BusSewa Case Study: E-commerce Revolution in Nepal Transport

Comprehensive Strategic Analysis and Case Study: BusSewa (Diyalo Technologies)

CHAPTER 1: Introduction and Methodology

1.1 Background of the Study

The global economic landscape has undergone a seismic shift over the last three decades, transitioning from traditional brick-and-mortar operations to a dynamic, digitally driven ecosystem known as Electronic Commerce (E-commerce). This transformation is not merely a change in the medium of transaction but a fundamental restructuring of value chains, supply logistics, and consumer behavior. As defined in the course literature, e-commerce encompasses the use of the Internet, the Web, and mobile apps to transact business. More digitally advanced nations have seen this sector mature into a primary driver of GDP, with “Mobility as a Service” (MaaS) emerging as a critical sub-sector that integrates various forms of transport services into a single accessible on-demand interface.

1.1.1 Global and Local Trends in E-commerce

Globally, the travel and ticketing industry has been a pioneer in the e-commerce revolution. The trajectory began with simple booking engines in the late 1990s and has evolved into complex, algorithm-driven ecosystems that utilize Artificial Intelligence (AI) and Big Data to personalize travel experiences. The current global trend is characterized by the “Super App” phenomenon, particularly visible in Asian markets (e.g., WeChat in China, Grab in Southeast Asia), where a single platform aggregates ride-hailing, food delivery, and long-distance travel booking. This consolidation reduces friction for the user and creates powerful network effects for the platform operator.

Furthermore, the post-pandemic era has accelerated the adoption of contactless payments and digital ticketing. Consumers, driven by health safety concerns and the convenience of instant confirmation, have moved away from physical counters. Global data suggests a significant migration toward mobile commerce (m-commerce), with handheld devices becoming the primary interface for travel bookings. This shift necessitates a “mobile-first” approach in platform design, focusing on responsive interfaces, location-based services, and app-centric loyalty programs.

1.1.2 E-commerce in Nepal

In the context of Nepal, the evolution of e-commerce mirrors global trends but faces unique infrastructural and cultural challenges. Historically, Nepal’s challenging topography and limited road infrastructure made transportation a complex logistical hurdle. The formal public transportation sector began with the Nepal Transport Service in 1959, founded by the Tuladhar brothers, which introduced the first regular bus service between Kathmandu and Amlekhganj. However, for decades following this inception, the sector remained fragmented, dominated by syndicates (Samitis) that operated on manual, paper-based systems.

The “Digital Renaissance” in Nepal, catalyzed by the rapid penetration of 4G internet and affordable smartphones, has created fertile ground for e-commerce. The introduction of digital wallets like eSewa (founded by the F1Soft Group) and Khalti revolutionized the payment landscape, enabling the unbanked population to participate in the digital economy. E-commerce in Nepal has evolved from simple classified sites (C2C) to sophisticated B2C marketplaces.

BusSewa, launched by Diyalo Technologies, represents the second major revolution in Nepal’s transport history: the digitization of the legacy booking infrastructure. Before BusSewa, passengers faced the “tyranny of the counter,” requiring physical presence at chaotic bus parks like Gongabu to secure tickets, often days in advance, with no transparency regarding seat availability or pricing. BusSewa disrupted this by introducing real-time inventory visibility, bridging the gap between rural transport operators and urban, tech-savvy commuters.

1.2 Types of E-commerce (B2C, B2B, C2C, C2B, etc.)

To understand the operational dynamics of BusSewa, it is essential to categorize it within standard e-commerce models. The platform operates a sophisticated Hybrid Model that encompasses elements of both B2B and B2C commerce.

-

Business-to-Consumer (B2C): This is the most visible interface of BusSewa. The platform acts as an online retailer, selling tickets directly to the end-user (the traveler). In this capacity, BusSewa functions as a Transaction Broker, facilitating the transaction between the passenger and the bus operator without owning the physical assets (the buses) itself. This aligns with the “Market Creator” business model described in standard e-commerce texts, where the platform provides a digital environment where buyers and sellers can meet and transact.

-

Business-to-Business (B2B): Beneath the consumer-facing app lies a robust B2B infrastructure. BusSewa’s parent company, Diyalo Technologies, provides Vehicle MIS (Management Information System) software to bus operators and transport committees. This SaaS (Software as a Service) solution digitizes the operator’s internal inventory, fleet management, and accounting. The relationship here is purely B2B, where Diyalo acts as a technology partner enabling the digital transformation of traditional transport companies.

-

Business-to-Government (B2G): While less explicit, the company’s involvement in digitizing water utilities (via Diyalo’s WaterMark product) and adhering to government transport norms suggests a burgeoning B2G component, particularly as the government pushes for smart city initiatives.

Therefore, BusSewa is best described as a B2B2C (Business-to-Business-to-Consumer) ecosystem. It aggregates supply through B2B partnerships and distributes it through B2C channels.

1.3 Introduction to Group Members

This case study is submitted as a requirement for the IT 204: E-Commerce course, BBA 6th Semester. The research team has divided responsibilities to ensure a holistic analysis:

- [Member Name 1], Lead Researcher & Strategist: Responsible for the overall narrative structure, business model analysis, and strategic recommendations. Focuses on synthesizing the connection between Diyalo’s B2B SaaS products and the BusSewa B2C marketplace.

- [Member Name 2], Technical Analyst: Focuses on the technological infrastructure, including the analysis of the Vehicle MIS, API integrations, security protocols (SSL, PCI-DSS), and the technical nuances of the payment gateway systems used.

- [Member Name 3], Marketing & Operations Analyst: Responsible for evaluating the digital marketing mix, analyzing social media engagement, consumer sentiment from reviews, and operational challenges such as refund policies and customer support.

1.4 Objectives of the Case Study

The primary objective of this study is to dissect the operational, technical, and strategic components of BusSewa to understand how it functions as a leading e-commerce application in Nepal. Specific objectives include:

- Business Model Analysis: To identify and analyze the hybrid e-commerce model adopted by BusSewa and how it generates revenue through commissions, SaaS fees, and value-added services.

- Infrastructure Examination: To examine the technological stack, including the inventory management systems provided to operators and the mobile platforms available to consumers, and how these systems synchronize in real-time.

- Marketing Evaluation: To evaluate the digital marketing strategies employed to attract and retain customers, focusing on SEO, social media engagement, and loyalty programs in a competitive digital landscape.

- Security and Payment Assessment: To assess the security measures (data privacy, encryption) and electronic payment systems integrated into the platform to ensure financial safety and build user trust.

- Regulatory Compliance Review: To understand the operational challenges imposed by the legal environment, specifically the new E-commerce Act 2025, and how BusSewa is adapting to these regulations.

- Strategic Forecasting: To provide evidence-based recommendations for future growth, innovation (AI/IoT), and service improvement to maintain market leadership.

1.5 Scope and Limitations of the Study

Scope:

The scope of this study is comprehensive, covering the entire digital ecosystem of BusSewa. It includes an analysis of the web application (bussewa.com.np), the mobile application (Android/iOS), and the operator-facing application (Smart Gadi). The study investigates the buying process, seller onboarding, revenue models, marketing channels, and legal compliance. It also touches upon the broader activities of the parent company, Diyalo Technologies, insofar as they impact the BusSewa platform (e.g., shared IoT infrastructure or R&D capabilities).

Limitations:

- Financial Transparency: As a private limited company, BusSewa/Diyalo Technologies does not publish detailed annual financial reports. Revenue figures, profit margins, and exact customer acquisition costs are estimated based on public snippets and industry averages rather than audited financial statements.

- Data Currency: While the research snippets provide up-to-date information (referencing 2024 and 2025), the rapidly evolving nature of the tech sector means that specific UI features or promo codes mentioned may have changed by the time of final submission.

- Review Bias: The sentiment analysis relies on public reviews from App Stores and social media. These platforms often suffer from selection bias, where users with extreme experiences (very good or very bad) are more likely to leave feedback than the average user.

Operational Opacity: The specific terms of the contracts between BusSewa and the bus operators (e.g., exact commission percentages) are proprietary and confidential, limiting the depth of the B2B financial analysis.

1.6 Research Methodology

To achieve the objectives and mitigate the limitations, a rigorous mixed-method research approach was employed:

- Secondary Data Analysis: The core of the research involves a deep dive into existing literature and digital footprints. This includes analyzing the “Suggested Reading” texts (E-commerce: Business, Technology, and Society by Laudon & Traver) to provide theoretical grounding. We examined BusSewa’s official website, privacy policies, Terms of Service, and press releases. Additionally, we reviewed legal texts regarding the E-commerce Act 2025 to assess compliance.

- Platform Simulation (Primary Research): The group conducted a “Walkthrough Audit” of the BusSewa platform. This involved creating user accounts, simulating the booking process (up to the payment page) to map the User Journey, testing search filters, and evaluating the responsiveness of the mobile app versus the web interface.

- Sentiment and Social Listening: We analyzed qualitative data from user discussions on Reddit (r/Nepal) and review sections of the Google Play Store. This provided insights into real-world user pain points, particularly regarding refunds and service reliability.

- Comparative Analysis: The study implicitly compares BusSewa’s features against global best practices (e.g., RedBus in India, FlixBus in Europe) to identify gaps and opportunities for innovation.

CHAPTER 2: Overview of the Selected E-commerce Platform

2.1 Company Profile

BusSewa stands as a pioneer in Nepal’s digital travel landscape, recognized as the country’s first real-time online bus ticket booking platform. It is not merely a standalone startup but a strategic product of Diyalo Technologies Pvt. Ltd., a software company with a deep focus on digitizing the utility and public service sectors in Nepal.

- Parent Entity: Diyalo Technologies Pvt. Ltd.

- Establishment: Diyalo was founded in 2012. The company has since grown into a market leader in utility solutions (Water, Electricity) and public transportation digitization.

- Leadership: The company is led by Mr. P.R. Khanal (Founder & CEO), whose vision emphasizes the democratization of technology to improve transparency and accessibility in public services.

- Strategic Alliance: A pivotal moment in the company’s history was its integration into the F1Soft Group in 2018. F1Soft is a conglomerate that owns eSewa (Nepal’s first digital wallet) and significant banking infrastructure. This partnership provided BusSewa with unparalleled access to financial technology resources, payment gateway integration, and a massive existing user base of eSewa customers.

The company’s mission is to “innovate business processes of Travel Operators in Nepal to provide quality service to road passengers”. This mission underscores their B2B2C approach: they cannot improve the passenger experience without first modernizing the operator’s business process.

2.2 Key Features of the Platform

BusSewa differentiates itself from traditional booking agents through a suite of digital features designed to mimic the airline booking experience:

- Real-Time Inventory Synchronization: Unlike static booking forms that require manual confirmation, BusSewa integrates directly with the operator’s backend. When a seat is sold at a physical counter, it disappears from the app instantly, and vice versa. This is achieved through the Vehicle MIS integration.

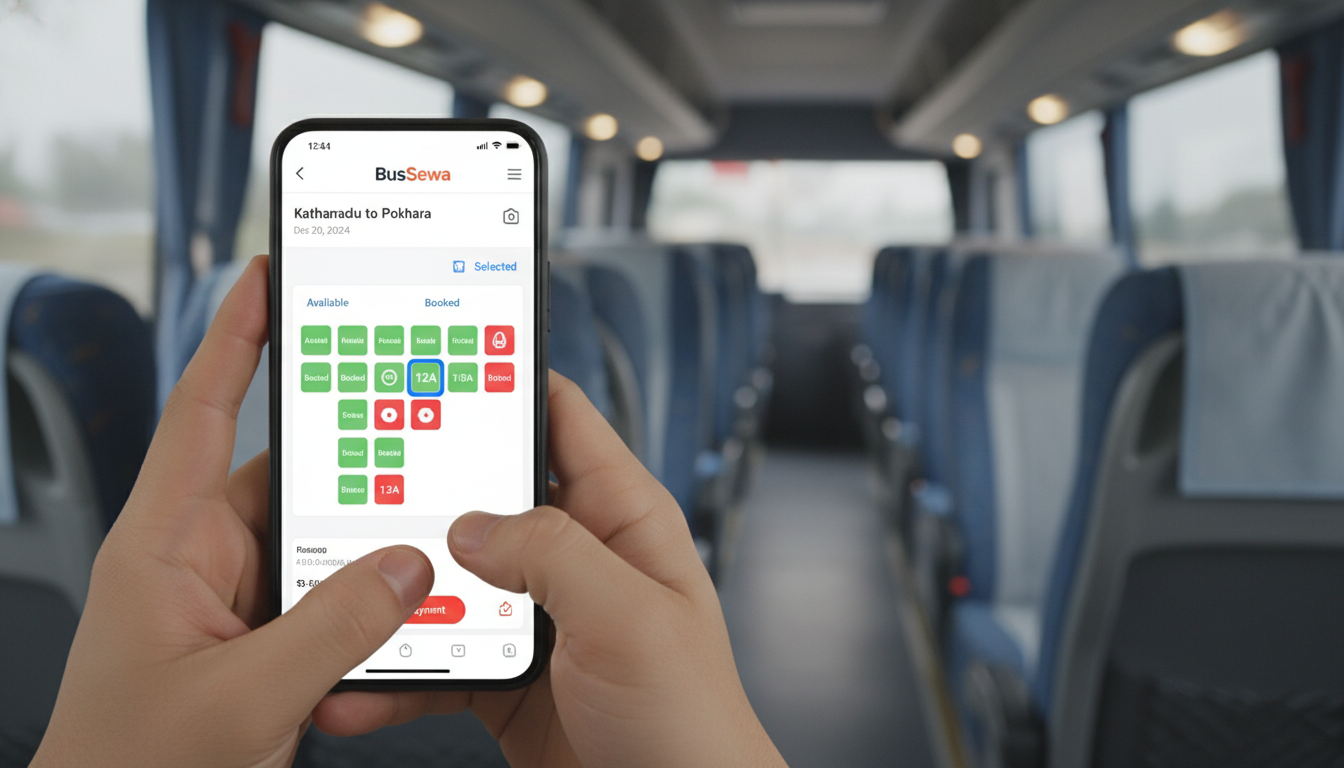

- Visual Seat Selection: The platform offers a graphical user interface (GUI) representing the bus layout. Users can distinguish between window and aisle seats, and between different bus tiers (e.g., standard 2×2 layouts vs. 2×1 luxury sofa seats).

- Paperless Ticketing (m-Ticket): The system generates a digital ticket containing a PNR (Passenger Name Record), which is sent via SMS and Email. This digital token is accepted by operators, eliminating the need for printing.

- Cross-Border Connectivity: Recognizing the high volume of travel between Nepal and India, the platform facilitates bookings for long-haul routes such as Kathmandu to Delhi. This feature serves both the diaspora and the growing segment of Indian tourists visiting Nepal.

- Multi-Modal “Super App” Capabilities: While “Bus” is in the name, the platform has expanded horizontally. It now offers domestic flight bookings (integrating with airlines like Buddha Air and Shree Airlines), car rentals (for events or tours), and hotel reservations. This move signals a strategic shift from a niche vertical player to a horizontal travel ecosystem.

- Transparent Pricing: The platform enforces price transparency, displaying the exact fare without hidden “agent fees.” They explicitly market “zero booking charges,” positioning themselves as a consumer-friendly alternative to scalpers.

2.3 Products/Services Offered

The platform’s offerings have diversified significantly to capture a larger share of the traveler’s wallet:

- Inter-City Bus Tickets (Description: The core product. Routes connect 75 districts. Inventory ranges from non-AC local buses to “VIP Sofa” coaches. Target Customer: Daily commuters, domestic tourists, students.)

- Tourist Bus Tickets (Description: A dedicated sub-segment (often branded via touristbussewa.com) focusing on high-quality, safer buses plying tourist routes (e.g., KTM-Pokhara-Chitwan). Target Customer: International tourists, expatriates, luxury travelers.)

- Domestic Flights (Description: API integration with domestic carriers allows users to compare and book flights. Target Customer: Business travelers, time-sensitive commuters.)

- Car/Jeep Rentals (Description: On-demand hiring of SUVs (Scorpio, Land Cruiser), EVs, and vans. Services include airport transfers, wedding hires, and off-road trips. Target Customer: Families, tour groups, event organizers.)

- Adventure/Activity Packages (Description: Bundled offerings that include travel and activities (e.g., rafting, paragliding, bungee jumping). Target Customer: Adventure seekers, youth demographic.)

- Hotel Reservations (Description: Booking engine for over 2,000 partner hotels across Nepal. Target Customer: All traveler segments.)

2.4 Buying and Selling Workflow

The efficacy of BusSewa relies on a seamless interaction between the Buyer (Passenger) and the Seller (Bus Operator), mediated by the platform’s technology.

2.4.1 Customer Journey (Buying Process)

The buying process is designed to be frictionless, following standard e-commerce UX patterns:

- Discovery: The user opens the app/website and inputs travel details (Origin, Destination, Date).

- Evaluation: The search engine returns a list of available buses. Users filter results based on Price, Departure Time, Bus Operator (e.g., Baba Adventure, Blue Sky), and Amenities (AC, WiFi, Water).

- Selection: The user views the seat map. Color codes indicate availability (e.g., Grey = Available, Red = Booked, Green = Selected).

- Authentication: The user logs in or provides guest details (Name, Mobile Number, Email). The mobile number is critical for PNR delivery.

- Transaction: The user proceeds to payment. The system holds the selected seat for a limited time (e.g., 10 minutes) to prevent concurrency issues.

- Fulfillment: Upon successful payment, the inventory is permanently deducted from the central database. The user receives an SMS/Email with the ticket details.

2.4.2 Seller Onboarding (Selling Process)

The “Selling” process is where Diyalo’s B2B strength lies. Operators do not simply “upload” tickets; they undergo a digital transformation.

- Digitization (The Lock-in): A bus operator (Seller) adopts Diyalo’s Vehicle MIS. This software replaces their manual ledger books. It manages their entire fleet, driver schedules, fuel costs, and offline ticket sales.

- Inventory Distribution: Once the operator inputs their schedule into the MIS, the inventory is automatically pushed to the BusSewa API.

- Real-Time Management: The operator uses the “Smart Gadi” app (Operator App). Conductors can see the passenger manifest in real-time. If a passenger books online, the conductor’s app updates instantly. Conversely, if the conductor sells a seat for cash mid-route, they update the app, and the seat becomes unavailable online.

- Reconciliation: At the end of a cycle, BusSewa reconciles the online payments and transfers the funds to the operator’s bank account, deducting the agreed commission.

2.5 Business Model

BusSewa operates a Marketplace Aggregator Model underpinned by a SaaS (Software as a Service) strategy.

2.5.1 B2C/B2B/Hybrid Analysis

- B2C Revenue Stream (Commission & Fees): BusSewa earns a commission on every ticket sold through its platform. While they advertise “no booking charges” to the customer to gain market share, the revenue likely comes from the operator side (a percentage of the ticket value) or through small convenience fees on premium services.

- B2B Revenue Stream (SaaS Subscription): The transport operators pay for the Vehicle MIS software. This might be a monthly subscription fee or an initial licensing fee plus maintenance. This provides Diyalo with recurring, stable revenue distinct from ticket volume volatility.

- The Hybrid Synergy: The B2B software acts as a “moat.” Once an operator’s entire business runs on Diyalo’s software, switching costs are high. This guarantees a steady supply of inventory for the B2C BusSewa platform. Conversely, the demand generated by the B2C platform makes the B2B software more valuable to the operator.

This is a classic Network Effect.

Network Infrastructure & Technology Stack

The platform’s architecture must support high concurrency, especially during festival seasons like Dashain when traffic spikes 10x-100x.

- Cloud Infrastructure: Given the scale (digitalizing 400k+ tickets), the system likely resides on scalable cloud infrastructure (e.g., AWS or similar), allowing for elastic scaling during demand surges.

- Database Synchronization: The core challenge is syncing the Distributed Database of offline operator counters with the Centralized Database of the web app. The system likely uses a combination of RESTful APIs and WebSockets to ensure near real-time updates.

- Mobile Technology:

- Consumer Apps: Native Android (Kotlin/Java) and iOS (Swift) apps ensure high performance and access to device features like GPS and Push Notifications.

- Operator Apps: Android-based apps for conductors, optimized for low-bandwidth environments (2G/3G) common on Nepali highways.

- IoT Integration: Diyalo’s expertise in IoT (demonstrated in their WaterMark product for water utilities) provides the technological foundation for future features like live GPS vehicle tracking.

Security Features and Policies

Security is critical to maintaining user trust, particularly regarding financial data and personal privacy.

- Data Privacy & Encryption: BusSewa implements SSL (Secure Sockets Layers) certificates, ensuring that all data transmitted between the user’s browser/app and the server is encrypted via HTTPS. The privacy policy explicitly states that personal information (Name, Email, Phone) is contained behind secured networks accessible only to authorized personnel.

- Access Control: The system uses strict Role-Based Access Control (RBAC). A ticket counter agent has different data access rights compared to a bus owner or a system administrator, minimizing the risk of internal data theft.

- Device Fingerprinting: The app collects Mobile Device IDs (e.g., IDFA). While primarily for personalization, this also serves a security function by helping to identify and block devices associated with fraudulent activity.

- Third-Party Liability: The privacy policy clearly demarcates liability. BusSewa does not store sensitive payment data (like credit card CVVs) on its own servers. Instead, it offloads this risk to PCI-DSS compliant payment partners.

Payment Gateways and Systems Used

BusSewa has integrated the most popular payment systems in Nepal, acknowledging the market’s fragmentation.

- Digital Wallets (The Dominant Method):

- eSewa: As a sister company under F1Soft, eSewa is the default and most deeply integrated option. It covers a vast majority of the digital payer base in Nepal.

- Khalti / IME Pay: Integrated to ensure users of competing ecosystems are not excluded.

- Mobile Banking (FonePay): Integration with the FonePay network allows users to pay directly from their bank accounts (via their respective bank apps) using QR codes or direct logins. This taps into the banked population who may not use wallets.

- Card Payments (VISA/MasterCard/SCT): Essential for the tourist segment and high-value transactions. The push towards “Open Loop” payment systems globally suggests BusSewa is positioning itself to accept foreign cards more seamlessly, catering to international trekkers.

- ConnectIPS: Used for direct bank-to-bank transfers, suitable for high-value B2B settlements or bulk bookings.

Rationale: The multi-gateway strategy minimizes “cart abandonment.” If a user’s preferred payment method is unavailable, they are likely to drop off. By supporting everything from wallets to international cards, BusSewa maximizes its conversion rate.

Marketing and Customer Engagement

Digital Marketing Strategies

BusSewa operates in a market where “Word of Mouth” was traditionally the only marketing channel. Shifting this behavior requires aggressive and targeted digital marketing.

Social Media Integration

Social media is the heartbeat of BusSewa’s marketing strategy.

- Facebook Dominance: In Nepal, Facebook is synonymous with the internet. BusSewa utilizes its Facebook page not just for announcements but as a primary customer service channel. They run contests (e.g., “Tag & Win”) to boost organic reach.

- Content Marketing: The brand leverages relatability. Campaigns often feature localized humor—memes about “bus travel struggles,” videos depicting the chaos of festival travel, or characters like “Pandey on Tyre.” This humanizes the brand and makes it shareable.

- Instagram Aesthetics: For the tourist and adventure segments, Instagram is used to showcase the destination (e.g., scenic shots of Pokhara or Mustang) rather than just the bus, selling the dream of travel.

SEO/SEM Approaches

- SEO (Search Engine Optimization): BusSewa targets high-volume keywords such as “Bus ticket Nepal,” “KTM to Delhi bus,” and “Tourist bus Pokhara.” They have created specific landing pages and sub-domains (e.g., touristbussewa.com) to capture niche search traffic for high-margin tourist vehicles.

- SEM (Search Engine Marketing): The use of promo codes like “BUSCHRISTMAS” indicates active paid campaigns. During peak seasons (Dashain/Tihar), they likely bid on keywords to capture users searching for transport options, competing against airlines and other travel modes.

Content & Influencer Marketing

- Influencer Partnerships: Travel vloggers and social media personalities (e.g., “Paradigm Shift” in Nepali marketing) are engaged to create video reviews of the booking process and the travel experience. By showcasing the ease of using the app, they break down the technological barrier for hesitant users.

- Blog Strategy: The website features a blog section discussing travel tips, route guides, and safety advice. This serves a dual purpose: educating the user and providing fresh content for Google’s indexing algorithms.

Mobile and Location-Based Marketing Techniques

- App-Centric Push Notifications: With over 100k+ app downloads, BusSewa has a direct line to the consumer. They use push notifications to alert users about flash sales, booking confirmations, or urgent travel advisories (e.g., road blockages).

- Location Services: The app utilizes GPS to guide passengers to their boarding points. While primarily operational, this is a marketing asset—offering “peace of mind” as a feature.

Social Commerce and Online Communities

While direct transactions happen on the app, “Social Commerce” in the Nepali context means discovery on social media.

- Community Management: The company actively replies to comments on their posts. This visibility is crucial; seeing a brand respond to a query builds trust for passive observers.

- Review Management: Active engagement with reviews on the Google Play Store shows that the company listens. Whether thanking a user for a 5-star review or addressing a 1-star complaint about a refund, the public response is part of their reputation management.

Advertising Campaigns and Communication Channels

- Seasonal Campaigns: The marketing calendar is heavily weighted towards Nepal’s festival cycle. “Cashback” offers (e.g., “100% Cashback for Dashain”) are the primary hook. These campaigns are designed to change behavior—incentivizing users to book early and online rather than waiting until the last minute.

- Partnership Promotions: Collaborations with banks (e.g., Sanima Bank, Prabhu Bank) offer mutual benefits. The bank promotes BusSewa to its customers to drive digital transaction volume, and BusSewa offers exclusive discounts to the bank’s cardholders.

Customer Retention and Loyalty Programs

- BusSewa Points: The platform has gamified travel through a loyalty points system. Users earn points for every kilometer or rupee spent. These points can likely be redeemed for discounts on future tickets. This creates a “switching cost” for the user—if they switch to a competitor, they lose their accumulated value.

- Cashback Economy: In a price-sensitive market like Nepal, cashback is the most effective retention tool. Immediate financial gratification (e.g., Rs. 200 off) is often valued higher than abstract loyalty points.

Technical and Strategic Analysis

Website and App UI/UX Evaluation

A heuristic evaluation of the BusSewa interface reveals a focus on functionality over aesthetics, which is appropriate for a utility app.

- Search Prominence: The “Origin-Destination-Date” search bar is the hero element, adhering to Jacob’s Law (users prefer sites to work the same way as other sites they know).

- Seat Map Visualization: This is the critical UX feature. It bridges the mental gap between the digital and physical worlds. Users can see where they will sit, which reduces the anxiety of the unknown.

- Error Prevention: The app validates mobile numbers and dates, preventing basic user errors during booking.

- Load Times: The web interface is optimized for mobile browsers, crucial for users on slower 3G/4G connections.

SWOT Analysis

Strengths (Internal)

- First Mover Advantage: Established brand trust and market share as the pioneer.

- Vertical Integration: Control over the supply side via Diyalo’s Vehicle MIS (B2B SaaS).

- F1Soft Ecosystem: Access to eSewa’s user base and fintech infrastructure.

- Diversified Portfolio: Revenue spread across Bus, Air, and Hotels reduces risk.

Weaknesses (Internal)

- Service Reliability: BusSewa owns no buses.

- Service quality (punctuality, hygiene) is fully dependent on third-party operators, leading to inconsistent CX.

- Refund Friction: Strict cancellation policies and delayed refunds are a major source of negative reviews.

- Customer Support: Limited to standard hours or overwhelmed during peaks, leading to unresolved grievances.

Opportunities (External)

- Cross-Border Expansion: High potential in the India-Nepal corridor (Delhi, Siliguri).

- Electric Mobility: Partnering with EV fleets aligns with government green energy goals.

- Data Monetization: Selling aggregated travel data to government or planners.

- Tourism Rebound: Post-COVID tourism surge offers high-margin potential.

Threats (External)

- Regulatory Tightening: The E-commerce Act 2025 imposes strict penalties for non-compliance and demands better grievance redressal.

- Disintermediation: Large bus operators (e.g., Sajha Yatayat) might launch their own direct booking apps, bypassing the aggregator.

- Infrastructure: Poor road conditions and frequent landslides can cause mass cancellations, hurting the platform’s reliability perception.

4.3 Mobile Commerce and Cross-Platform Features

BusSewa exemplifies a “Mobile First” strategy. In Nepal, for many users, the smartphone is their only computer.

- Cross-Platform Consistency: The user account syncs across devices. A booking started on the web can be viewed on the app.

- Operator Mobility: The most innovative m-commerce feature is arguably the “Smart Gadi” app for conductors. By putting the “Point of Sale” (POS) in the pocket of the bus conductor, BusSewa digitizes the last mile of the transaction, capturing walk-in customers into the digital inventory.

4.4 Use of EDI or Integration Tools

While the term EDI (Electronic Data Interchange) is traditional, BusSewa uses modern API equivalents.

- Inventory API: The Vehicle MIS acts as the EDI, standardizing data formats (Time, Seat No, Price) across hundreds of different bus operators and feeding it to the BusSewa central engine.

- Banking APIs: Integration with connectIPS and various banking APIs facilitates the complex B2B settlements required to pay operators their dues.

4.5 Reviews, Ratings, and Customer Feedback Loop

The feedback loop reveals a significant “Trust Gap.”

- Positive Sentiment: Users praise the convenience—avoiding queues and having a guaranteed seat.

- Negative Sentiment: A recurring theme is the O2O (Online to Offline) Disconnect. Users report booking a “Sofa Seat” digital ticket, only to find a different, lower-quality bus upon arrival. Others report issues with refunds not being processed after cancellations.

- Strategic Implication: This indicates that while the software works, the operational compliance of the bus partners is a weak link. BusSewa absorbs the reputational damage for the operator’s failure.

4.6 Innovation, Trends, and Future Technologies

- IoT (Internet of Things): Diyalo is a leader in IoT for water management (GreenMark). Applying this to transport is the next frontier. Installing GPS trackers on partner buses would allow passengers to track their bus’s live location, solving the “Where is my bus?” anxiety that plagues Nepali travelers.

- AI & Chatbots: Currently, support seems human-driven. Implementing AI-driven chatbots for instant Tier-1 support (e.g., “Where is my ticket?”, “Cancel my booking”) would drastically reduce support costs and improve response times.

CHAPTER 5: Conclusion and Strategic Recommendations

5.1 Summary of Key Findings

BusSewa has successfully executed a digital transformation of Nepal’s chaotic bus transport sector. Its success is not accidental but structural: by deploying the Vehicle MIS (B2B SaaS) to operators, it secured a monopoly on real-time inventory, creating a high barrier to entry for competitors. The platform utilizes a Hybrid Business Model that monetizes both the operator (SaaS fees) and the passenger (commissions/fees). It leverages the F1Soft Fintech Ecosystem to minimize payment friction and uses aggressive Social Media Marketing to drive behavioral change. However, the platform faces significant Operational Risks regarding service delivery quality and Regulatory Risks with the new E-commerce Act 2025 demanding stricter consumer protection standards.

5.2 Limitations of the Study

This study relied on external observation and secondary data. The “black box” of the specific commercial agreements between BusSewa and its operators (e.g., exclusivity clauses, commission rates) limits the financial analysis. Additionally, as the E-commerce Act 2025 is in the early stages of implementation, its full impact on BusSewa’s compliance costs is yet to be seen.

5.3 Strategic Suggestions and Recommendations

To sustain its market leadership and address identified weaknesses, BusSewa should implement the following strategies:

- Close the O2O Trust Gap (Service Assurance):

Recommendation: Implement a “Verified by BusSewa” program. Buses that meet strict criteria (GPS tracking, punctuality, hygiene) get a “Verified” badge.

Mechanism: Enforce strict Service Level Agreements (SLAs) with operators. If a bus is swapped for a lower category, the system should automatically refund the price difference + a penalty bonus to the user wallet.

- Revolutionize Refunds (Fintech Integration):

Recommendation: Leverage the F1Soft connection to offer “Instant Wallet Refunds.”

Mechanism: Instead of the standard 3-7 day bank reversal, offer instant credit to the user’s eSewa wallet. This keeps the money within the ecosystem and turns a negative experience (cancellation) into a neutral one.

- Implement Live GPS Tracking (IoT):

Recommendation: Roll out GPS tracking for all premium buses.

Mechanism: Use the conductor’s “Smart Gadi” app to broadcast location or install dedicated IoT hardware. Provide a “Share Ride Details” feature for passenger safety, appealing to female travelers.

- Regulatory Compliance as a Feature:

Recommendation: proactively embrace the E-commerce Act 2025.

Mechanism: Appoint a dedicated Nodal Officer for grievance redressal as required by law. Publish a “Consumer Charter” explicitly stating refund timelines and rights, positioning the brand as the “Safe & Legal” choice compared to informal booking channels.

- Data-Driven Personalization (AI):

Recommendation: Move from reactive booking to predictive selling.

Mechanism: Analyze user history. If a user travels to Chitwan every Dashain, send a push notification 30 days prior: “Dashain is coming! Book your usual seat to Chitwan now to avoid the rush.”

5.4 Potential for Expansion or Innovation

- Electric Vehicle (EV) Integration: The government of Nepal is aggressively promoting EVs. BusSewa should create a dedicated “Green Travel” filter for electric vans and buses. They could potentially partner with carbon credit platforms to allow tourists to offset their travel footprint.

- Cross-Border Integration: Deepen the integration with Indian bus aggregators (like RedBus) to offer seamless “One Ticket” travel from Kathmandu to Delhi or Bangalore, capturing the massive medical and educational student traffic.