) or established figures like Dr. Sandesh Lamsal allows for the dissemination of compliant health information through a trusted voice, bypassing the skepticism associated with direct corporate messaging.

- Email Marketing: While direct-to-consumer email marketing is nascent, it remains a crucial channel for engaging with Healthcare Professionals. Building a compliant, opt-in email list of doctors, pharmacists, and hospital administrators allows for the targeted distribution of new research findings, product updates, and invitations to exclusive educational webinars. All communications must strictly adhere to the DDA’s regulations on drug promotion, which prohibit direct advertising of prescription medicines to the public.

Local and Global Examples/Case Studies

The potential for digital success in pharma is well-documented globally and can be adapted to Nepal’s unique context.

- Global Success Stories: International case studies demonstrate the transformative power of digital. For instance, one pharma giant leveraged a comprehensive SEO strategy to achieve a 117% increase in organic traffic, significantly reducing its reliance on paid advertising. Another company, through a multi-channel digital campaign for a brand relaunch, drove a staggering 6,025% increase in on-site goal completions. These examples prove that strategic digital investment yields substantial, measurable results.

- Local Adaptation: A global strategy, such as building an omnichannel experience for HCPs, can be effectively localized for Nepal. Instead of integrating a complex web of numerous social platforms, the Nepalese equivalent would focus on creating a seamless and valuable journey for an HCP that moves between a highly informative corporate website, a professional Viber channel for quick updates, and value-added interactions with a digitally-equipped medical representative. This tailored approach leverages available channels to achieve the same goal: a consistent, high-value customer experience.

Competitive Analysis: An Unclaimed Digital Territory

A thorough review of the digital presence of leading pharmaceutical companies in Nepal reveals a striking pattern: while a basic online footprint exists, a sophisticated, strategic approach to digital marketing is conspicuously absent. The digital landscape is not a crowded battlefield but rather an unclaimed territory, presenting a significant first-mover advantage to any organization willing to invest strategically.

Current Digital Presence of Top Pharmaceutical Companies

An analysis of the websites and digital assets of key market players shows a consistent focus on corporate communication over audience engagement.

- Deurali-Janta Pharmaceuticals: The company’s website serves as a professional corporate brochure. It effectively details the organization’s history, vision, mission, and certifications like WHO-GMP and ISO. The content is heavily geared towards an investor or business partner audience, showcasing R&D capabilities and infrastructure. However, it lacks any meaningful patient-facing educational content or clear calls-to-action designed to foster engagement.

- Magnus Pharma: Magnus Pharma’s website features a well-organized product list categorized by therapeutic area, which is useful for HCPs. It also includes a “Health & Wellness” section and highlights its CSR activities through the “Sano Kura” initiative. Despite these elements, the content often remains at a surface level. The primary focus is on corporate branding and product announcements rather than providing deep, educational value that would position them as a thought leader.

- Quest Pharmaceuticals: The Quest Pharmaceuticals website functions primarily as a showcase for corporate achievements. It prominently features its ISO certification, industry awards, and key impact metrics like the number of patients served and funds donated. While it includes a news section, the content is often dated and sparse.

The overall design and user experience feel static and are not optimized for continuous user engagement or information seeking.

- Asian Pharmaceuticals: Similar to its competitors, the Asian Pharmaceuticals website is structured around its product divisions and corporate identity. It includes a media center for press releases and corporate news. The main engagement tool is a basic newsletter subscription form, but there is a significant lack of patient resources, in-depth articles, or interactive tools.

4.2 What They Are Doing Well

The current digital efforts of these companies are not without merit. Their primary strength lies in establishing a baseline of corporate credibility.

- Establishing Credibility: The top domestic companies have successfully used their websites to create a professional digital headquarters. They effectively communicate their manufacturing credentials, WHO-GMP certifications, and extensive product ranges, which is a crucial foundational step for building trust with an HCP audience.

- Corporate Communication: These websites function adequately as a central repository for official company news, press releases, and information for potential business partners or investors.

4.3 Gaps and Opportunities to Outperform Them

The homogeneity of the current digital approach reveals several critical gaps, each representing a strategic opportunity for a forward-thinking competitor.

- The Patient is Invisible: The most glaring omission across the board is the near-total absence of patient-centric content. No major player is actively engaging with or educating the general public about health conditions, treatments, or wellness. This creates a massive opportunity to build a community, foster brand loyalty, and become the go-to resource for patients in Nepal.

- Rudimentary SEO and Invisibility: A preliminary analysis indicates that these corporate websites are not optimized for search engines. They are built as digital brochures, not as traffic-generating assets. They fail to target the informational and transactional keywords that Nepalese patients and HCPs are using on Google every day, rendering them effectively invisible to a vast potential audience.

- Lack of Interactivity and Engagement: The existing websites are overwhelmingly static. They lack the dynamic features that encourage user interaction and return visits, such as regularly updated blogs, interactive health tools, webinars, or compelling calls-to-action that go beyond a simple “contact us” page.

- Absence of a Multi-Channel Strategy: There is no evidence of an integrated digital strategy that connects the corporate website to other compliant channels. The potential of platforms like Viber for direct communication, TikTok for awareness campaigns, or email for HCP nurturing remains entirely untapped.

To crystallize these findings, the following table provides a comparative analysis of the digital footprint of key competitors, starkly illustrating the opportunity gap.

| Company | Website User Experience (UX) | SEO Performance (Visibility Score) | Content Focus (HCP vs. Patient) | Digital Engagement Channels |

|---|---|---|---|---|

| Deurali-Janta | Professional but static | Low | 95% HCP / 5% Patient | None evident |

| Magnus Pharma | Decent navigation, weak content | Low | 90% HCP / 10% Patient | None evident |

| Quest Pharma | Dated design, static | Very Low | 95% HCP / 5% Patient | None evident |

| Asian Pharma | Basic, corporate-focused | Very Low | 95% HCP / 5% Patient | Basic newsletter |

This analysis makes it clear that the digital field is wide open. The first company to move beyond a “digital brochure” and implement a genuine, audience-centric digital strategy will not just be competing—it will be defining the market.

5. Recommended Strategy: A Patient-Centric, Trust-Based Approach

To capitalize on the identified gaps and navigate the unique Nepalese digital environment, a strategy built on the pillars of trust, education, and accessibility is recommended. This approach pivots away from the traditional, product-centric model towards a more modern, audience-centric framework that serves the distinct needs of both patients and healthcare professionals.

5.1 Target Audience Personas

A successful strategy begins with a deep understanding of the target audience. Two key personas represent the primary targets for digital engagement in Nepal.

- Persona 1: “Anjali,” the Proactive Caregiver (Patient Segment)

- Demographics: A 35-year-old mother and professional living in Kathmandu. She is digitally proficient, using her smartphone as her primary gateway to the internet. She is an active user of Viber for family communication and consumes short-form video content on TikTok.

- Behavior and Needs: Anjali is the primary healthcare decision-maker for her family. She uses Google, searching in both English and Romanized Nepali, to look up symptoms for her children (e.g., “bacha lai rugha khoki ko gharelu upchar” – home remedies for child’s cold and cough) and to better understand the medications prescribed to her elderly parents. She is wary of misinformation and highly values trustworthy, clear, and easily accessible health information. Her goal is to feel confident and informed in her caregiving role.

- Persona 2: “Dr. Sharma,” the Digital Native HCP (Professional Segment)

- Demographics: A 45-year-old General Practitioner with a busy clinic in Pokhara. He relies on his smartphone and laptop to stay current with medical advancements in between patient consultations.

- Behavior and Needs: Dr. Sharma subscribes to several international and local medical e-newsletters to keep abreast of new research. He values evidence-based, concise, and clinically relevant information. He is motivated by opportunities for online Continuing Medical Education (CME) that fit into his demanding schedule. His goal is to access credible information efficiently to provide the best possible care to his patients.

5.2 Recommended Channels and Campaign Types

The strategy should utilize a hub-and-spoke model, with the corporate website at the core and other channels driving traffic and engagement.

- Primary Channel (The Hub): A completely redesigned website that is mobile-first, technically sound, and optimized for search engines. Crucially, the site architecture must feature two distinct, clearly signposted portals: one for Patients (like Anjali) with accessible, educational content, and a gated one for HCPs (like Dr. Sharma) with technical, clinical information.

- Traffic and Engagement Channels (The Spokes):

- Google Search (SEO): This will be the primary engine for audience acquisition, attracting both Anjali and Dr. Sharma as they actively seek information.

- Viber for Business: To be used for building a direct communication channel with HCPs for non-promotional updates and for providing customer service to pharmacies and distributors.

- TikTok: The main channel for top-of-funnel, unbranded disease awareness campaigns. These campaigns will not mention products but will focus on public health topics relevant to Anjali, such as “Monsoon Health Tips” or “Diabetes Awareness Week,” building brand affinity and trust.

- Email Marketing: The primary tool for nurturing relationships with Dr. Sharma and other HCPs through a targeted, value-driven newsletter.

5.3 Content Ideas Specific to Pharmaceutical Companies in Nepal

Content must be tailored to the specific needs of the personas and the health landscape of Nepal.

- For Patients (Anjali):

- Bilingual Health Blog: A cornerstone of the patient portal, featuring articles on diseases prevalent in Nepal, such as Chronic Obstructive Pulmonary Disease (COPD), diabetes, dengue fever, and common respiratory infections. Content must be optimized with long-tail keywords in both English and Nepali.

- “Ask a Doctor” Video Series: A series of short, 1-2 minute videos for TikTok and the website. These videos would feature a credible, media-trained Nepalese doctor answering common health questions in simple terms, directly addressing Anjali’s need for trustworthy advice.

- Myth vs. Fact Infographics: Visually engaging graphics that can be shared on Viber and other platforms to address common health myths and superstitions, reinforcing the brand’s commitment to scientific accuracy.

- For HCPs (Dr. Sharma):

- Gated Content Portal: A secure, login-protected section of the website offering access to high-value resources, including detailed product monographs, downloadable clinical trial data, and summaries of recent research papers.

- CME-Accredited Webinar Series: Monthly or quarterly online events hosted by medical experts on new therapeutic advancements. Offering CME points would be a significant value-add for Dr. Sharma and his peers.

- HCP-Exclusive E-Newsletter: A concise, monthly email digest summarizing key product updates, new clinical evidence, and highlights from recent medical conferences, designed for the time-poor professional.

5.4 Budget-Friendly Digital Marketing Approaches

Significant impact can be achieved without a massive initial investment by prioritizing sustainable, long-term strategies.

- Prioritize Organic Growth: The primary focus of the budget and effort should be on SEO and content marketing. While the results are not immediate, building a strong organic presence on Google provides the most cost-effective and durable return on investment, creating a digital asset that generates traffic and leads for years.

- Leverage In-House Expertise: A company’s greatest content asset is its internal team of medical and scientific experts.

By creating a process to involve them in writing, reviewing, or providing insights for content, the company can produce highly accurate and credible material at a fraction of the cost of outsourcing to external medical writers.

- Micro-Influencer Collaborations: Instead of pursuing expensive celebrity endorsements, the company should build relationships with micro-influencers in the health space—nurses, pharmacists, and doctors with smaller but highly engaged and trusted followings. These collaborations are often more authentic and provide a better ROI.

6. Keywords & SEO Opportunities: The Blueprint for Visibility

A successful digital strategy hinges on being discoverable. For the Nepalese pharmaceutical sector, this means mastering Search Engine Optimization (SEO) by targeting the specific queries that both patients and healthcare professionals use when searching for health information online. A deep understanding of these keywords, in both English and Nepali, is the foundation upon which all content should be built.

6.1 High-Intent Keywords for Ranking

High-intent keywords are search terms that indicate a user is close to making a decision, whether it’s a purchase, a professional inquiry, or seeking specific services. Targeting these keywords is crucial for capturing valuable traffic.

- For HCPs (Transactional/Commercial Intent): These keywords are used by professionals seeking business and clinical solutions.

- Examples: “pharmaceutical distributors in Kathmandu,” “cardiac medicine portfolio Nepal,” “new diabetes drug launch Nepal,” “WHO-GMP certified pharma companies Nepal,” ” supplier Nepal.”

- For Patients/Pharmacies (Transactional Intent): These keywords are used by consumers or retailers looking to purchase products or find services, particularly for Over-The-Counter (OTC) items and general health products.

- Examples: “buy vitamin C online Nepal,” “online pharmacy Kathmandu,” “medicine home delivery in Lalitpur,” “paracetamol price in Nepal,” “best antiseptic cream Nepal”.

6.2 Long-Tail Keyword Opportunities (Nepal-Specific)

Long-tail keywords are longer, more specific search phrases. They have lower search volume but much higher conversion rates because they capture a user’s specific intent. They are the key to reaching the majority of the patient audience.

- English Informational Keywords: These are used by individuals seeking detailed health information and advice.

- Examples: “symptoms of typhoid fever in Nepal,” “how to prevent dengue during monsoon,” “best diet for diabetic patient in Nepal,” “treatment for high blood pressure at home.”

- Nepali & Romanized Nepali Informational Keywords: This is the most critical and underserved category. The majority of the patient population, like the “Anjali” persona, will search in their native language.

- Examples: “high blood pressure ko lakshan” (symptoms of high blood pressure), “madhumeha ko upchar” (treatment for diabetes), “jwaro aauda k garne” (what to do when you have a fever), “pet dukhdako aushadhi” (medicine for stomach ache), “chhati polne samasya” (problem of heartburn).

To operationalize this strategy, the following master keyword list provides a framework for content creation, ensuring each piece of digital content is targeted, purposeful, and optimized for search visibility.

| Keyword | Language | Target Audience | Search Intent | Example Content Type |

|---|---|---|---|---|

| buy paracetamol online Nepal | English | Patient / Pharmacy | Transactional | OTC Product Page / E-commerce Portal |

| madhumeha ko lakshan haru | Nepali | Patient | Informational | Blog Post: “मधुमेहका १० प्रमुख लक्षणहरू” |

| new anti-hypertensive drugs Nepal | English | HCP | Commercial Investigation | Gated HCP Portal Page on Cardiovascular Portfolio |

| Deurali-Janta products list | English | HCP / Investor | Navigational | ‘Our Products’ Website Page |

| child fever medicine Nepal | English | Patient (Caregiver) | Informational | Blog Post: “Choosing the Right Fever Medicine for Your Child” |

| टाइफाइडको लक्षण र उपचार | Nepali | Patient | Informational | Video / Infographic on Typhoid Symptoms & Treatment |

| pharmaceutical tender Nepal | English | B2B / Distributor | Transactional | Dedicated “Tenders & Partnerships” Page |

By systematically creating content around these and other related keywords, a pharmaceutical company can build a comprehensive digital library that meets the needs of its diverse audience, establishing a dominant and trusted presence on search engines.

7. Implementation Roadmap: From Strategy to Execution

A robust strategy requires a clear and actionable implementation plan. This roadmap breaks down the digital transformation journey into phased, manageable steps, ensuring that foundational work is completed first to support more advanced initiatives. Each phase includes specific activities and measurable Key Performance Indicators (KPIs) to track progress and ensure accountability.

7.1 Short-Term Quick Wins (Months 1–3): The Foundation

The initial phase focuses on establishing a solid technical and strategic foundation. These actions are designed to yield immediate improvements in online visibility and establish core communication channels.

- Month 1: Technical & Strategic Setup

- Activity: Conduct a comprehensive technical SEO audit of the existing website to identify and rectify issues like slow page speed, broken links, and poor mobile responsiveness. Implement critical on-page SEO fixes, including optimizing title tags, meta descriptions, and image alt text for core pages.

- KPIs: Audit completion report with a prioritized list of fixes; implementation of at least 80% of critical on-page SEO recommendations.

- Activity: Set up and configure Google Analytics 4 and Google Search Console to begin tracking website traffic, user behavior, and keyword performance.

- KPIs: Correct installation and data collection verified in both platforms.

- Month 2: Local Presence & Direct Communication

- Activity: Claim and fully optimize Google Business Profile listings for the corporate office and all manufacturing facilities. This includes adding accurate location details, operating hours, photos, and a link to the website.

- KPIs: All listings claimed, verified, and 100% complete.

- Activity: Launch an official Viber for Business channel. Develop an initial campaign to encourage existing HCP contacts and distribution partners to subscribe.

- KPIs: Viber channel live; initial subscriber target of 100 HCPs/partners.

- Month 3: Initial Content & Website Restructuring

- Activity: Research, write, and publish the first 3-4 foundational blog posts. These should be bilingual and target high-priority, informational long-tail keywords identified in the SEO strategy (e.g., “Understanding Diabetes in Nepal”).

- KPIs: 4 blog posts published; initial keyword rankings tracked in Search Console.

- Activity: Redesign the website’s homepage to be more user-centric. Implement a clear navigational structure that immediately directs visitors to either a “For Patients” section or a “For Healthcare Professionals” section.

- KPIs: New homepage design launched; bounce rate reduction of 5% on the homepage.

7.2 Long-Term Strategy (Months 4–12): Building Momentum and Engagement

With the foundation in place, the focus shifts to scaling content production, nurturing audiences, and expanding to new platforms.

- Months 4-6: Scaling Content and Building the HCP Hub

- Activity: Establish a consistent content production schedule, publishing 2-3 new blog posts or videos per month.

- KPIs: 100% adherence to the content calendar; month-over-month growth in organic website traffic of 10%.

- Activity: Develop and launch the gated, password-protected content portal for HCPs. Populate it with initial product monographs and clinical data.

- KPIs: HCP portal live and functional; target of 50 verified HCP registrations.

- Activity: Begin building a compliant email list of HCPs through registrations on the portal and sign-ups for future webinars.

- KPIs: Email list growth to 100+ verified HCPs.

- Months 7-9: Nurturing and Experimentation

- Activity: Launch the first monthly HCP e-newsletter, providing valuable, non-promotional content and clinical updates.

- KPIs: Achieve an average email open rate of >25% and a click-through rate of >3%.

- Activity: Execute a pilot unbranded awareness campaign on TikTok in partnership with a credible health influencer. The campaign should align with a major health awareness day (e.g., World Diabetes Day, World Heart Day).

- KPIs: Reach and engagement metrics for the campaign (e.g., 100,000+ views, 5% engagement rate).

- Months 10-12: Analysis, Optimization, and Planning

- Activity: Conduct a comprehensive analysis of all performance data from the first nine months.

Use insights from Google Analytics, Search Console, and social media metrics to identify top-performing content and channels.

- KPIs: A detailed performance report with actionable recommendations for the next year.

- Activity: Based on the analysis, refine the content strategy and develop the content calendar for the following year.

- KPIs: Year 2 content plan and budget approved.

- Activity: Explore the feasibility of launching targeted, compliant digital advertising campaigns for the OTC product portfolio.

- KPIs: A research report and proposed media plan for OTC digital advertising.

The following Gantt chart provides a visual representation of this 12-month implementation roadmap.

| Task | Month 1 | Month 2 | Month 3 | Month 4-6 | Month 7-9 | Month 10-12 | Key Performance Indicator (KPI) |

|---|---|---|---|---|---|---|---|

| Phase 1: Foundation | |||||||

| Technical SEO Audit & Fixes | ■■■ | Audit Completion; 80% of fixes implemented | |||||

| Google Analytics/Console Setup | ■■■ | Verified data collection | |||||

| Google Business Profile Optimization | ■■■ | 100% profile completion | |||||

| Viber Channel Launch | ■■■ | Channel live; 100+ initial subscribers | |||||

| Foundational Content Creation | ■■■ | 4 blog posts published | |||||

| Homepage Redesign | ■■■ | New homepage live; reduced bounce rate | |||||

| Phase 2: Momentum | |||||||

| Consistent Content Production | ■■■ | ■■■ | ■■■ | 10% monthly organic traffic growth | |||

| Gated HCP Portal Development | ■■■ | Portal live; 50+ HCP registrations | |||||

| HCP Email List Building | ■■■ | ■■■ | ■■■ | 100+ verified HCP emails | |||

| Phase 3: Engagement | |||||||

| HCP E-Newsletter Launch | ■■■ | ■■■ | >25% open rate | ||||

| Pilot TikTok Influencer Campaign | ■■■ | 100k+ views; 5% engagement rate | |||||

| Phase 4: Optimization | |||||||

| Full Performance Analysis | ■■■ | Performance report with recommendations | |||||

| Year 2 Strategy & Planning | ■■■ | Approved Year 2 content plan | |||||

Conclusion: The Digital Imperative for Nepalese Pharma

Summary: Why Digital is Crucial for Survival and Growth

The Nepalese pharmaceutical market is at a critical inflection point. It is a sector defined by immense potential yet constrained by a deep-seated trust deficit, fierce and often unstructured competition, and a radically shifting regulatory landscape for digital communication. In this new environment, clinging to traditional, representative-led marketing models is no longer a viable strategy for sustainable growth. A strategic digital presence has evolved from a “nice-to-have” promotional tactic into an essential business imperative for survival and market leadership.

Digital marketing offers the most effective solution to the industry’s core challenges. It provides the tools to directly combat misinformation and build brand trust by becoming an authoritative source of health information. It enables the creation of direct, value-based relationships with both patients and healthcare professionals, bypassing the ethically fraught and competitive traditional channels. Most importantly, in the wake of new regulations, a mature digital strategy focused on owned assets like a high-performing website and direct channels like Viber is the only sustainable path forward. The territory is unclaimed, and the opportunity for a first-mover to establish digital dominance is immense.

Call-to-Action: Partnering with Gurkha Technology

Navigating this complex and rapidly changing environment requires more than just a digital agency; it requires a strategic partner with deep, localized expertise. A successful transformation demands a nuanced understanding of Nepal’s unique digital behaviors, its regulatory framework, and the cultural context of its healthcare system.

Gurkha Technology is uniquely positioned to lead this transformation. With a comprehensive suite of services perfectly aligned with the strategic needs outlined in this report—including expert Search Engine Optimization (SEO), custom Web Development, and strategic Social Media Marketing on compliant platforms like TikTok—we possess the technical capabilities to build and execute a world-class digital strategy. Our proven expertise in the Nepalese market ensures that every campaign, every piece of content, and every strategic decision is tailored for maximum impact within the local context.

The digital territory in Nepalese pharma is unclaimed. The first to plant their flag with a strategic, trust-based approach will not just compete; they will dominate. Gurkha Technology (www.gurkhatech.com) has the map, the tools, and the local expertise to lead the expedition. Let’s build the future of healthcare in Nepal, together.

📚 For more insights, check out our comprehensive digital marketing guide.