Digital Marketing Pricing Models: Retainer, Performance, Value

Executive Summary

The selection of a pricing model is one of the most consequential decisions in the relationship between a business and its digital marketing agency. Far more than a simple billing mechanism, the pricing structure serves as the foundational contract that defines incentives, allocates risk, and codifies the very definition of success. This report provides an exhaustive analysis of the three predominant strategic pricing models in the digital marketing industry: the Retainer Model, Performance-Based Models, and Value-Based Pricing. These models are not merely alternatives but represent distinct points on a strategic continuum, moving from compensation based on effort and access to compensation based on direct business impact.

A central finding of this analysis is the existence of a “Risk-Reward-Predictability Trilemma,” wherein no single pricing model can simultaneously optimize financial predictability, minimize performance risk, and maximize profit potential for both the agency and the client. The Retainer Model offers high predictability for both parties but places performance risk on the client. Performance-Based Models shift this risk to the agency, offering clients a direct link between cost and results, but introduce significant revenue volatility for the agency. Value-Based Pricing offers the highest profit potential and strategic alignment but requires a high degree of mutual trust, a complex sales process, and a shared understanding of how to quantify business impact.

The analysis reveals that the choice of a pricing model is the most critical initial alignment between an agency and a client. It is a statement of intent and a pact on how success will be measured and risk will be shared. A mismatch between a client’s goals and the chosen model’s inherent incentives creates friction and undermines the potential for a true partnership. Furthermore, the report establishes that advanced models, particularly Value-Based Pricing, are not merely a pricing tactic but a comprehensive business model that requires a fundamental transformation of an agency’s sales, delivery, and marketing operations.

Key recommendations emerging from this report include:

- For Clients: The selection of a pricing model must be a strategic decision aligned with specific business objectives, internal risk tolerance, and the desired depth of the agency relationship. Businesses seeking predictable budgets for long-term brand building are best served by retainers, while those focused on immediate, quantifiable conversions may find performance models more suitable.

- For Agencies: A diversified portfolio of pricing models is essential to cater to a broad range of client needs and maturity levels. Agencies should aim to guide clients along a “trust continuum,” potentially starting with project-based or retainer agreements to build confidence before graduating to more sophisticated performance or value-based partnerships.

The digital marketing industry is progressively moving towards hybrid models that blend the stability of retainers with the incentive structures of performance-based fees. This trend, coupled with the increasing role of advanced data analytics and AI in measuring and predicting outcomes, underscores a definitive market trajectory: compensation will be increasingly tied not to the work performed, but to the tangible value created.

The Evolving Landscape of Agency Compensation

The framework for compensating a digital marketing agency is not a trivial administrative detail; it is the strategic cornerstone of the client-agency relationship. The chosen pricing model dictates the flow of communication, the focus of reporting, the allocation of risk, and the very nature of the partnership. As the digital marketing landscape matures, the dialogue around compensation is shifting from a simple transaction for services rendered to a sophisticated negotiation of shared risk and reward. This evolution reflects a broader market trend away from pricing based on inputs (effort) toward pricing based on outcomes (results).

The Strategic Importance of Pricing

A pricing model is a powerful signaling mechanism that shapes a client’s perception of an agency’s value, confidence, and strategic orientation. An agency that prices solely by the hour signals that its primary value is time, whereas an agency that prices based on revenue generated signals that its value is business growth. This positioning has a direct impact on an agency’s ability to attract certain types of clients and command premium fees. Factors such as agency size, established reputation, geographic location, and the complexity of the services offered all contribute to the final price point, but the underlying model frames the entire value proposition. For an agency, the pricing structure directly influences operational focus—whether teams are optimized for efficiency in hours, delivery of outputs, or achievement of outcomes—and ultimately determines the business’s potential for scalable growth.

The initial discussion and agreement on a pricing model function as a strategic handshake, representing the first and most critical point of alignment between a client and an agency. The incentives embedded within each model fundamentally shape the behavior of both parties. For instance, hourly billing incentivizes the agency to work more hours, which can be at odds with the client’s desire for efficiency. Conversely, a performance-based model incentivizes the agency to achieve specific, measurable results, which directly aligns with a client’s business objectives. A retainer model, which guarantees a certain level of service over a long period, incentivizes a focus on building a durable, collaborative relationship.

This dynamic means that the pricing model is the operational manifestation of the relationship’s core principles. A client who desires a deep, strategic partnership but opts for a series of short-term, project-based contracts for a long-term need like SEO is creating a structural misalignment. The agency is incentivized to complete the discrete project efficiently and move on, not to invest in the long-term strategic thinking the client desires. Therefore, the negotiation of the pricing model should not be viewed as a simple financial transaction but as the foundational strategic exercise that determines whether the engagement will be a vendor-client transaction or a true business partnership.

The Shift from Inputs to Outcomes

Historically, professional services have been priced based on inputs, primarily the time and materials required for delivery. In the digital marketing world, this manifests as the hourly rate model. While simple and transparent, this approach compensates for effort, not effectiveness. As analytics and tracking technologies have become more sophisticated, it is now possible to draw a much clearer line between marketing activities and business results. This technological advancement has fueled a client-driven demand for accountability and a demonstrable return on investment (ROI). Consequently, the industry is experiencing a significant migration along the pricing spectrum:

- Input-Based Pricing (e.g., Hourly Rate): Clients pay for the agency’s time and resources. Risk is almost entirely on the client, who pays for effort regardless of the outcome.

- Output-Based Pricing (e.g., Project-Based, Retainer): Clients pay for a defined set of deliverables or a consistent volume of work. This provides more predictability than hourly rates but still does not explicitly tie compensation to business impact.

- Outcome-Based Pricing (e.g., Performance-Based, Value-Based): Clients pay for the achievement of specific, measurable business results. This model aligns incentives and shifts a significant portion of the performance risk to the agency.

This report will focus on the most prevalent strategic models within the output-based and outcome-based categories: Retainers, Performance-Based, and Value-Based pricing.

The Retainer Model: The Bedrock of Predictability

The retainer model is a cornerstone of the agency world, serving as a foundational structure for long-term client-agency partnerships. It is an agreement wherein a client pays a recurring, fixed fee in advance for a predetermined scope of work or guaranteed access to an agency’s services over a set period, typically monthly. This model prioritizes stability and strategic continuity for both parties.

Mechanics and Variations

While the concept of a fixed monthly fee is simple, the retainer model has evolved into several distinct variations, each offering a different balance of structure and flexibility.

- Fixed-Scope Retainer: This is the most traditional form, where the monthly fee covers a clearly defined set of ongoing services and activities. For example, a $5,000 monthly retainer might include SEO management, weekly social media posting, and monthly performance reporting. This structure provides maximum predictability for both the client’s budget and the agency’s revenue.

- Output-Based Retainer: A more tangible variation, this model guarantees a specific quantity of deliverables for the monthly fee.

“`html

- For instance, a client might pay $4,500 per month for a package that includes four 1,000-word blog posts, 15 social media updates across three platforms, and one email newsletter. This approach provides clients with clear, quantifiable outputs for their investment.

- Points-Based Retainer: An innovative and flexible approach where clients purchase a monthly budget of “points.” The agency creates a menu of services, with each task assigned a point value based on its complexity and resource requirements (e.g., a blog post might be 10 points, a social media update 1 point). Clients can then “spend” their points as needed throughout the month, allowing them to adjust priorities without renegotiating the contract. This model blends the predictability of a fixed fee with the flexibility of a la carte services.

- Hourly Credits Retainer: In this model, the client pre-purchases a block of the agency’s time each month at a set rate (e.g., 20 hours at $150/hour for a $3,000 monthly retainer). This guarantees the agency a minimum level of income and ensures the client has priority access to resources. To protect agency revenue and encourage client engagement, these retainers often include a “use it or lose it” clause, meaning unused hours do not roll over to the next month.

Strategic Analysis for Agencies

Advantages:

The paramount advantage of the retainer model for an agency is the creation of a predictable and stable revenue stream. This recurring income is the lifeblood of an agency, enabling effective cash flow management, accurate financial forecasting, strategic resource planning, and sustainable business growth. Financial stability allows the agency to move beyond a constant “feast-or-famine” cycle of project work and invest in talent and infrastructure. Furthermore, the ongoing nature of retainer agreements fosters deeper, more strategic, and long-term client relationships. The agency becomes an embedded extension of the client’s team, gaining a nuanced understanding of their business, which in turn leads to better results and higher client retention.

Disadvantages:

The primary risk for agencies on retainer is “scope creep,” the tendency for clients to make requests that fall outside the originally agreed-upon scope of work. Without diligent project management and clear contractual boundaries, these small, additional tasks can accumulate, severely eroding the engagement’s profitability. Another significant challenge is “value communication failure.” If an agency fails to consistently and effectively report on its activities and demonstrate the value being delivered, clients may begin to question the justification for the recurring monthly fee, leading to churn. Compared to outcome-based models, retainers can also have lower profit margins, as the fee is not directly tied to exceptional results. Finally, there is a risk of underutilization, where a client pays the full retainer but does not provide the necessary feedback, approvals, or collaboration, leading to an inefficient use of the agency’s allocated resources.

Strategic Analysis for Clients

Advantages:

For clients, the principal benefit of a retainer is budget predictability. A fixed monthly fee eliminates financial surprises and allows for straightforward forecasting and allocation of marketing expenses. A retainer agreement secures priority access to the agency’s team and expertise, ensuring that their marketing needs are addressed promptly and consistently. This model provides the strategic continuity necessary for long-term marketing initiatives, where consistent effort and momentum are crucial for success. The client benefits from a partner who is invested in their business over the long haul, rather than a vendor focused on a single project’s completion.

Disadvantages:

The most significant risk for a client is paying for underutilized services. If the scope of work is not fully executed—whether due to the agency’s inefficiency or the client’s own lack of engagement—the client effectively pays for nothing. This can lead to a perception that the retainer is a poor value. Clients may also feel constrained by long-term contracts, which can be difficult to terminate without penalty if the agency’s performance declines or the client’s business needs change unexpectedly.

Best-Fit Services

The retainer model is optimally suited for digital marketing disciplines that require sustained, consistent effort over an extended period to generate meaningful results. It is the preferred model for ongoing campaigns and long-term strategic partnerships.

- Search Engine Optimization (SEO): SEO is a quintessential long-term strategy. Achieving and maintaining high search engine rankings requires continuous activity, including technical site audits, ongoing content creation and optimization, and consistent backlink acquisition. A retainer model provides the necessary structure for this sustained, marathon-like effort.

- Content Marketing and Social Media Management: These services thrive on consistency. A regular cadence of blog posts, articles, videos, and social media updates is essential for building an audience, fostering community engagement, and establishing thought leadership. A monthly retainer ensures this consistent output and management.

- Full-Service Digital Marketing: When a client requires an integrated strategy across multiple channels (e.g., SEO, PPC, social media, and email marketing), a retainer is the most effective model. It provides the framework for a cohesive partnership, allowing the agency to manage and optimize the entire marketing ecosystem in a coordinated fashion.

Performance-Based Models: Aligning Incentives with Outcomes

Performance-based pricing represents a significant shift in the client-agency dynamic, moving compensation from a basis of effort or outputs to one of tangible, measurable results. Also known as pay-for-performance, results-based, or outcome-driven marketing, this model directly ties an agency’s fees to the achievement of specific, pre-agreed-upon business outcomes. The core philosophy is straightforward: the client pays for performance, not just for activity. This approach creates a powerful alignment of financial incentives between both parties.

Defining the “Pay-for-Performance” Spectrum

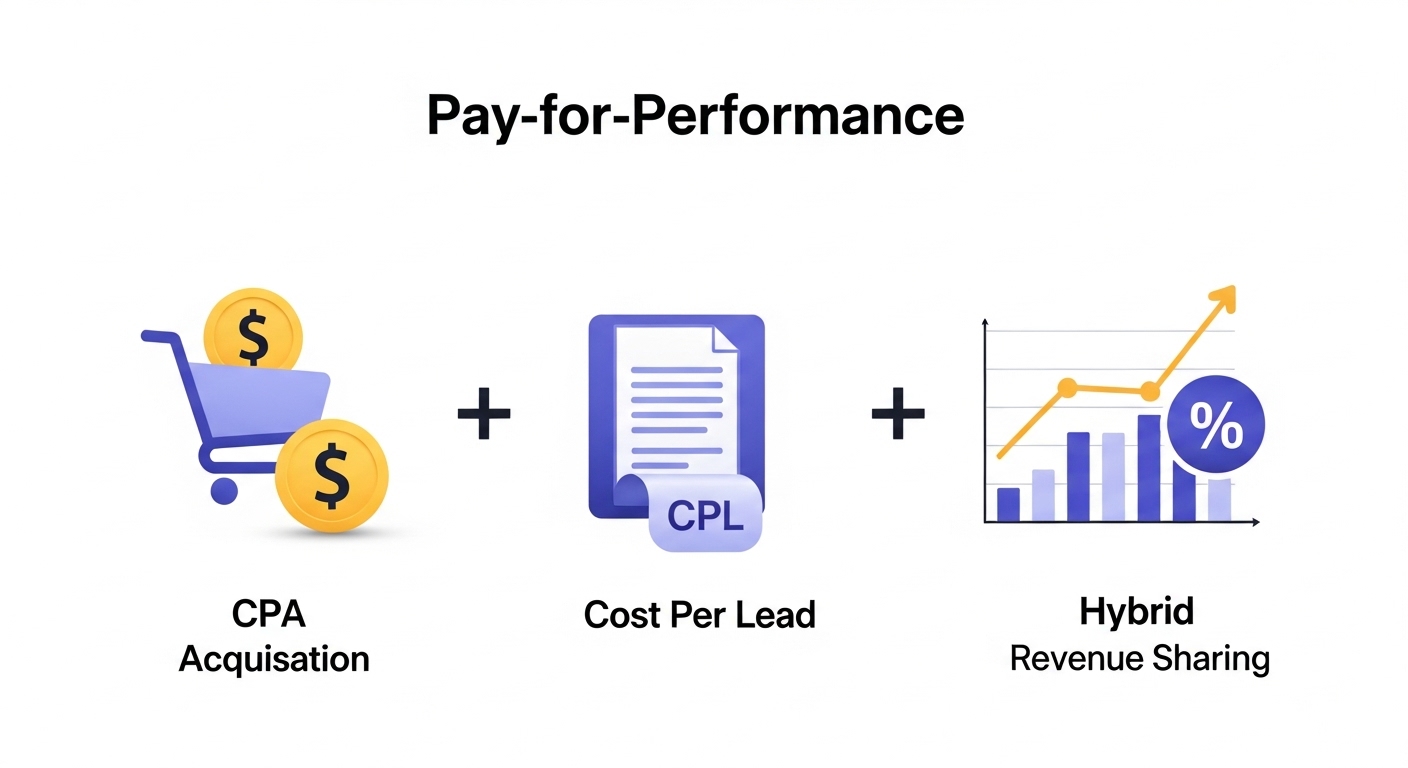

Performance-based pricing is not a single model but a spectrum of arrangements, each tied to a different type of measurable action or result.

- Cost Per Action / Cost Per Acquisition (CPA): This is one of the purest forms of performance pricing. The agency is compensated only when a user completes a specific, high-value action, such as making a purchase, downloading a whitepaper, or completing a trial sign-up. For the client (the advertiser), this model is extremely low-risk, as they only pay for a confirmed conversion.

- Cost Per Lead (CPL): A widely used variation of CPA, the CPL model compensates the agency for each qualified lead it generates. A “lead” is typically defined as the submission of contact information through a form. The success of this model depends heavily on a clear, mutual definition of what constitutes a “qualified” lead to ensure the agency is not incentivized to deliver a high volume of low-quality contacts.

- Revenue Sharing / Commission-Based: This model creates the deepest level of partnership. The agency earns a percentage of the revenue or profit that is directly attributable to its marketing efforts. For example, an agency might receive 10% of all sales generated through its PPC campaigns. This structure makes the agency a direct stakeholder in the client’s financial success, fostering a powerful collaborative dynamic focused on sustained growth.

- Hybrid (Base + Bonus): Recognizing the financial risk that pure performance models place on agencies, the hybrid structure is extremely common. It combines a reduced fixed monthly fee (a base retainer) with performance-based bonuses that are paid when the agency meets or exceeds specific KPIs. This model provides the agency with a degree of revenue stability to cover its operational costs while still strongly incentivizing the achievement of client goals.

The Critical Role of KPIs

The entire foundation of any performance-based model rests upon the selection of clear, measurable, and mutually agreed-upon Key Performance Indicators (KPIs). Ambiguity in defining or tracking these metrics is the most common point of failure and can lead to significant disputes. The contract must explicitly state what will be measured, how it will be measured, and how compensation will be calculated based on those measurements.

Essential Metrics for Performance Models:

- Top-of-Funnel (Traffic & Engagement): While less common for direct compensation, metrics like Cost Per Click (CPC) and Click-Through Rate (CTR) are crucial for campaign optimization and can be used in some performance models, particularly for brand awareness campaigns.

- Mid-Funnel (Conversion Metrics): These are the most common KPIs for performance models. They include Conversion Rate (CVR), Cost Per Lead (CPL), and Cost Per Acquisition (CPA).

- Bottom-of-Funnel (Financial Metrics): For models like revenue sharing, the key metrics are Return on Ad Spend (ROAS) and total Revenue Generated.

A non-negotiable requirement for this model is the implementation of a sophisticated and transparent tracking and attribution system. Both the agency and the client must have access to a shared, real-time dashboard to monitor performance against the agreed-upon KPIs.

“`

“`html

This technological infrastructure is essential for building the trust and accountability upon which the model depends.

Strategic Analysis for Agencies

Advantages:

The primary attraction for agencies is the potential for significantly higher profit margins and uncapped revenue potential on highly successful campaigns. Because compensation is tied to results, it is often easier to justify higher effective fees to clients who are focused on ROI. This model inherently aligns the agency’s interests with the client’s, which can be a powerful sales tool and foster a strong, results-driven partnership. It also forces the agency to be highly selective about the clients it works with, focusing only on those where it is confident it can deliver measurable results, which can lead to a stronger client portfolio over time.

Disadvantages:

The most substantial drawback is the creation of an unpredictable and highly volatile income stream. The agency assumes the vast majority of the financial risk in the engagement. A campaign can underperform for numerous reasons outside of the agency’s direct control—such as a weak client offer, a poor landing page experience, negative market shifts, or new competitor actions.

In such cases, the agency may invest significant time and resources for little or no compensation. This high-risk environment can make financial planning and resource allocation extremely challenging.

Strategic Analysis for Clients

Advantages:

The chief benefit for clients is the dramatic reduction of financial risk. The “pay for results” principle ensures that marketing expenditure is directly tied to the achievement of tangible business goals, which maximizes the client’s ROI. This model provides an unparalleled level of transparency and accountability; the agency is unequivocally responsible for delivering the agreed-upon outcomes.

For businesses with tight budgets, this model allows them to engage marketing services with the assurance that they will only pay for what works.

Disadvantages:

A potential downside is the risk of the agency adopting a myopic focus on achieving the specific, compensated KPIs at the expense of broader, long-term strategic goals like brand building or customer relationship nurturing. If the KPIs are not carefully chosen, an agency might, for example, optimize for a high volume of cheap, low-quality leads to maximize their CPL compensation, which ultimately provides little value to the client’s sales team.

There is also a risk of fraudulent activity, such as using bots to generate fake clicks or lead form submissions, if the agency is not reputable and tracking systems are not robust.

Finally, the process of defining, negotiating, and verifying the KPIs can be complex and contentious, requiring a significant investment of time and legal oversight upfront.

Best-Fit Services

Performance-based models are most effective for digital marketing channels and tactics where the user journey from initial interaction to final conversion is short, direct, and can be tracked with a high degree of accuracy.

- Pay-Per-Click (PPC) Advertising: The entire PPC ecosystem, on platforms like Google Ads and social media, is built around measurable actions such as clicks, impressions, and conversions. This makes it a natural and common fit for performance-based compensation structures.

- Lead Generation Campaigns: Any campaign where the primary goal is to capture user information via a form—such as for a webinar registration, an e-book download, or a sales inquiry—can be effectively structured with a CPL model.

- Affiliate Marketing: This is the archetypal performance-based channel. Affiliates (partners) are paid a commission only when they successfully drive a sale or a lead, making it a pure pay-for-performance arrangement.

- App Install Campaigns: In the mobile marketing space, it is common for agencies or ad networks to be compensated on a cost-per-install (CPI) basis, directly tying payment to the number of successful application downloads they generate.

Value-Based Pricing: The Apex of Strategic Partnership

Value-based pricing represents the most advanced and strategically aligned form of agency compensation. It is a paradigm shift that moves beyond pricing based on inputs (time), outputs (deliverables), or even discrete actions (performance metrics).

Instead, this model sets the agency’s fee based on the perceived or quantified business value that its services deliver to the client. The fundamental question it seeks to answer is not “How much effort did this take?” or “How many leads did we generate?” but rather, “What is the financial impact of this outcome on the client’s business?”

The Philosophy of Value-Based Pricing

The core concept of value-based pricing is to capture a portion of the economic value the agency creates for the client. It requires a deep, consultative approach where the agency understands the client’s business model, revenue streams, profit margins, and strategic objectives as well as the client does.

It is crucial to distinguish value-based pricing from performance-based pricing, though they are related and often confused. Performance-based pricing is transactional and tied to specific, granular outputs; for example, an agency is paid $50 for each lead generated. Value-based pricing is holistic and tied to strategic impact; for example, an agency charges a $30,000 fee to design and implement a lead generation system that is projected to generate $500,000 in new annual revenue for the client. The fee is not based on the number of leads but on the total economic value of the outcome. This approach fundamentally repositions the agency from a service provider to a strategic investment partner.

The Challenge of Quantifying Value

The primary hurdle and the reason value-based pricing is difficult to implement is the challenge of quantifying “value” in a way that is credible, defensible, and mutually agreeable. This process is far more complex than tracking clicks or conversions and requires a sophisticated discovery and analysis framework.

A Framework for Quantifying Value:

- Identify and Define Tangible Outcomes: The first step is to work with the client to identify the direct, measurable financial impacts the agency’s work is expected to produce. This could include metrics like an increase in total revenue, a reduction in Customer Acquisition Cost (CAC), an improvement in Customer Lifetime Value, or direct cost savings from improved efficiency.

- Monetize the Outcomes: Once the outcomes are defined, they must be assigned a clear dollar value. This is the most critical calculation. For example, if an agency’s CRO services are projected to increase a client’s e-commerce conversion rate from 2% to 2.5% on a site with $10 million in annual sales, the tangible value created is $2.5 million in additional revenue. Another example would be saving a client’s compliance team 1,200 hours of manual work annually; at a blended rate of $60 per hour, this represents $72,000 in direct cost savings.

- Quantify Intangible Benefits (where possible): While more difficult, intangible benefits can also be assigned a proxy value. For instance, the value of reducing the risk of a compliance failure can be modeled based on the potential cost of fines. The value of an improved brand reputation can be linked to metrics like Net Promoter Score (NPS) and its correlation with customer retention and CLV.

- Validate Willingness to Pay (WTP): Quantifying the value created is only half the battle. The agency must also understand what portion of that value the client is willing to pay to achieve it. This can be assessed through direct C-level conversations and formal market research techniques like conjoint analysis, which helps determine how clients trade off features and price. The final price is typically set to capture a fraction (e.g., 20-33%) of the total value created.

Strategic Analysis for Agencies

The successful implementation of value-based pricing is not merely a change in billing tactics; it necessitates a fundamental transformation of the agency’s entire business model. The sales process can no longer be handled by junior representatives; it requires seasoned business consultants who can engage in strategic discussions with C-suite executives about their P&L, operational challenges, and long-term financial goals.

The service delivery teams must shift their focus from completing tasks to achieving the client’s business outcomes, which requires a deeper level of strategic thinking and analytical capability.

“`

“`html

The agency’s own marketing must pivot to be heavily reliant on detailed case studies that don’t just list activities but explicitly quantify the financial value and ROI delivered to past clients. In essence, an agency cannot simply decide to offer value-based pricing; it must rebuild its talent, processes, and market positioning to support this sophisticated model.

Advantages:

When executed correctly, value-based pricing offers the highest possible profit margins, as it completely decouples revenue from the agency’s time and costs. It elevates the agency to the status of a high-level strategic partner, leading to stronger, more resilient, and more loyal client relationships built on a foundation of shared success. This positioning allows the agency to be highly selective, working only on high-impact projects with sophisticated clients.

Disadvantages:

The model involves a significantly more complex and longer sales cycle that requires access to senior decision-makers. The process of quantifying value can be subjective and is often met with skepticism from clients, especially without a portfolio of strong, data-backed case studies. It carries a high risk of failure if the agency cannot accurately forecast the potential value or if the client disputes the calculation.

Strategic Analysis for Clients

Advantages:

For the client, value-based pricing provides the ultimate justification for their marketing investment. It ensures that the price they pay is directly and explicitly linked to the business value they receive. This model forces both parties to maintain a laser focus on the most important strategic business goals, moving the conversation away from tactical minutiae like hours worked or number of posts, and toward bottom-line impact.

Disadvantages:

The upfront fees in a value-based arrangement are often substantially higher than in other models, which can be a barrier for many businesses. The model requires an exceptionally high degree of trust in the agency’s capabilities and its methodology for calculating value. If the agency is not transparent about how it arrived at its value calculation, the process can feel opaque and arbitrary to the client, undermining the trust it is meant to build.

Best-Fit Services

Value-based pricing is reserved for strategic, high-impact projects where the agency’s expertise can generate a significant and clearly measurable effect on the client’s core business metrics.

- Conversion Rate Optimization (CRO): This is a prime candidate for value-based pricing. A small percentage increase in the conversion rate for a high-traffic e-commerce site or a lead generation platform can result in a large, directly calculable increase in revenue, making the value proposition clear and compelling.

- Strategic Consulting and Go-to-Market Strategy: Engagements that involve developing a strategy to enter a new market, launch a new product line, or fundamentally pivot a business model have an immense potential value that can be estimated based on market size and revenue projections.

- Comprehensive Rebranding and Market Positioning Projects: While seemingly intangible, the value of a successful rebranding can be quantified through its impact on metrics like brand equity, market share, price elasticity, and customer lifetime value. An agency with a proven track record in this area can command value-based fees.

A Comparative Framework for Strategic Decision-Making

Choosing a pricing model requires a careful evaluation of the inherent trade-offs between risk, predictability, and goal alignment. No single model is universally superior; the optimal choice depends on the specific context of the service being offered, the client’s objectives and risk tolerance, and the agency’s business model and capabilities. This section provides a direct, side-by-side comparison of the Retainer, Performance-Based, and Value-Based models to illuminate these critical trade-offs and serve as a practical framework for decision-making.

Risk Distribution

The allocation of risk is a primary differentiator among the models. Risk, in this context, refers primarily to the financial consequences of an underperforming marketing strategy.

- Retainer Model: This model is client-centric in its risk allocation. The client pays a fixed fee regardless of the campaign’s short-term results, thereby assuming the financial risk of an ineffective strategy. The agency’s primary risk is not financial but operational—the risk of scope creep eroding its profit margins.

- Performance-Based Model: This model is agency-centric, shifting the bulk of the performance risk onto the agency. If the agreed-upon KPIs are not met, the agency’s revenue suffers directly. The client’s risk is mitigated financially but exists strategically; they risk receiving low-quality leads or seeing the agency focus on short-term metrics at the expense of long-term brand health.

- Value-Based Model: Risk in this model is more nuanced and shared. The agency risks a significant investment of time in a complex sales process that may not close. The client commits to a potentially high fee based on a projected outcome. The model is predicated on the agency’s confidence in its ability to deliver, and as such, it implicitly accepts a high degree of accountability, while the client accepts the value proposition as a calculated investment risk.

Revenue and Budget Predictability

Predictability of cash flow for the agency and costs for the client is another critical dimension of comparison.

- Retainer Model: This model offers the highest degree of predictability for both parties. The agency secures a stable, recurring revenue stream, and the client has a fixed, forecastable monthly marketing expense.

- Performance-Based Model: This model is characterized by low predictability for the agency, with revenue being volatile and directly tied to campaign success. For the client, costs are variable; they scale with results, which can be a positive but can also lead to unpredictable monthly expenditures if a campaign is wildly successful.

- Value-Based Model: Predictability is low to medium. Fees are often large and may be tied to project milestones rather than a monthly schedule. While the total fee is known upfront, the timing and flow of revenue can be less predictable than a standard retainer.

Goal Alignment

The degree to which a pricing model inherently aligns the agency’s financial incentives with the client’s business objectives is perhaps the most important strategic consideration.

- Retainer Model: Goal alignment is moderate. The model fosters a long-term partnership, which is a form of alignment. However, because compensation is fixed, it can inadvertently incentivize a focus on “activity” and “hours” rather than on “results,” potentially creating a divergence of interests if not managed with strong reporting on outcomes.

- Performance-Based Model: Goal alignment is high and explicit. The agency’s compensation is directly and mathematically linked to the achievement of specific, pre-defined KPIs like leads or sales. This creates a powerful, shared focus on hitting those targets.

- Value-Based Model: This model offers the highest possible level of goal alignment. It moves beyond tactical KPIs to align the agency’s compensation with the client’s most fundamental business success metrics, such as revenue growth, profitability, and market share. The agency is compensated for its contribution to the client’s overall business impact.

Scalability and Profitability

For an agency, scalability refers to the ability to grow revenue without a linear increase in headcount or costs.

- Retainer Model: Scalability is low to moderate. While more scalable than hourly billing, revenue growth is still largely tied to the team’s capacity to service a certain number of clients or deliverables. Profit margins are generally stable but capped by the fixed fee structure.

- Performance-Based Model: This model has high scalability potential. A successful, well-optimized campaign can generate significant revenue with minimal incremental effort, allowing an agency to scale its profits without scaling its team. However, this is balanced by the volatility and risk involved.

- Value-Based Model: This model offers the highest potential for scalability and profitability. Because revenue is completely detached from time and resources, an agency can generate exceptionally high profit margins on projects where its expertise creates a disproportionately large value for the client.

Comparative Analysis of Core Digital Marketing Pricing Models

The following table provides a consolidated framework, summarizing the key strategic dimensions of each pricing model to facilitate at-a-glance comparison and aid in the decision-making process. This structure allows stakeholders to weigh the trade-offs and identify the model that best aligns with their organization’s specific priorities regarding risk, budget, and the nature of the desired agency relationship.

| Dimension | Retainer Model | Performance-Based Model | Value-Based Model |

|---|---|---|---|

| Core Philosophy | Pay for consistent Effort & Access | Pay for specific Actions & Outputs | Pay for strategic Outcomes & Impact |

| Risk Distribution | Client-centric: Client pays fixed fee regardless of results, bearing the risk of ineffective strategy. Agency risks scope creep. | Agency-centric: Agency bears the financial risk of campaign underperformance. Client risks poor quality leads or short-term focus. | Shared/Calculated: Risk is shared, but the model is predicated on the agency’s confidence to deliver a quantifiable, high-value outcome. |

| Revenue/Budget Predictability | High for both agency (stable revenue) and client (fixed costs). | Low for Agency (volatile income). |

“`

“`html

Variable for Client

- Low to Medium: Can be unpredictable upfront. Often involves large, but justifiable, fees. Less predictable than retainers.

Goal Alignment

- Moderate: Aligns on long-term partnership but can incentivize “activity” over “results.”

- High: Directly aligns agency compensation with pre-defined KPIs (e.g., leads, sales).

- Highest: Aligns agency compensation with the client’s core business success and financial impact.

Scalability & Profit Potential

- Low to Moderate: Scalability is tied to team capacity and efficiency. Profit margins are stable but capped.

- High: Highly scalable with successful campaigns, but volatile. High profit potential is directly tied to performance.

- Highest: Revenue is detached from time/resources, offering the greatest potential for high-profit margins and scalability.

Best-Fit Services

- SEO, Content Marketing, Social Media Management, Ongoing Strategy.

- PPC Advertising, Lead Generation, Affiliate Marketing, App Installs.

- Conversion Rate Optimization (CRO), Strategic Consulting, Market Entry Strategy, Rebranding.

Operational Requirements

- Clear scope of work, strong project management, consistent reporting.

- Sophisticated tracking & attribution tools, real-time dashboards, clear KPI definitions, fraud detection.

- Deep consultative sales process, C-level access, robust case studies, high degree of mutual trust.

The Rise of Hybrid Models: Crafting the Optimal Engagement

The distinct advantages and disadvantages of each pure pricing model have led to a growing trend in the digital marketing industry: the adoption of hybrid models. These structures strategically combine elements from different models to create a more balanced, flexible, and mutually beneficial arrangement. The primary rationale for a hybrid approach is risk mitigation and incentive alignment; it allows the agency and client to share the benefits of a model while buffering against its primary weaknesses. This approach acknowledges that a one-size-fits-all pricing strategy is often suboptimal and that the most effective engagements are tailored to the specific needs of the client and the nature of the services provided.

This trend is not unique to marketing. The Software-as-a-Service (SaaS) industry, for example, widely employs hybrid models, such as combining a fixed-fee, seat-based subscription with usage-based overage charges for API calls or data storage. This provides the vendor with predictable recurring revenue while allowing them to capture additional value from high-usage customers, a principle directly applicable to agency services.

Common Hybrid Structures

-

Retainer + Performance Bonus: This is arguably the most popular and effective hybrid model. The structure consists of a fixed monthly retainer fee that covers the agency’s baseline costs and guarantees a certain level of service and activity. On top of this, the agreement includes performance-based bonuses that are paid when the agency achieves or surpasses pre-defined KPIs. For example, an agency might have a $5,000 monthly retainer for managing a PPC campaign, plus a $500 bonus for every 10% increase in conversion rate above the baseline. This model gives the agency the financial stability to operate effectively while strongly incentivizing them to drive superior results. For the client, it provides budget predictability with a clear, performance-oriented upside.

-

Project Fee + Revenue Share: This model is well-suited for engagements that involve the creation of a specific asset designed to generate long-term revenue. The agency charges an upfront, fixed project fee to cover the cost of creating the asset (e.g., designing and building an automated sales funnel, developing a lead-generation webinar, or creating an e-commerce website). Once the asset is launched, the agency then receives an ongoing percentage of the revenue or profit it generates. This structure compensates the agency for its initial development work while giving it a long-term stake in the asset’s success.

-

Tiered Retainers with Value-Based Add-ons: An agency might offer several standardized retainer packages (e.g., Bronze, Silver, Gold) that cover core, ongoing services like SEO and social media management. These packages provide predictable costs and clear deliverables. In addition, the agency can offer high-impact, strategic projects—such as a comprehensive CRO audit or a market entry analysis—as optional, value-priced add-ons. This allows clients to maintain a predictable budget for their day-to-day marketing while making strategic, ROI-focused investments in high-value initiatives as needed.

-

Fixed Fee + Limited Kick-backs: In scenarios where an agency’s work heavily involves managing relationships with third-party vendors (e.g., media buying platforms or technology providers), a hybrid model can involve a fixed fee from the client, supplemented by a commission or “kick-back” from the vendor. For this to be ethical and effective, it requires full transparency with the client, who may in turn receive a discount on the agency’s services, creating a mutually beneficial arrangement.

By combining the stability of fixed-fee structures with the powerful incentives of outcome-based models, hybrid arrangements represent a mature and sophisticated approach to pricing that can foster stronger, more aligned, and more profitable client-agency partnerships.

A Practical Guide to Selecting Your Pricing Model

The selection of a digital marketing pricing model is a strategic decision that should be driven by a thoughtful assessment of a company’s unique circumstances. The optimal model is one that aligns with the business’s objectives, budget, risk appetite, and the nature of the relationship it seeks to build with its agency. This section provides an actionable framework, structured around key criteria and critical questions, to guide businesses in making an informed choice.

Key Decision Criteria

Before evaluating agency proposals, a business should first conduct an internal assessment based on the following criteria:

-

Business Objectives and Goals: The primary goal of the marketing engagement is the most important factor. Is the objective long-term brand building and establishing thought leadership? This requires sustained effort and is well-suited to a Retainer Model. Is the goal to generate a specific number of qualified leads or sales in the short term? This points towards a Performance-Based Model. Is the objective a fundamental transformation of a business process, like dramatically improving e-commerce profitability? This may justify the investment in a Value-Based Model.

-

Budget and Risk Tolerance: A business’s financial posture plays a critical role. Is there a strict, fixed monthly marketing budget that cannot be exceeded? A Retainer or Fixed-Project Fee provides the necessary cost predictability. Is the business more comfortable with variable costs, as long as they are directly tied to revenue or leads generated? This indicates a higher risk tolerance, making Performance-Based models viable. Is the business willing to make a significant upfront investment for a potentially massive long-term return? This opens the door to Value-Based pricing.

-

Service Complexity and Scope: The nature of the work itself is a key determinant. Is it a discrete, one-time project with a clearly defined start and end, such as a website redesign? A Project-Based model is the logical choice. Is it an ongoing, multifaceted campaign requiring continuous management and optimization, like a comprehensive SEO and content strategy? A Retainer is more appropriate. Is it a highly specialized, strategic initiative with a direct and substantial impact on the bottom line, like a CRO program? This is the territory of Value-Based pricing.

-

Clarity and Measurability of Outcomes: The ability to track success is a prerequisite for certain models. Can the desired outcomes be measured clearly, accurately, and without ambiguity? If success can be boiled down to easily trackable KPIs like CPA or ROAS, Performance-Based models are feasible. If the value is more strategic and long-term (e.g., brand equity), making direct attribution difficult, a Retainer is a safer and more practical choice.

-

Desired Agency Relationship: A business should consider the type of partnership it wants. Is the need for a tactical service provider to execute specific tasks? A Project-Based or Hourly model may suffice. Is the goal to have an ongoing, collaborative partner who acts as an extension of the in-house team? A Retainer fosters this type of relationship.

“`

Is the need for a high-level strategic consultant who is a stakeholder in the business’s success? Value-Based pricing cultivates this deepest level of partnership.

Key Questions to Ask a Potential Agency

Once a business has a clearer sense of its own needs, it can more effectively evaluate agency proposals by asking targeted questions related to their pricing structure:

Regarding Transparency and Scope:

- What specific deliverables, activities, and services are included in this fee? What is explicitly excluded?

- How do you handle requests that fall outside the initial scope? What is your process and pricing for “scope creep”?

- Are there any additional costs or hidden fees, such as for technology platforms, reporting tools, or ad spend management?

Regarding Performance and Accountability:

- How will you track, measure, and report on performance? Can we see a sample report or dashboard?

- For performance-based models: How are the KPIs defined and attributed? What systems are in place to ensure tracking is accurate and transparent for both parties?

- Can you provide detailed case studies from past clients with similar goals, demonstrating a clear return on investment?

Regarding Alignment and Partnership:

- How does this specific pricing model align with our primary business objective of [e.g., increasing market share, generating qualified sales leads]?

- What is the length of the contract? What are the terms for termination or modification if our needs change or we are not satisfied with the performance?

- Who will be our dedicated point of contact, and who are the team members who will be working on our account?

By systematically working through these internal criteria and external questions, a business can move beyond a simple cost comparison and select a pricing model—and an agency partner—that is strategically aligned for long-term success.

Future Outlook: Trends Shaping Digital Marketing Pricing in 2025 and Beyond

The landscape of digital marketing agency pricing is in a state of continuous evolution, driven by technological advancements, shifting client expectations, and a relentless market focus on accountability and ROI. Looking ahead to 2025 and beyond, several key trends are poised to reshape how digital marketing services are bought and sold. The overarching trajectory is clear: a sustained movement away from opaque, effort-based models toward pricing structures that are more transparent, flexible, and directly aligned with the creation of demonstrable business value.

Increased Demand for Transparency and Flexibility

Modern clients are more sophisticated and data-savvy than ever before. They are increasingly demanding greater transparency in pricing structures and rejecting the rigidity of long-term, restrictive contracts. This is likely to lead to several shifts. More agencies may adopt public pricing for standardized services, allowing potential clients to easily compare offerings without engaging in a lengthy sales process. This transparency builds trust and streamlines the procurement process. Furthermore, contracts are likely to become more flexible, with shorter commitment periods and clearer performance-related clauses that allow clients to scale services up or down or pivot strategies without facing prohibitive penalties.

The Impact of AI and Dynamic Pricing

The integration of Artificial Intelligence (AI) and machine learning into marketing platforms is set to have a profound impact on pricing. AI algorithms can analyze vast datasets to predict campaign outcomes with greater accuracy, assess market demand in real-time, and monitor competitor pricing dynamically. This capability will enable the development of more sophisticated and truly dynamic pricing models. For instance, an agency’s fee for a PPC campaign could be adjusted in real-time by an algorithm based on fluctuations in cost-per-acquisition, conversion rates, and even external factors like competitor ad spend or seasonal demand. While still nascent, AI-driven pricing promises a future where agency compensation can be optimized with unprecedented precision.

The Growth of Productized Services

In a move to create more predictable revenue streams and improve scalability, a growing number of agencies are “productizing” their services. This involves packaging a specific, high-demand service—such as an “SEO Foundation Audit,” a “Local SEO Starter Pack,” or a “Content Strategy Blueprint”—into a standardized offering with a fixed scope and a set price. These productized services are easier to sell, deliver, and scale than fully custom engagements. They often serve as an effective entry point for new clients, allowing them to experience the agency’s expertise with a lower-risk, defined investment before committing to a larger, ongoing retainer.

The Ascendancy of Value-Based Principles

While pure value-based pricing may remain a niche for high-level strategic engagements, its underlying principles are permeating the entire industry. The core idea—that price should be a function of the value delivered—is becoming the central tenet of modern agency compensation. This trend is reflected in the popularity of hybrid models that incorporate performance bonuses and the increasing expectation that even retainer-based agencies must provide regular, data-driven reports that demonstrate ROI. The global digital advertising and marketing market is projected to grow from $667 billion in 2024 to $786.2 billion by 2026, and as businesses continue to increase their digital marketing budgets—with 63% having already done so in recent years—the pressure to justify this spend with clear business outcomes will only intensify.

In conclusion, the future of digital marketing pricing is personalized, dynamic, and inextricably linked to performance and value. The models that thrive will be those that foster trust through transparency, offer flexibility to adapt to changing business needs, and, most importantly, create a clear and defensible alignment between the agency’s compensation and the client’s success.