Tourism Pricing Strategy: Revenue Optimization & Dynamic Pricing

The Architecture of Value: Advanced Revenue Optimization and Dynamic Pricing in Modern Tourism

The paradigm of pricing in the global tourism and hospitality sectors has undergone a fundamental transformation, shifting from a reactive, competitor-centric model to a proactive, data-driven architecture known as Strategic Revenue Management. For decades, the industry relied on the simplistic heuristic of “what others are charging,” a strategy that often resulted in a “race to the bottom” or significant missed opportunities during demand surges. Modern revenue management represents a holistic discipline that integrates data analytics, demand forecasting, and inventory control to optimize financial outcomes by selling the right product to the right customer at the optimal price point.

The core challenge for tourism operators—ranging from boutique hotels and vacation rentals to large-scale tour providers—is the perishable nature of their inventory. A room night or a tour seat that remains unsold is a permanent loss of potential revenue. Consequently, the objective is not merely to achieve 100% occupancy but to maximize the yield of every available unit of inventory. This necessitates a strategy that moves beyond static pricing into the realms of dynamic adjustments, temporal demand arbitrage, and the psychological engineering of value perception.

The Strategic Framework of Revenue Management vs. Tactical Dynamic Pricing

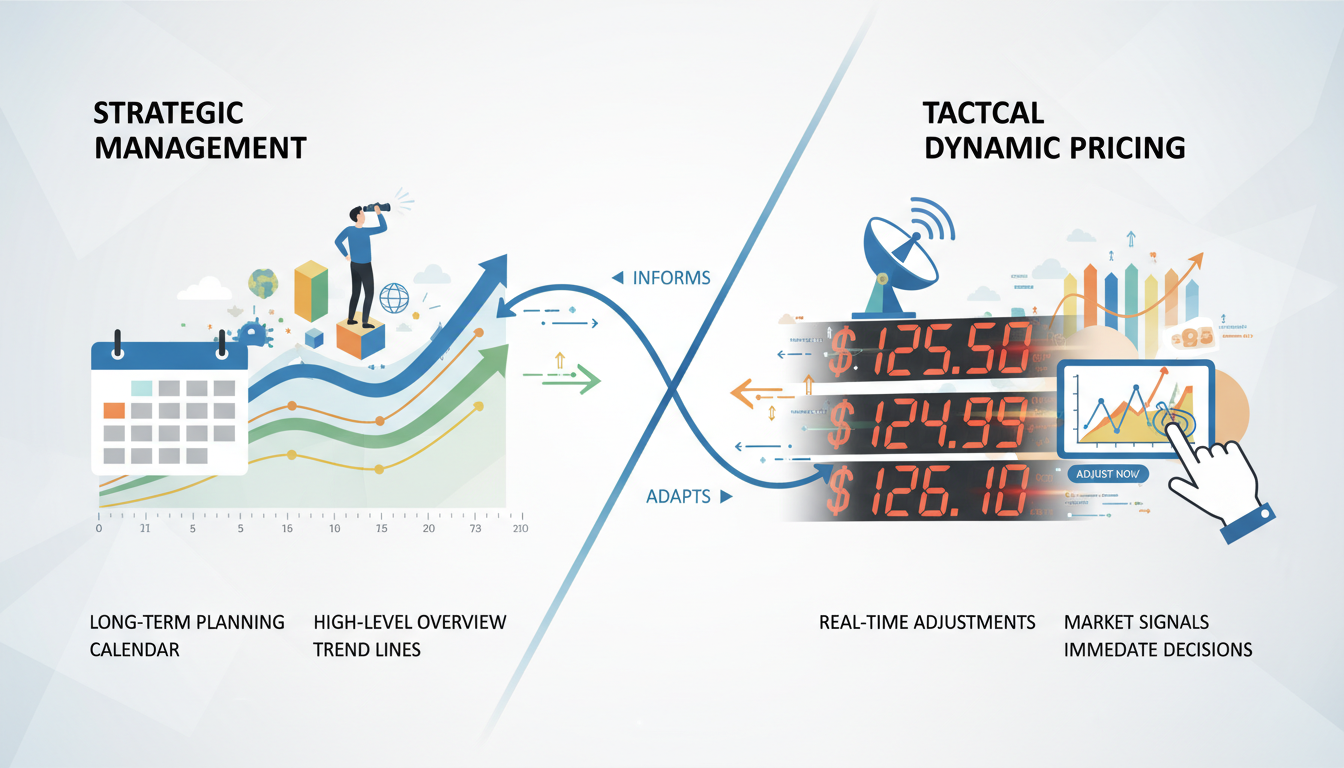

In contemporary hospitality discourse, the terms “revenue management” and “dynamic pricing” are frequently used interchangeably, yet they represent distinct levels of strategic operation. Revenue management is the overarching strategy that encompasses long-term financial planning, customer segmentation, and distribution channel management. It utilizes historical data, often spanning several years, to establish baseline demand patterns and define key performance indicators (KPIs).

Dynamic pricing, conversely, is the tactical lever within this framework. It involves the real-time adjustment of rates based on immediate market signals such as booking velocity, competitor price shifts, local events, and even weather conditions. While revenue management focuses on the “why” and “when” of the broader market cycle, dynamic pricing addresses the “how much” in the immediate moment. The integration of these two approaches allows a property to maintain a clear path toward sustainable growth while retaining the agility to adapt to daily market fluctuations.

Core Principles of Integrated Revenue Strategy

The efficacy of a revenue strategy is predicated on foundational pillars: demand forecasting, market segmentation, inventory control, and price optimization. These components do not operate in isolation; rather, they form a feedback loop where forecasting informs segmentation, which in turn dictates inventory controls and final price points.

| Core Principle | Strategic Focus | Operational Mechanism |

|---|---|---|

| Demand Forecasting | Predicting future booking volumes | Analysis of historical data, macro-economic trends, and local events. |

| Segmentation | Identifying customer willingness to pay | Categorizing guests by lead time, stay purpose, and price sensitivity. |

| Inventory Control | Managing availability across channels | Implementation of MLOS, CTA (Closed to Arrival), and channel restrictions. |

| Price Optimization | Determining the optimal rate | Balancing occupancy and ADR to maximize total yield (RevPAR/RevPAN). |

The shift toward dynamic pricing is driven by the reality that consumer behavior is increasingly elastic. In the digital age, travelers have access to near-perfect information regarding competitor rates and availability. If an operator fails to adjust their pricing in response to these external conditions, they risk either losing the booking to a more price-aligned competitor or, conversely, leaving significant “money on the table” during peak demand periods.

The Metrics of Truth: RevPAR, RevPAN, and the Exposure of Silent Losses

To effectively manage revenue, an operator must employ metrics that accurately reflect the health of the business beyond simple occupancy percentages. While the Average Daily Rate (ADR) and Occupancy Rate remain fundamental, they offer an incomplete picture when viewed in isolation. A high ADR may coincide with low occupancy, indicating that the property is overpriced, while high occupancy with a low ADR suggests significant underpricing.

The Evolution from RevPAR to RevPAN

Revenue Per Available Room (RevPAR) has long been the gold standard for measuring top-line performance. It combines both occupancy and rate to provide a snapshot of how well a hotel is filling its rooms at its chosen price points. However, RevPAR is limited by its focus on room revenue alone and its failure to account for operational costs or the impact of non-revenue nights.

In the short-term rental (STR) and vacation rental markets, Revenue Per Available Night (RevPAN) has emerged as a more nuanced KPI. Unlike RevPAR, which focuses on the room as the unit of supply, RevPAN focuses on the night as the unit of availability. This metric is particularly effective at exposing the “silent losses” associated with owner stays, maintenance blocks, or unbookable gaps in the calendar.

Identifying Opportunity Costs via RevPAN

RevPAN serves as a forensic tool for property managers. By using all available nights as the common denominator, it makes the cost of non-revenue activities visible. For instance, if an owner stays in their beachfront property during a peak summer weekend, the “lost” revenue is not zero; it is the RevPAN that would have been generated if that night were sold at market rates. This clarity allows for more data-driven conversations between property managers and owners regarding the real cost of personal usage or delayed maintenance.

Furthermore, RevPAN acts as a profitability indicator by clarifying whether a property is effectively selling all bookable nights when compared to operational costs. By comparing RevPAN to operational expenses, managers can determine if their pricing strategy is yielding profit across the entire available inventory, rather than just the occupied portion.

Expanding the Scope: TRevPAR and RevPAG

Sophisticated operators are increasingly moving toward Total Revenue Per Available Room (TRevPAR) and Revenue Per Available Guest (RevPAG). These metrics capture the impact of ancillary revenue streams, such as food and beverage, spa treatments, parking, and resort fees.

| Metric | Calculation | Strategic Value |

|---|---|---|

| RevPAR | Total Room Revenue / Total Rooms Available | Benchmarking room pricing and occupancy efficiency. |

| RevPAN | Total Revenue / Total Available Nights | Exposing opportunity costs and maintenance impacts in STRs. |

| TRevPAR | Total Revenue / Total Available Rooms | Measuring the overall revenue efficiency of the property’s assets. |

| RevPAG | Total Revenue / Total Number of Guests | Focusing on the “second wallet” and guest-centric spend optimization. |

The divergence between these metrics can reveal hidden trends. A resort might see a decline in RevPAR but an increase in RevPAG due to highly effective upselling of premium add-ons, indicating that while occupancy is down, the value extracted from each guest has significantly increased.

Temporal Demand Engineering: Weekday vs. Weekend Arbitrage

Demand in the tourism sector is rarely uniform. Treating every day of the week as having the same value is a major source of revenue leakage. Modern revenue management treats individual days as separate micro-markets, each with its own supply-and-demand curve.

The Business and Leisure Dichotomy

In urban and business-centric destinations, demand typically peaks during the workweek (Monday–Thursday), driven by corporate travelers. This segment is often less price-sensitive but requires high flexibility and specific business amenities. Conversely, leisure travelers dominate the weekend market. They are generally more price-conscious, book further in advance, and prioritize “experience” amenities like spa access or late check-outs.

A hotel that fails to differentiate between these segments risks underpricing its weekday inventory to corporate clients or overpricing its weekend inventory for families, resulting in either lost profit or lost occupancy.

The Mathematics of Temporal Segmentation

Consider a property that charges a flat rate of $150 per night. If it fills every night, it generates $1,050 per week. However, a segmented approach might reveal that on weekdays, business travelers are willing to pay $180, while on weekends, a $120 rate is necessary to attract price-sensitive families. By adjusting the rates accordingly ($180 x 5 weekdays + $120 x 2 weekends), the property generates $1,140—a nearly 9% increase in revenue achieved through simple day-of-week arbitrage.

In more extreme cases, such as popular weekend getaway spots, the disparity is even greater. A hotel might charge $100 on weeknights but surge to $300 on Friday and Saturday.

This shifts the weekly revenue from $700 (at a flat $100 rate) to $1,100, representing a 57% increase in total yield.

Strategic Adjustments for Temporal Fluctuations

To capitalize on these shifts, revenue managers should implement the following micro-adjustments:

- Business-Friendly Weekday Packages: Including high-speed Wi-Fi, laundry credits, or breakfast can attract the less price-sensitive corporate segment.

- Leisure-Focused Weekend Deals: Offering spa credits, late check-outs, or “Sunday Funday” discounts can fill rooms that might otherwise remain vacant as business travelers depart.

- Last-Minute Business Surcharges: Recognizing that business travelers often book with short lead times, managers can hold back inventory and charge a premium for last-minute availability.

The Mechanics of Seasonal Demand and Value-Based Frameworks

Seasonality is the most predictable yet often most poorly managed driver of demand. Many operators fall into the trap of “high” and “low” seasons without recognizing the nuances of shoulder periods or micro-seasons created by local events.

Defining the Seasonal Spectrum

Successful seasonal pricing requires defining distinct demand periods and adjusting the base rate accordingly. This is a structured form of demand-based pricing where rate bands are set for each season and then fine-tuned dynamically as the booking pace (pickup) evolves.

| Season Tier | Demand Profile | Strategic Objective |

|---|---|---|

| Peak Season | High demand (Holidays, major festivals) | Maximize ADR; command premium rates; use MLOS to ensure full stays. |

| Shoulder Season | Moderate demand (Spring/Autumn) | Maintain occupancy; use value-adds to bridge the gap to peak rates. |

| Off-Peak Season | Low demand (Winter in beach towns) | Drive interest; cover fixed costs; use long-stay discounts to attract digital nomads. |

The Perceived Fairness Lens in Seasonal Pricing

A critical aspect of seasonal pricing is guest perception. Decades of research show that guests judge pricing through a fairness lens; they accept higher prices when demand is visibly higher or value is clearly enhanced. Conversely, raising prices without a clear demand driver or value increase is perceived as unfair and can damage brand loyalty.

To mitigate this, operators should focus on “Value-Based Pricing.” Instead of simply slashing prices in the off-season, which can devalue the brand, properties can offer inclusive packages that add perceived value—such as dining credits or room upgrades—at the same base rate. In peak seasons, the higher rate must be justified by superior service availability or exclusive seasonal offerings.

Inventory Controls: The Strategic Logic of Minimum Length of Stay (MLOS)

While price adjustments are the primary tool of revenue management, inventory restrictions are the “secret weapon” for optimizing occupancy. The most critical of these is the Minimum Length of Stay (MLOS) restriction.

Solving the “Orphan Night” Dilemma

During high-demand events—such as a city-wide convention, a major concert, or a sporting event—the demand for a single night (e.g., Saturday) may far exceed supply. If an operator allows guests to book only that Saturday, they are often left with “orphan nights” on Friday and Sunday that are harder to sell in isolation.

By setting a three-night MLOS (requiring guests to book Friday, Saturday, and Sunday), the property ensures that its inventory is used to its full potential. This strategy bridges high-demand dates with adjacent, lower-demand “shoulder” nights, thereby maintaining a consistent occupancy rate across the entire period.

Operational Efficiency and Profitability through MLOS

The logic of MLOS extends beyond just occupancy; it significantly impacts the bottom line through operational cost reduction.

- Turnover Costs: Every check-in and check-out requires a full room turnover, involving housekeeping labor, linen replacement, and front-desk administrative time. By encouraging longer stays, properties reduce the frequency of turnovers, directly lowering labor and maintenance costs.

- Guest Quality and Loyalty: Longer stays (Average Length of Stay or ALOS) provide more opportunities for staff to impress guests and personalize their experience, which can boost long-term loyalty and total guest spend (RevPAG).

- Forecasting and Booking Pace: Guests who book for longer durations typically do so further in advance. Locking in these reservations early allows managers to forecast revenue more accurately and refine pricing strategies for the remaining inventory as the arrival date approaches.

Strategic Implementation and Competitive Edge

Implementing MLOS requires a delicate balance. If a property sets a minimum stay that is significantly longer than its competitors, it may deter potential guests who prefer flexibility.

| Property Size/Type | Typical MLOS Logic | Competitive Play |

|---|---|---|

| Large Resort | 5–7 nights during peak | High amenities allow for longer mandated stays. |

| Urban Hotel | 2–3 nights during events | Strategic use on peak weekends; flexibility on weekdays. |

| Boutique B&B | 2 nights for all weekends | Ensures turnover happens on non-peak days (Monday). |

| Off-Season STR | 10–30 nights | Targeting “digital nomads” with deep monthly discounts. |

Behavioral Economics: Psychological Pricing and Add-On Optimization

Pricing is not merely a mathematical exercise; it is a psychological one. Consumer behavior is driven by cognitive biases, and understanding these allows operators to influence guest decisions and maximize total revenue per guest.

The Anchoring Effect and Tiered Pricing

The “anchoring effect” is a cognitive bias where the first piece of information encountered (the anchor) influences subsequent evaluations of value. In tourism, this is used to frame prices in a way that makes the preferred option seem like a bargain.

For example, a luxury hotel might prominently feature a “Presidential Suite” at $2,500 per night. While very few guests may book this, it serves as an anchor. When the guest then sees a “Deluxe Suite” for $800, that price feels much more reasonable and attractive than if it were presented in isolation. This shift in frame of reference guides guests toward mid-tier and high-tier inventory rather than the baseline “economy” option.

The Decoy Effect and Choice Architecture

The “decoy effect” involves introducing a third choice that is clearly inferior to one of the other options, thereby steering the customer toward the more expensive but higher-value choice.

- Option A: Basic Spa Treatment – $100

- Option B: Deluxe Spa Treatment (Includes massage and facial) – $180

- Option C (The Decoy): Facial Only Treatment – $170

By making the “Facial Only” (Option C) nearly the same price as the “Deluxe” package (Option B), the customer perceives Option B as having immense extra value for only a marginal cost increase. This technique effectively increases the Average Daily Spend per guest while making the guest feel they have made a “smart” and value-driven choice.

Threshold Awareness and Charm Pricing

Research into psychological thresholds reveals that consumers are highly sensitive to specific price markers. For instance, in the UK tourism market, family attractions see significant drops in conversion when crossing thresholds of £20, £25, or £30.

| Psychological Marker | Perceived Value Category | Strategic Application |

|---|---|---|

| £19.99 (Charm Pricing) | Bargain/Deal | Used for high-volume, low-margin add-ons or entry-level tours. |

| £500 (Rounded Pricing) | Quality/Prestige | Used for luxury accommodations or premium experiences to signal status. |

| “3 for $5” (Anchoring) | Value in Bulk | Encourages higher volume purchases even without a significant discount. |

Add-On Engineering and the “Second Wallet”

Ancillary revenue optimization focuses on tapping into the traveler’s “second wallet”—the funds allocated for on-site spending after the primary travel cost (flight or room) is paid. This is achieved through unbundling and hyper-personalization.

- Paid Room Upgrades: Gently nudging guests with upgrade options via pre-arrival emails or at check-in is highly effective, especially when premium rooms would otherwise sit empty.

- Tailored Ancillaries: Using AI to recommend specific add-ons—such as extra legroom for frequent flyers or spa credits for honeymooners—can increase ancillary revenue by 5–10%.

- Strategic Bundling: Offering “stay-and-dine” or “spa getaway” packages creates a perception of enhanced savings while increasing the total guest spend. Studies show all-inclusive bundles can increase guest satisfaction scores by 15% and perceived value by 20%.

Forensic Revenue Protection: Identifying and Fixing Silent Losses

Underpricing is a “silent loss” that often goes undetected because it manifests as missed potential rather than an out-of-pocket expense. Revenue leakage—the unintended loss of income—can amount to an average of 14.9% across the hospitality industry.

Common Sources of Revenue Leakage

Leakage often occurs at the intersection of operational silos and manual processes.

It is frequently caused by unbilled services, pricing inefficiencies, and inventory waste.

| Source of Leakage | Specific Mechanism of Loss | Remediation Strategy |

|---|---|---|

| Unbilled Services | Mini-bar items not recorded; “free” late check-outs granted by front desk; untracked use of premium amenities. | Automate POS (Point of Sale) integration with the PMS to ensure real-time posting. |

| Pricing Inefficiencies | Lack of dynamic adjustments during demand spikes; unmonitored rate disparities between OTAs and direct site. | Implement AI-driven RMS to manage channel parity and automate rate changes. |

| Inventory Waste | Overstocking perishable F&B; linen shrinkage due to poor tracking; heating/cooling empty rooms. | Use inventory management software and smart sensors to monitor usage patterns. |

| Staff-Driven Erosion | Unapproved complimentary upgrades; “extension” of promotional rates beyond the end date. | Establish strict discounting policies and perform regular departmental audits. |

The Forensic Revenue Audit Checklist

To reclaim these silent losses, tourism operators must implement a rigorous audit framework. This foundational audit scrutinizes all monetary flows to ensure accuracy and prevent leakage.

- Daily Revenue Reconciliation: Compare the “end of day” report from the PMS against departmental sales reports (F&B, Spa, Parking). Investigate any variances immediately.

- Channel Parity Audit: Weekly checks across all distribution platforms (Booking.com, Expedia, Airbnb) to ensure the property’s pricing strategy is reflected accurately and that no unintended discounts are active.

- Inventory Consumption Benchmarking: Tracking usage of housekeeping supplies (linens, amenities) against occupancy to identify shrinkage or theft.

- Energy Usage Monitoring: Auditing HVAC and lighting systems in unoccupied rooms to reduce unnecessary operational expenses.

- Contract and Compliance Monitoring: Ensuring that negotiated corporate rates are correctly applied by the reservation system and that staff are not manually overriding these with lower rates.

Technology and the Future of Pricing Architecture

The complexity of modern demand signals—incorporating flight cancellations, weather patterns, competitor sell-outs, and social media trends—makes manual pricing obsolete. The implementation of AI-powered Revenue Management Systems (RMS) is now a prerequisite for competitiveness.

Key Features of Advanced RMS Solutions

Modern systems like IDeaS, Duetto, or ZettaRMS provide the “intelligence layer” that sits atop the Property Management System.

- Automated Price Optimization: Continuously monitors market trends to adjust rates in real-time, ensuring the property does not underprice during sudden surges.

- Machine Learning Forecasting: Uses predictive analytics to anticipate demand fluctuations weeks or months in advance, allowing for strategic inventory allocation.

- Open Pricing Capability: Allows for independent pricing of every room type, channel, and date, moving away from rigid “rate bands” and maximizing flexibility.

- Automated Reporting and Insights: Provides dashboards that break down performance by segment, channel, and product, allowing managers to identify underperforming areas instantly.

Case Study: Financial Impact of Digital Transformation

A study of ski resorts that transitioned from static to dynamic pricing infrastructure demonstrated significant gains. By refining predictive models with weather data and pre-booking pace, these resorts achieved:

- Increased Revenue per Pass: Precise adjustments based on demand forecasts resulted in a consistent uplift in yield per customer.

- Optimized Occupancy: Resorts could maintain higher occupancy by lowering prices during lulls and surging during peak powder days.

- Stabilized Cash Flow: The ability to adjust prices in real-time minimized revenue losses during low-demand periods, enhancing overall financial resilience.

Conclusions and Strategic Outlook

The shift from “what others are charging” to a multi-dimensional pricing architecture is no longer optional in the tourism industry. Underpricing is a persistent, silent loss that erodes profitability from within, often hidden behind the mask of high occupancy. By adopting forensic metrics like RevPAN, operators can expose the true opportunity costs of their inventory decisions and move toward a model of total yield optimization.

Strategic success in the modern landscape requires the integration of temporal demand logic (weekday vs. weekend), sophisticated inventory controls like MLOS, and the psychological engineering of value. Furthermore, the role of AI and automation is critical; it provides the agility needed to respond to market shifts in minutes rather than days. As the industry continues to evolve, the most successful operators will be those who view pricing not as a administrative task, but as a strategic asset—a dynamic, living architecture that continuously balances market demand with the perceived value of the guest experience. By plugging revenue leaks and embracing data-driven decision-making, tourism businesses can ensure that every night, every seat, and every guest contributes to a sustainable and profitable future.