Programmatic Advertising Explained: Ecosystem & Real-Time Bidding

Part I: Foundations of Automated Media Trading

1.1 Defining Programmatic Advertising: Beyond Automation

Programmatic advertising represents a fundamental re-engineering of the digital advertising marketplace, utilizing sophisticated technology, including artificial intelligence (AI) and machine learning algorithms, to automate the buying, selling, and optimization of digital advertising inventory. While often equated with simple automation, its true significance lies in its capacity to make data-driven decisions on a per-impression basis, transforming every ad opportunity into a unique, real-time transaction. This process serves relevant ad impressions to precisely defined audiences across a vast and expanding array of digital channels. The reach of programmatic extends far beyond traditional display banners on websites, now encompassing mobile web, in-app environments, streaming video, Connected TV (CTV), social media platforms, digital audio streams, and even Digital Out-of-Home (DOOH) billboards.

The entire lifecycle of a programmatic transaction—from a user initiating a page load to a tailored advertisement being fully rendered on their screen—is executed with extraordinary speed, typically concluding in under a second, and often in less than 100 milliseconds. This high-velocity environment is not merely about speed for its own sake; it is the foundational element that enables a dynamic, auction-based marketplace to function at the scale of the global internet. By automating these complex, high-frequency trades, programmatic technology liberates marketing professionals from repetitive, low-impact tasks, allowing them to redirect their focus toward higher-value activities such as strategic planning, creative development, and in-depth campaign analysis and optimization.

1.2 The Paradigm Shift: From Manual Negotiations to Real-Time Auctions

To fully appreciate the revolutionary nature of programmatic advertising, it is essential to contrast it with the traditional media buying processes that dominated the industry for decades. The conventional model was characterized by manual, slow, and labor-intensive workflows. Advertisers or their agencies would engage in a protracted process involving direct communication with publisher sales teams, the issuance of formal requests for proposals (RFPs), the manual preparation of insertion orders, and lengthy negotiations over fixed pricing models for bulk inventory purchases. This system was inherently inefficient, opaque, and incapable of scaling to meet the demands of a rapidly fragmenting digital media landscape.

Programmatic advertising, which gained prominence in the late 2010s, dismantled this legacy framework by introducing an automated, auction-based model powered by a sophisticated technological infrastructure. This transformation is analogous to the shift seen in financial markets from floor-based trading to high-frequency algorithmic trading. Just as electronic trading created a more efficient and liquid marketplace for financial assets, programmatic advertising did the same for digital ad impressions. The core innovation was not merely the automation of existing processes, but the fundamental liquefaction of ad inventory.

This liquefaction represents a profound change in how advertising is valued. In the traditional model, an ad slot on a website was an illiquid asset, often sold in bulk for a fixed price over a set period (e.g., a month-long campaign). Programmatic technology deconstructed this model, turning every single ad impression—the opportunity to show one ad to one user at one specific moment in time—into a fungible, tradable commodity. The value of this commodity is no longer predetermined through manual negotiation but is established dynamically in a real-time auction, based on the specific characteristics of the user and the context of the impression. This creation of a high-frequency trading market for user attention has had far-reaching consequences, fundamentally altering the mechanisms for valuing, targeting, and measuring the effectiveness of digital advertising.

Part II: The Architecture of the Programmatic Ecosystem

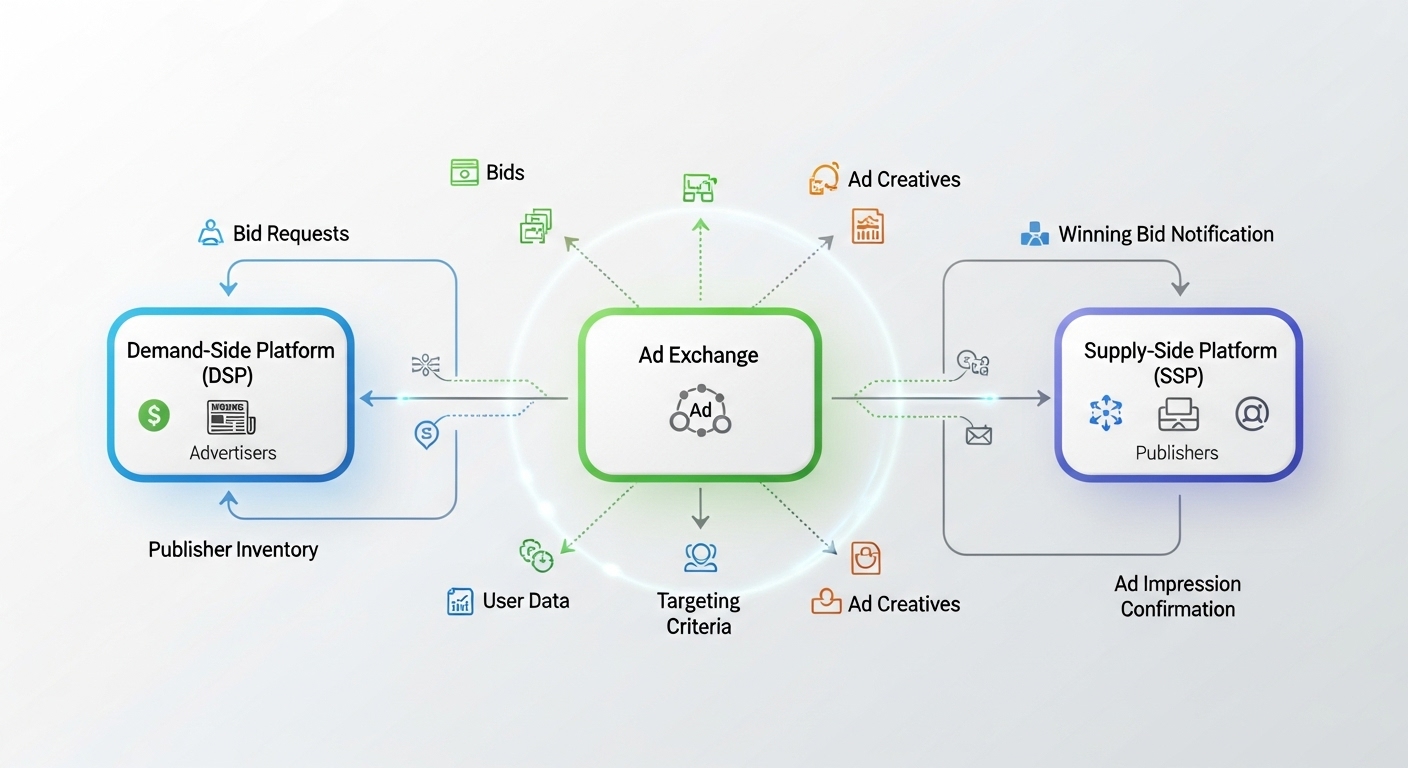

The programmatic ecosystem is a complex network of interconnected technologies and platforms designed to facilitate the seamless buying and selling of digital ad inventory. Its architecture is best understood as a sophisticated, two-sided market with specialized platforms serving the distinct needs of buyers and sellers, all connected by a central marketplace where transactions occur.

2.1 The Two Sides of the Marketplace: Supply and Demand

At its core, the programmatic ecosystem operates on the principles of a classic two-sided market, balancing the needs of those who wish to buy advertising with those who have advertising space to sell.

- The Demand Side (Buy Side): This side of the market consists of advertisers, brands, and the advertising agencies that represent them. Their primary objective is to purchase advertising space to reach specific target audiences in the most effective and efficient manner possible. The ultimate goal for the demand side is to maximize the performance of their campaigns and achieve the highest possible Return on Ad Spend (ROAS).

- The Supply Side (Sell Side): This side comprises publishers—the owners of websites, developers of mobile applications, and other media owners who possess digital real estate where ads can be displayed. This available ad space is referred to as “ad inventory”. The principal goal for the supply side is to maximize the revenue and yield generated from their inventory by selling it at the highest possible price.

2.2 The Demand-Side Platform (DSP): The Advertiser’s Command Center

The Demand-Side Platform (DSP) is the primary technology used by the buy side of the ecosystem. It is a sophisticated software platform that provides advertisers and agencies with a centralized command center to purchase digital ad inventory from a vast array of publishers in an automated fashion. In essence, the DSP acts as the advertiser’s automated agent, navigating the complexities of the programmatic marketplace to execute campaign objectives.

A DSP’s power lies in its key capabilities:

- Centralized Campaign Management: Perhaps the most significant efficiency gain offered by a DSP is the ability to manage advertising campaigns across a multitude of ad exchanges, Supply-Side Platforms (SSPs), and ad networks through a single, unified interface. This eliminates the cumbersome process of negotiating with and managing relationships with dozens of individual salespeople and platforms, streamlining workflow and providing a holistic view of media buying activities.

- Advanced Audience Targeting: DSPs empower advertisers with a formidable array of targeting options. Campaigns can be aimed at users based on a wide variety of signals and data points, including demographic information (age, gender), geographic location, device type, browsing behavior, expressed interests, and contextual relevance. Crucially, DSPs also allow advertisers to activate their own first-party data (e.g., CRM lists) for highly precise targeting and retargeting efforts.

- Real-Time Bidding (RTB) Engine: At the heart of every DSP is a “bidder,” a powerful algorithmic engine that operates in real time. For every available ad impression broadcast across the ecosystem, the bidder analyzes its characteristics in milliseconds, evaluates its potential value against the advertiser’s specific campaign goals and target audience criteria, and determines an appropriate bid price to place in the instantaneous auction.

- Performance Optimization and Reporting: DSPs provide robust, real-time analytics and reporting dashboards. This allows advertisers to continuously monitor key performance indicators (KPIs) such as impressions, clicks, conversions, and cost per action (CPA). Armed with this immediate feedback, they can optimize campaigns while they are still running—adjusting bids, refining targeting parameters, or swapping out creative assets—to improve performance and maximize their return on investment.

DSPs typically offer two primary management models to cater to different advertiser needs. A self-serve DSP provides the advertiser or agency with direct access to the platform’s interface, giving them full control over campaign setup and management. A full-service or managed DSP, by contrast, operates more like a traditional agency, where the DSP’s internal team of experts manages the campaign on behalf of the advertiser. Prominent examples of DSPs in the market include Google’s Display & Video 360 (DV360), The Trade Desk, Amazon DSP, and StackAdapt.

2.3 The Supply-Side Platform (SSP): The Publisher’s Monetization Engine

The Supply-Side Platform (SSP) is the technological counterpart to the DSP, serving the needs of the sell side of the ecosystem.

An SSP is a platform used by publishers to programmatically manage, sell, and optimize their available ad inventory. It functions as the publisher’s automated agent, with the primary objective of connecting their inventory to the largest possible pool of potential buyers to maximize revenue.

The core capabilities of an SSP are designed to enhance a publisher’s monetization efforts:

- Yield Optimization: The fundamental purpose of an SSP is to maximize the publisher’s revenue, a metric often referred to as “yield.” It achieves this by making the publisher’s inventory available to numerous DSPs, ad exchanges, and ad networks simultaneously. This creates a competitive auction environment for each ad impression, ensuring it is sold to the highest bidder and thus fetching the highest possible price, or cost per mille (CPM).

- Inventory Management and Control: While maximizing revenue is key, publishers also require control over how their inventory is sold. SSPs provide a suite of tools that allow publishers to set specific rules and safeguards. These include establishing minimum prices (known as “floor prices”) below which their inventory will not be sold, blacklisting certain advertisers or sensitive ad categories (e.g., gambling, politics) to maintain brand integrity, and controlling which ad formats are permissible on their properties.

- Header Bidding Integration: Header bidding is a critical piece of modern programmatic technology that has been widely adopted by publishers. It is an advanced technique that allows a publisher to offer an ad impression to multiple demand sources (SSPs and exchanges) simultaneously before making a call to their primary ad server. This process flattens the traditional “waterfall” auction sequence, fostering a more competitive and transparent auction that significantly increases competition and, consequently, publisher revenue.

- Reporting and Analytics: SSPs furnish publishers with detailed analytics dashboards. These reports provide granular insights into which advertisers are buying their inventory, the CPMs being paid, the fill rate (the percentage of ad requests that result in an ad being shown), and overall revenue performance. This data is invaluable for publishers looking to optimize their content strategy, audience development, and overall monetization approach.

Leading SSPs in the industry include Google Ad Manager (which combines ad serving and SSP functionalities), Magnite, OpenX, and PubMatic.

2.4 The Ad Exchange: The Central Marketplace

The Ad Exchange sits at the very center of the programmatic ecosystem, functioning as a neutral, technology-driven digital marketplace. Its primary role is to facilitate the real-time buying and selling of ad inventory from a multitude of sources, connecting the supply aggregated by SSPs with the demand aggregated by DSPs. If the DSP is the buyer’s agent and the SSP is the seller’s agent, the Ad Exchange is the auction house where the transaction is executed.

It is crucial to distinguish an Ad Exchange from an older piece of ad technology, the Ad Network. An Ad Network typically acts as a broker or intermediary; it purchases inventory from publishers in bulk, aggregates and packages it (often based on audience segments or content categories), and then resells it to advertisers. In this model, the network takes a principal position, owning the inventory for a period and often lacking the transparency of real-time, impression-level bidding. An Ad Exchange, in contrast, is a technology platform that does not own the inventory. Instead, it enables a direct, transparent transaction between the ultimate buyer (represented by a DSP) and the ultimate seller (represented by an SSP) on an impression-by-impression basis.

The very architecture of the modern programmatic stack—with distinct platforms for the buy-side (DSP) and sell-side (SSP) connected by a neutral exchange—is a direct structural evolution designed to disintermediate the more opaque, brokered model of the Ad Network. This shift was driven by a market demand for greater transparency, control, and efficiency, giving more power to the end parties in the transaction.

Ad Exchanges can operate in different ways:

- Open Ad Exchange: This is a public marketplace where theoretically any buyer or seller can participate in the auction, offering the greatest potential scale and reach.

- Private Marketplace (PMP): This is an invitation-only marketplace. A publisher can use a PMP to make their premium inventory available to a select, curated group of advertisers. These deals often come with pre-negotiated price floors and provide a more brand-safe, controlled environment for both parties.

Major Ad Exchanges include Google AdX (a core component of Google Ad Manager), as well as platforms like Xandr and OpenX, which often bundle exchange functionality with their SSP offerings.

2.5 The Intelligence Layer: Data Management Platforms (DMPs) & Customer Data Platforms (CDPs)

Data is the fuel that powers the entire programmatic engine. Two key platforms are responsible for managing and activating this data: the Data Management Platform (DMP) and the Customer Data Platform (CDP). While their names are similar, their functions and the types of data they handle are fundamentally different.

- Data Management Platform (DMP): A DMP is a platform designed to collect, organize, and activate large volumes of primarily anonymous, third-party audience data. This data is typically gathered from sources like cookies, mobile advertising identifiers (MAIDs), and other data providers. The core purpose of a DMP is to create broad audience segments based on inferred interests, browsing behaviors, or general demographics, which can then be used for large-scale ad targeting, prospecting for new customers, and audience extension. A key characteristic of DMPs is that they work with pseudonymous data and have short-term data retention periods, typically 30 to 90 days, aligning with the needs of short-term advertising campaigns.

- Customer Data Platform (CDP): In contrast, a CDP is focused on collecting and unifying first-party data. This is data that a company collects directly from its own customers and includes personally identifiable information (PII) such as names, email addresses, phone numbers, and purchase history. A CDP ingests this data from multiple sources (e.g., a company’s website, CRM system, mobile app, point-of-sale system) to create a persistent, unified, and comprehensive profile of each individual customer. The primary use of a CDP is for long-term customer relationship management, enabling deep personalization across a company’s owned channels like email, SMS, and website experiences. While its core function is not advertising, the rich, first-party audience segments created in a CDP can be exported to a DSP to power highly effective and privacy-compliant advertising campaigns.

The critical distinction lies in the data source and the nature of user identification. DMPs are built for third-party, anonymous data to find new audiences at scale. CDPs are built for first-party, known-customer data to better engage and retain existing customers. This distinction has become increasingly important in an era of heightened data privacy regulations.

Table 1: Key Platforms in the Programmatic Ecosystem

To summarize the roles and relationships of these core technologies, the following table provides a comparative overview.

| Platform | Primary User | Core Function | Key Objective | Primary Data Type |

|---|---|---|---|---|

| Demand-Side Platform (DSP) | Advertisers & Agencies | Centralized, automated ad buying and campaign management. | Maximize campaign performance and Return on Ad Spend (ROAS). | Activates 1st, 2nd, and 3rd-party data. |

| Supply-Side Platform (SSP) | Publishers & Media Owners | Centralized, automated ad inventory selling and management. | Maximize ad revenue and yield. | Manages publisher’s 1st-party inventory and audience data. |

| Ad Exchange | Technology Platform (Connects DSPs & SSPs) | Facilitates real-time auctions for ad impressions. | Create an efficient, liquid marketplace for supply and demand. | Passes anonymous user and impression data. |

| Data Management Platform (DMP) | Advertisers & Publishers | Collects, segments, and activates large-scale, anonymous audience data. | Enhance ad targeting, prospecting, and audience insights. | Primarily 3rd-party (anonymous) data. |

| Customer Data Platform (CDP) | Marketers (Brand-side) | Unifies 1st-party customer data into persistent profiles. | Create a single customer view for personalization and engagement. | Primarily 1st-party (PII) data. |

Part III: The Transactional Core: Real-Time Bidding (RTB) and Deal Types

The programmatic ecosystem’s dynamism is driven by its transactional core, where ad impressions are bought and sold in real time. This section provides a granular, step-by-step deconstruction of the Real-Time Bidding (RTB) process and explores the spectrum of programmatic deal types that offer varying levels of control, predictability, and access to inventory.

3.1 The Real-Time Bidding (RTB) Auction in Milliseconds: A Step-by-Step Workflow

Real-Time Bidding (RTB) is the foundational mechanism of programmatic advertising. It is the process through which ad inventory is bought and sold on an impression-by-impression basis via an instantaneous, automated auction. The entire sequence unfolds in the fraction of a second it takes for a webpage to load.

- Step 1: User Interaction and Page Load: The process begins the moment a user navigates to a publisher’s website or opens a mobile application in their browser. This single action initiates the entire ad-serving chain.

- Step 2: Ad Request Initiated by Publisher: As the user’s browser begins to render the page content, the publisher’s ad server identifies an available ad slot (also known as an ad tag or zone).

It immediately sends an ad request to the publisher’s integrated Supply-Side Platform (SSP), signaling that an impression opportunity is available.

-

Step 3: SSP Creates and Sends Bid Request: The SSP receives this request and enriches it with valuable, non-personally identifiable data. This data package, known as a “bid request,” includes information about the user (gleaned from cookies or other identifiers, such as their general geographic location, device type, and browsing history) and details about the ad slot itself (such as its dimensions, position on the page, and the content category of the page). The SSP then sends this bid request to one or more Ad Exchanges to put the impression up for auction.

-

Step 4: Ad Exchange Broadcasts to DSPs: The Ad Exchange acts as a central distribution hub. Upon receiving the bid request from the SSP, it instantly broadcasts this opportunity to numerous Demand-Side Platforms (DSPs) that are plugged into its marketplace.

-

Step 5: DSPs Evaluate and Place Bids: Each DSP receives the bid request and its powerful algorithmic engine springs into action. In a matter of milliseconds, the DSP analyzes the data within the bid request and compares it against the predefined campaign parameters (such as target audience segments, budget constraints, frequency caps, and performance goals) of all the advertisers it represents. For each advertiser whose campaign criteria match the impression opportunity, the DSP calculates the impression’s value and submits a bid—typically a CPM price—back to the Ad Exchange.

-

Step 6: Ad Exchange Conducts the Auction and Declares a Winner: The Ad Exchange gathers all the bids submitted by the various DSPs. It then conducts an instantaneous auction to determine the winner. The highest bidder wins the right to serve their ad for that impression. The auction model used can vary. Historically, second-price auctions (where the winner pays $0.01 more than the second-highest bid) were common. However, the industry has largely shifted to a more straightforward first-price auction model, where the winner pays the exact amount they bid.

-

Step 7: The Winning Ad is Served to the User: The Ad Exchange immediately notifies the winning DSP of its victory. The winning DSP’s ad server is then called upon to deliver the ad creative (the actual image, video, or banner ad) back through the chain to the publisher’s website. This final piece is slotted into the ad space just as the webpage finishes loading for the user, completing the entire transaction.

3.2 Beyond the Open Auction: A Spectrum of Programmatic Deals

While the RTB open auction is the most prevalent form of programmatic transaction, the market has evolved to include a range of deal types that offer different balances of automation, exclusivity, and price certainty. These deal types exist on a spectrum, from the fully open and dynamic to the pre-negotiated and guaranteed.

This spectrum of options is not a linear evolution where one model replaces another; rather, it represents a sophisticated market-driven solution to the inherent trade-off between efficiency and control. The ecosystem has matured to offer a versatile toolkit that allows buyers and sellers to balance competing priorities—such as scale, price, inventory quality, and brand safety—based on their specific strategic objectives for a given campaign.

-

Open Marketplace (Open Auction/RTB): This is the standard, real-time auction described in the workflow above. It is a public marketplace open to all participating buyers and sellers. It offers the greatest potential for scale and reach but provides the least amount of control over pricing and the specific advertisers that may appear on a publisher’s site.

-

Private Marketplace (PMP): A PMP is an invitation-only auction. In this model, a publisher or group of publishers makes their premium ad inventory available to a select group of advertisers. While still an auction, it takes place in a more controlled environment. PMPs offer advertisers privileged access to higher-quality inventory and provide publishers with greater control over which brands can advertise on their properties, thus enhancing brand safety.

-

Preferred Deals: This is a one-to-one arrangement that gives a single advertiser a “first look” at a publisher’s inventory. The publisher offers the inventory to the advertiser at a pre-negotiated, fixed price before it is made available to the wider PMP or open auction. The advertiser is not obligated to purchase the inventory, but they have the first right of refusal. This model is ideal for advertisers who want priority access to premium placements without a guaranteed commitment.

-

Programmatic Guaranteed (or Programmatic Direct): This deal type is the most analogous to traditional, direct media sales. An advertiser and a publisher directly negotiate a deal for a fixed volume of ad impressions at a fixed price. Once the terms are agreed upon, the execution of the campaign—the delivery of the ad creatives and the financial transaction—is automated through programmatic technology. There is no auction involved. This model provides the highest level of predictability and control for both parties, guaranteeing revenue for the publisher and premium, reserved inventory for the advertiser.

Part IV: Strategic Implications for Market Participants

The technological architecture and transactional mechanisms of programmatic advertising have profound strategic implications for the primary participants in the ecosystem. The shift to automated, data-driven media trading has unlocked significant benefits for both advertisers and publishers, but it has also introduced a new set of complex challenges that require careful management and strategic navigation.

4.1 The Advertiser’s Perspective: Benefits and Headwinds

For advertisers and their agencies, programmatic advertising has fundamentally transformed the media buying process, offering unprecedented levels of efficiency, reach, and precision. However, these advantages are accompanied by significant risks that must be actively mitigated.

Key Benefits for Advertisers

-

Efficiency and Speed: The automation inherent in programmatic platforms streamlines the entire media buying workflow. It replaces time-consuming manual negotiations, RFPs, and insertion orders with a rapid, machine-driven process, freeing up human capital for strategic planning and analysis.

-

Enhanced Reach and Scale: Through a single DSP interface, advertisers gain access to a massive, global network of publishers and ad inventory sources. This provides an unparalleled ability to reach vast and diverse audiences at a scale that would be impossible to achieve through manual, direct deals alone.

-

Precise Audience Targeting: Programmatic advertising’s greatest strength is its data-driven targeting capabilities. Advertisers can move beyond broad demographic targeting to reach granular audience segments based on their online behaviors, interests, purchase intent, location, and more. This precision reduces wasted ad spend by ensuring that marketing messages are delivered to the consumers most likely to be receptive, thereby increasing ad relevance and effectiveness.

-

Real-Time Measurement and Optimization: Programmatic platforms provide immediate feedback on campaign performance. Advertisers can monitor key metrics in real time and make on-the-fly adjustments to their campaigns. If a particular targeting strategy or creative is underperforming, it can be changed instantly, allowing for continuous optimization that improves the overall return on investment.

-

Greater Transparency and Control: Compared to the “black box” nature of some older ad network models, programmatic platforms generally offer greater transparency. Advertisers can gain insights into which specific websites their ads are appearing on, how much they are paying per impression, and the performance of their campaigns, giving them more control over their media spend.

Key Challenges for Advertisers

-

Ad Fraud: The automated and high-speed nature of the ecosystem makes it a target for fraudulent activities. A significant challenge for advertisers is the risk of wasting budget on invalid traffic (IVT), where non-human bots generate fake impressions and clicks. This is a persistent, multi-billion dollar problem that erodes campaign effectiveness and ROI.

-

Brand Safety: Automation creates the inherent risk of an advertiser’s ad appearing alongside inappropriate, offensive, or controversial content that does not align with the brand’s values. Such an association can cause significant damage to a brand’s reputation, making brand safety a paramount concern for advertisers operating in the programmatic space.

-

Supply Chain Opacity and the “AdTech Tax”: While more transparent than legacy systems, the programmatic supply chain can still be complex and murky. A portion of every dollar an advertiser spends is consumed by fees taken by each intermediary in the chain (DSP, Ad Exchange, SSP, and other data or verification providers). This “AdTech tax” can be substantial, and a lack of full transparency can make it difficult for advertisers to understand precisely how much of their budget is actually reaching the publisher to pay for media.

-

Complexity and the Learning Curve: The programmatic ecosystem is technologically sophisticated and replete with specialized jargon and complex platforms. Effectively managing programmatic campaigns requires a significant level of expertise, presenting a steep learning curve for those new to the field and requiring ongoing education to keep pace with its rapid evolution.

4.2 The Publisher’s Perspective: Monetization and Risks

For publishers, programmatic advertising has become the dominant engine for monetization, offering a powerful way to generate revenue from their digital content.

However, this reliance on automated systems also introduces risks related to revenue stability, user experience, and control over their own properties.

Key Benefits for Publishers

- Increased Revenue and Yield Maximization: The core benefit for publishers is the potential for significantly increased revenue. By creating a real-time auction environment where numerous advertisers compete for their inventory, programmatic technology drives up the price (eCPM) for each impression, thereby maximizing the publisher’s overall yield.

- Automation and Operational Efficiency: SSPs automate the entire ad sales process. This eliminates the need for large, costly direct sales teams to handle every transaction and provides an efficient mechanism for selling “remnant” inventory—the ad space that is not sold through direct deals—ensuring that no monetization opportunity is wasted.

- Access to a Wider Pool of Demand: Through an SSP, even small or niche publishers can connect their inventory to a global pool of advertisers and demand sources. This broadens their potential customer base far beyond what they could reach through direct sales efforts alone, increasing competition and the likelihood of selling all available inventory.

- Data-Driven Insights: The analytics provided by SSPs offer publishers valuable insights into the performance of their inventory. They can understand which content generates the most ad revenue, which audience segments are most valuable to advertisers, and how different ad formats perform, allowing them to make data-informed decisions to optimize their content and monetization strategies.

Key Challenges for Publishers

- Loss of Direct Control and Brand Dilution: In the open auction, publishers cede a degree of control over which specific advertisements appear on their sites. The placement of low-quality or off-brand ads can detract from the user experience and potentially dilute the publisher’s own brand identity.

- Page Latency and User Experience: The implementation of programmatic ad technology, particularly complex client-side header bidding setups, can add a significant amount of code and script requests to a publisher’s website. This can slow down page load times, leading to a poor user experience, increased bounce rates, and negative impacts on search engine optimization (SEO).

- Revenue Volatility and Inconsistency: While programmatic can increase overall revenue, earnings from the open auction can be highly volatile. Revenue can fluctuate significantly based on seasonal advertising demand, changes in advertiser bidding strategies, and broader economic factors, making financial forecasting more challenging.

- Ad Quality and the Rise of Ad Blockers: An aggressive monetization strategy that prioritizes filling every ad slot can lead to an overwhelming or intrusive ad experience for users. The proliferation of low-quality, disruptive ad formats can frustrate audiences and is a primary driver for the widespread adoption of ad-blocking software, which directly threatens a publisher’s ability to generate revenue.

- Technical Complexity and Resource Strain: Successfully managing a modern programmatic ad stack is a technically demanding task. Integrating and maintaining relationships with multiple SSPs, implementing header bidding, and staying abreast of the latest ad tech innovations requires significant technical expertise and resources, which can be a challenge for smaller publishers.

The dynamics between these two sides of the market reveal a fundamental strategic tension. The advertiser’s primary demand is for efficiency, accountability, and the ability to purchase high-quality, targeted impressions at the lowest possible cost. The publisher’s primary need is for maximized yield, revenue predictability, and control over the user experience on their properties. The challenges faced by each party are often the inverse of the other’s benefits. For instance, the very automation and scale that provide efficiency for advertisers can create brand safety risks and a loss of control for publishers. Similarly, the intense competition that drives up yields for publishers can increase costs for advertisers. This inherent conflict is a powerful engine of innovation within the ecosystem, driving the development of new solutions like PMPs, brand safety tools, and supply path optimization (SPO) techniques that seek to better balance these competing interests.

Part V: The Evolving Landscape: Future Trends and Regulatory Pressures

The programmatic advertising ecosystem is not a static entity; it is in a constant state of evolution, shaped by powerful external forces. Two of the most significant forces currently reshaping the industry are the rise of stringent data privacy regulations and the technology-driven transition to a “cookieless” future. These shifts are fundamentally altering how audiences are identified, targeted, and measured, while new channels continue to expand the programmatic frontier.

5.1 The Tectonic Shift: Impact of Privacy Regulation (GDPR & CCPA)

The implementation of comprehensive data privacy laws, most notably the European Union’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), has marked a tectonic shift for the digital advertising industry. These regulations have moved consumer privacy from a secondary consideration to a primary legal and ethical obligation, fundamentally changing the rules for data collection, processing, and usage in programmatic advertising.

- GDPR (General Data Protection Regulation): Enforced since 2018, the GDPR operates on a strict “opt-in” consent model. This means that for any data processing related to advertising, businesses must obtain explicit, unambiguous, and freely given consent from users before any personal data is collected or used. This has had a massive impact on programmatic practices in the EU, requiring clear legal justification for all tracking and targeting activities and making robust consent management an absolute necessity.

- CCPA/CPRA (California Consumer Privacy Act/Privacy Rights Act): The CCPA, and its successor the CPRA, grants California residents specific rights over their personal information and operates primarily on an “opt-out” model. Consumers have the right to direct businesses not to sell or share their personal data. To comply, businesses must provide clear and conspicuous links on their websites, such as “Do Not Sell or Share My Personal Information,” and establish transparent privacy policies that detail their data practices.

The collective consequence of these regulations for the programmatic ecosystem has been profound. They have severely restricted the uninhibited use of third-party data, which was once the bedrock of behavioral targeting. Compliance has become a significant operational and financial burden, necessitating the widespread adoption of Consent Management Platforms (CMPs). These platforms are crucial for capturing and storing user consent preferences and, critically, for signaling those preferences throughout the programmatic bidstream to ensure that all parties in the ad tech chain act in accordance with the user’s choices. Failure to comply carries the risk of severe financial penalties—up to 4% of global annual revenue under GDPR—and significant reputational damage that can erode consumer trust.

5.2 Navigating the Cookieless Future: Life After the Third-Party Cookie

Compounding the impact of privacy legislation is a parallel technology-driven shift: the deprecation of the third-party cookie. For decades, third-party cookies have been the primary mechanism for tracking users across different websites, enabling functionalities like behavioral targeting, retargeting, and conversion attribution. Driven by both regulatory pressure and a consumer demand for greater privacy, major web browsers like Apple’s Safari, Mozilla’s Firefox, and, most consequentially, Google’s Chrome are phasing out support for these cookies. This move is forcing the entire industry to re-architect its approach to identity and addressability.

There is no single, one-to-one replacement for the third-party cookie. Instead, the industry is coalescing around a portfolio of alternative solutions and strategies:

- First-Party Data Activation: In a cookieless world, data that brands and publishers collect directly from their users with explicit consent becomes the most valuable asset. The strategic focus is shifting toward enhancing first-party data collection (e.g., through subscriptions, loyalty programs) and utilizing privacy-enhancing technologies (PETs) like CDPs and Data Clean Rooms to activate this data for advertising in a secure and compliant manner.

- The Resurgence of Contextual Targeting: There is a strong revival of contextual targeting, which involves placing ads based on the content of the webpage a user is currently viewing, rather than their past browsing history. Modern contextual targeting solutions leverage AI and natural language processing to analyze page content, video, and audio with far greater nuance and accuracy than older keyword-based methods, offering a powerful, privacy-safe alternative.

- Universal ID Solutions: A number of industry-led initiatives are working to create new, privacy-centric identifiers to replace the third-party cookie. These “universal IDs” are often based on deterministic, encrypted user information (like a hashed email address) and are designed to provide a common currency for identification across the open internet, but with user consent and control built in from the ground up. An example is The Trade Desk’s Unified ID 2.0.

- Google’s Privacy Sandbox: As the owner of the dominant Chrome browser, Google is developing its own set of solutions within its Privacy Sandbox initiative.

This includes a suite of browser-based APIs, such as the Topics API (for interest-based advertising) and the Protected Audience API (for retargeting), which are designed to enable relevant advertising use cases without allowing third parties to track individual users across sites.

The transition to a cookieless future is not merely a technical challenge; it is a catalyst for a fundamental re-architecting of the digital advertising value chain. This shift creates a dual-track future. On one track, the competitive advantage of “walled gardens”—large, closed ecosystems like Google, Meta, and Amazon that possess massive, logged-in user bases and rely on their own vast first-party data—is significantly deepened. They are largely insulated from the demise of the third-party cookie. On the second track, the rest of the “open internet,” comprising independent publishers, advertisers, and ad tech companies, is experiencing an intense period of competition and innovation. This is driving the development of a new, privacy-first infrastructure for identity, targeting, and measurement, which will likely result in a more fragmented but potentially more transparent ecosystem outside of the major platforms.

5.3 The Expansion of Programmatic: New Channels and Innovations

Even as its foundational technologies are being re-engineered, the reach of programmatic advertising continues to expand into new and rapidly growing digital channels, moving far beyond its origins in desktop display advertising.

- Connected TV (CTV) and Over-the-Top (OTT): Programmatic is rapidly becoming the dominant method for buying and selling advertising on streaming services and internet-connected televisions. Programmatic CTV offers the data-driven targeting precision of digital advertising combined with the high-impact, full-screen environment of traditional television, representing a massive growth area for the industry.

- Digital Out-of-Home (DOOH): The inventory on digital billboards, screens in public transit, and displays in retail locations is now increasingly being traded programmatically. This allows for dynamic creative that can change based on time of day, weather, or other data signals, bringing a new level of flexibility and data-driven decision-making to out-of-home advertising.

- Programmatic Audio: The explosive growth of music streaming services and podcasts has created a substantial new market for programmatic audio advertising. Advertisers can now programmatically buy ad slots in audio streams, targeting listeners based on their music preferences, podcast genres, and demographic data.

Conclusion

The programmatic advertising ecosystem represents a paradigm shift in media trading, replacing archaic manual processes with a highly efficient, data-driven, and automated marketplace. Its architecture, built upon the interplay of Demand-Side Platforms (DSPs), Supply-Side Platforms (SSPs), and Ad Exchanges, has created a liquid, high-frequency trading environment for digital ad impressions. This technological framework has unlocked immense value for both advertisers, who benefit from unprecedented scale, targeting precision, and real-time optimization capabilities, and for publishers, who can maximize their revenue through automated, competitive auctions.

However, this sophistication is not without its challenges. The very automation that drives efficiency also creates vulnerabilities to ad fraud and brand safety risks. The complex supply chain can lack full transparency, and the entire ecosystem operates under a fundamental tension between the advertiser’s quest for performance and accountability and the publisher’s need for yield and control.

Looking forward, the ecosystem is navigating its most significant transformation to date. The dual pressures of stringent privacy regulations like GDPR and CCPA, combined with the industry-wide deprecation of the third-party cookie, are forcing a fundamental re-evaluation of how user identity, targeting, and measurement are handled. This evolution is catalyzing a shift towards privacy-first solutions, elevating the importance of first-party data, and spurring innovation in areas like contextual targeting and privacy-enhancing technologies. As programmatic continues its expansion into new channels like Connected TV, audio, and Digital Out-of-Home, its principles of data-driven, automated trading are set to define the future of the entire advertising landscape. Successfully navigating this complex and dynamic environment will require a deep understanding of its technology, a strategic approach to its inherent trade-offs, and a proactive adaptation to the new era of digital privacy.